It’s still all to play for in the REIT sector.

I make no apologies whatsoever for repeating much of my mantra for the quoted REIT sector this year. The themes remain consistent, successful and unlikely to change for the rest of the year. I concluded my article for the summer edition with the phrase, ‘All to play for’, and so it has proven. The REIT sector had shown very modest outperformance against the All Share Index in H1 of this year, a mere 3%, but the past few months have seen this outperformance accelerate to a much more meaningful 10% and an absolute gain for the sector of a very healthy 25%. No hesitation in repeating my ‘something for everyone’ from durable income growth from true REITs, to still-strengthening logistics rents and values, to a recovering London office market, a selectively well-bid retail warehousing market and just maybe close to nadir valuations for certain retail assets. Throw in the swathes of cash from private equity attracted by broader UK equity valuations and the income characteristics of much UK real estate, and the prospect of further corporate activity in the sector isn’t fanciful.

Blackstone increased its offer for St Modwen to a slightly more acceptable level, although it still looks a cheap deal to me, and the same buyer has emerged in partnership with APG to acquire student accommodation specialist GCP Student Living for just under £1b. That represents a 9% premium to GCP’s NAV as at June and a whopping 30% premium to the pre-bid share price. That the shares were trading on such a discount simply reflected the impact of the pandemic. The bid price is identical to where the shares traded in the weeks immediately prior to the first UK lockdown in March last year, when GCP had a portfolio full of rent-paying students and a pipeline of potential development assets.

The pandemic prompted the shares to trade on a discount for an asset class that has historically traded at a premium to NAV in the REIT arena.

“Looking through the 30 or so REITs we follow, there currently remain just six trading at discounts to NAV, mainly characterised by just one thing –they own retail assets”

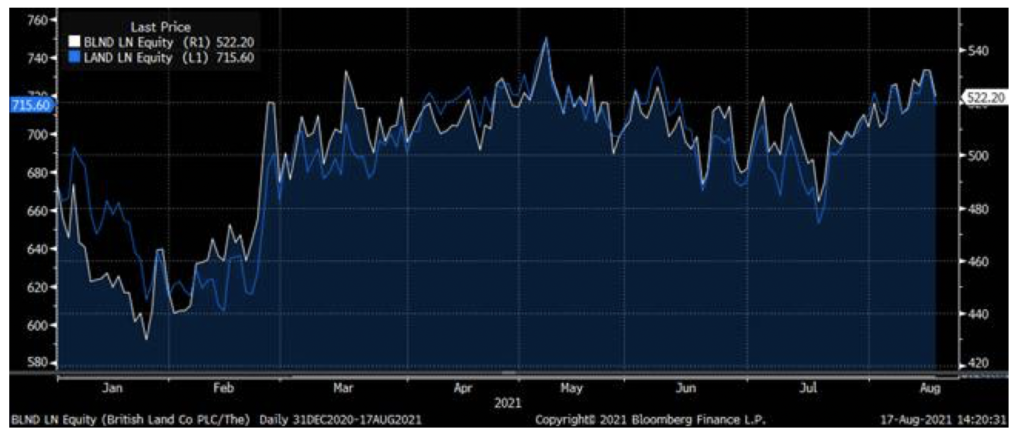

That’s three down and counting for REIT takeovers this year. There’s no obvious common asset theme running through the bids for GCP (student accommodation), St Modwen (housebuilding, but above all logistics) and RDI REIT (mixed portfolio and geographies). The common denominator instead is that they are all small or mid-cap stocks that were trading on a discount to NAV. Looking through the 30 or so REITs we follow, there currently remain just six trading at discounts to NAV, mainly characterised by just one thing –they own retail assets, namely Hammerson, Capital & Counties and Capital & Regional, where retail assets dominate, but also Landsec and British Land, where retail assets don’t dominate but remain meaningful at circa 30% at both. The two former sector leaders trading on among the cheapest ratings on respective discounts of 28% and 18% – and we are expecting both companies’ NAVs to rise by a small amount this financial year. Those share valuations just seem a little too harsh to me. So, we’ve had small cap and mid-cap takeovers. Could it happen for larger cap companies? I see little reason why not. Above is a chart showing the share prices of the two companies this year. Spot the difference!

In all the years I’ve followed these two companies, I can’t recall a sustained period where the share prices have so performed. REIT investors don’t much like hybrid asset ownership; they much prefer sector specialisation so they can make their bets on an asset class rather than trust management teams to do it for them. It’s a cynical but realistic interpretation. However, as retail becomes less important to both, for all the wrong reasons of course, and as both invest significant capital into their London office assets, just maybe a re-rating is overdue. All the London specialists – Great Portland, DerwentLondon, Helical Bar and Workspace – have recently confirmed an uptick in tenant demand and indeed take up. Derwent even went so far as to raise its rental guidance for 2021 from a barely measurable 0 to -5%, to -2% -+2%, but more importantly, it has spent over £250m acquiring assets for potential redevelopment. Big sign of confidence that, as the impact the Government’s proposals for energy efficient buildings start to take effect, tenants will only consider occupying those that are or become A rated and precious few of those exist at the moment. Estimates vary, but it is probably less than 10% of the current standing stock, with maybe another 20-30% rated B. Part of the reason for Landsec especially

to be so lowly rated is that it owns a number of London offices which don’t yet match the A and B criteria and much CapEx will be required to upgrade them, and I might argue that that’s a short-term concern but a medium-term opportunity.

Another very positive sign came recently from Great Portland. It confirmed a major pre-letting in Finsbury Square and is committing to another net zero carbon scheme in the City for completion four years out. More importantly to me though, it announced that rent reviews, lease renewal and development lettings were between 6% and 9% above the valuers ERVs at March this year. Valuers being overly cautious, methinks. This all strikes me as rather positive, with London offices looking cheap in valuation terms against other major European gateway cities, rental growth emerging and a meaningful potential shortage of energy compliant buildings.

“Big shopping centres are still declining in value by double-digit percentages pa”

All to play for again. Well, nearly! It’s the shopping centre market that is missing from the sector playing with a full deck of cards, and nothing has emerged from the companies long and wrong of the asset class to yet give REIT investors the confidence to step up to the plate. Big shopping centres are still declining in value by double-digit percentages pa and rental values are imprecise, but downward by very meaningful amounts. Hammerson reported that peak-to-date UK centres are down in value by 60%, with rental values down by 29%. Clutching at straws, the positives would be that rental collection has improved, footfall is returning and some letting activity has happened. For REIT investors, and indeed for landlords, one thing is missing: a meaningful arm’s length sale of a big shopping centre at a premium to carrying value. Nonetheless, we must be pretty close to the bottom, but whether values stagnate at the lower level or eventually recover has been deferred by the extension of the moratorium on tenant eviction, unfortunately. In any case, big retail has become almost marginalised within the REIT arena, except for those who own it!

I remain pretty bullish on the sector overall.