Originally published May 2023.

H2 2023

At the time of writing (March 20th 2023) the news is dominated by the recent collapse or rescue of a number of banks. It remains to be seen how this story will develop. However, initial signs are that regulators and the banking industry have moved quickly to stabilise the situation, providing some reason for optimism that we are not facing anything as bad as the 2008-09 financial crisis.

Nevertheless, for the property sector the timing is unfortunate. Most real estate markets are several months into a price correction that – in the U.K. at least – has developed far quicker than had been anticipated. The speed of the re-pricing had prompted discussion on whether a turning point could be reached by as soon as spring or early summer of this year. Undoubtedly, the timeline for the correction and the arrival point of a future recovery has moved back by several months.

However, assuming that the banking sector is seeing a brief storm and not something bigger, we feel recent economic data suggests property markets could still see a recovery in H2 2023; and perhaps by late summer.

Recent weeks have seen a shift in the mood among economic commentators on prospects for 2023. In November 2022, the consensus forecast for German GDP growth this year was -0.9%; yet by March 2023 this had been revised to 0.0%, according to Consensus Economics. Over the same period, the US has seen an upwards revision, from 0.2% GDP growth in 2023 to 1.0%, while the Eurozone forecast has risen from -0.1% to 0.6% and the UK from -0.9% to -0.5%.

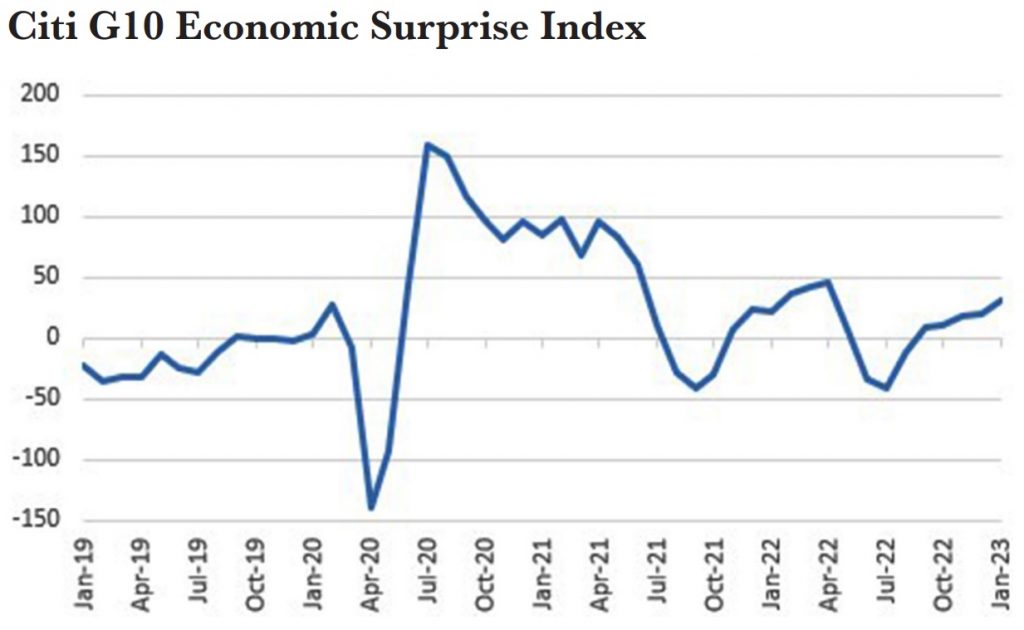

Citi’s Economic Surprise Index measures whether reported indicators have come in above or below forecast. The Index for the G10 nations read at -40 in July 2022, but had risen into positive territory by February 2023 at 45.4. This is consistent with an environment where sentiment had become too bearish. The February Purchasing Managers Index (PMI) figures are a good example, with a range of major economies, including the UK, US and Eurozone, all coming in above expectations, and at a level consistent with growth.

In part, this relates to labour markets holding up better than expected and supply chain problems moderating. For instance, a year ago the consensus view was that the Eurozone unemployment rate would rise to 7.1% in 2022, but in fact it finished the year at 6.6%. Meanwhile, energy costs have declined and shipping costs have fallen enormously as the bottlenecks constraining global supply chains have eased.

So, a general shift in sentiment has occurred among analysts on the economic outlook. This is well illustrated by the rebound for the ZEW Euro Area sentiment index, which leapt from -23.6 in December 2022 to 29.7 in February 2023. The index slid to 10.0 in March on the banking sector news, but remained in positive territory. As recently as September 2022, the index stood at -60.7. If sentiment on the economic outlook continues to hold up despite the bank insolvencies, the impact on the real economy could be marginal. In that scenario, sentiment in the property market might quickly recover by early summer.

The improvement in the macro-economic outlook needs to be viewed in the context of the significant headwinds facing the economy in the first half of 2023, particularly nervous and volatile financial markets. This brings us back to the issue of the strength of the banks, as supporting them means reining back on interest rate hikes; however, the inflation risks would normally mean more tightening.

No one could realistically claim that the current economic situation is ‘good’. However, a quick resolution to the banking crisis might result in rebounding sentiment by the summer, which combined with improved economic data could form the basis for a property market recovery in H2 2023.

From a real estate perspective, it should be remembered that investors usually try to pre-empt the turning point in the cycle, in order to buy when seller morale is at its lowest and competition is sparce. However, for buyers who rely heavily on leverage, a cautious debt market will hinder their ability to re-enter the market. Consequently, cash rich investors could decide Q2-Q3 2023 is the moment to begin deploying funds while they face less competition for assets from leveraged buyers.

In the UK, debate is growing on how far away the turning point for commercial property prices might be. Since peaking in June 2022, the MSCI UK all property capital growth index has undergone its fastest correction of any downturn since the benchmark was created in 1986 – dropping 21% by the end of February 2023. It is our view that values have further to decline, but the majority of the correction for commercial property is now priced in. Numbers like these will draw the attention of buyers who have ample dry powder and are looking for long-term investments.