…and from place to place.

Part two of a three-part mini-series written by economist Savvas Savouri.

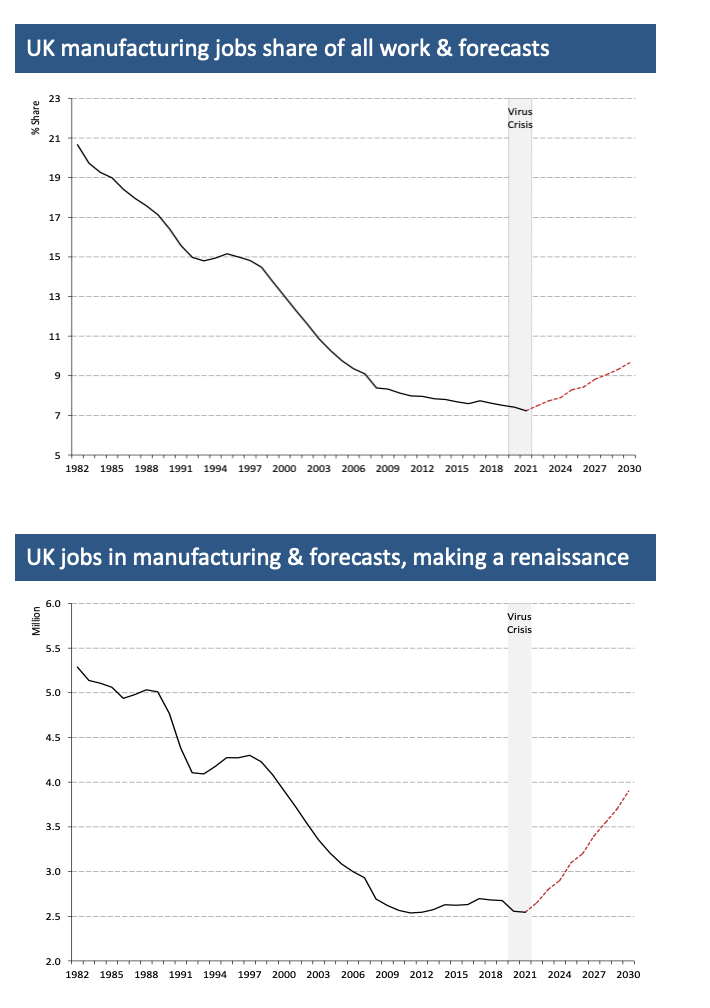

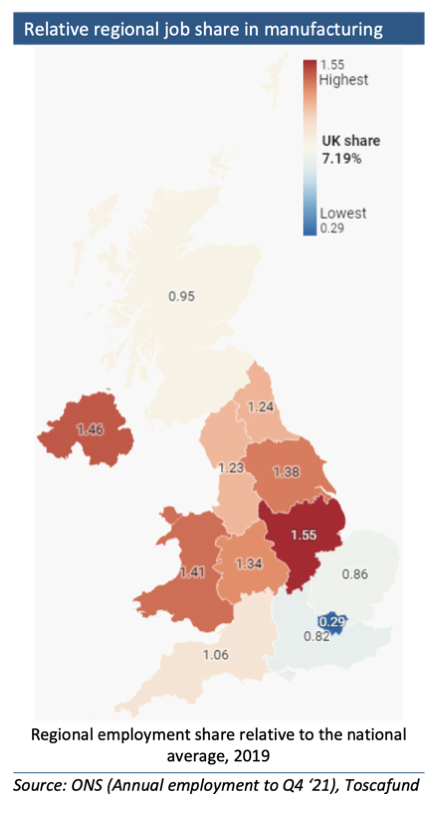

I claim that UK regions with established and comparatively large manufacturing sectors will economically outperform over the rest of the decade. And, in this regard, one cannot help noticing how Central and Northern England (CaNE) distinguishes itself.

Much of CaNE’s future prosperity will draw upon old foundations – old foundations that is made ANEW. CaNE has extensive capital – both physical and human – vested in manufacturing and more specifically automotive engineering capacity. Of the latter, we can be sure it is being rapidly re-tooled and its workers re-skilled by its very commercial owners, to quickly produce all manner of components, engines and assembled vehicles for our cleaner transport future. After all, ambitious net carbon neutral timing-targets create enormous replacement demand which, if to be met quickly, demands lucrative round-the-clock production. Electrifyingly positive economic matters do not end here.

We can hotly debate the nature of improvements to transport infrastructure promised and delivered upon, or not, in and around CaNE. That accepted, none can seriously challenge the claim that CaNE already boasts an established and extensive network of roads and rail, and in many ways these reflect where industrial hubs have long been located. Indeed, demands for environmental and social responsibility should force supply lines to be shortened and production re-shored – in ways that CaNE cannot fail to be more favoured than other parts of the UK. CaNE sits so perfectly well as a logistical hub to all points of the UK compass.

Having considered UK manufacturing in its general form, we now cover more fully the sizeable component of it which, though challenged over recent years, promises impressive growth ahead – automotive engineering.

There should be no doubt that there will be a surge in UK-based manufacturing of electric vehicles and their essential parts and so too an increase in employment related to these sectors. This will come about thanks to regional capacity long established in the automotive sector, as well as the building of entirely new plants close by. In this instance we can clearly see how the North East stands out with the Midlands and North West also blushing nicely.

Having considered what we predict to be a surge in UK car-making and where this will drive regional fortunes, we turn to looking at how their topography helps or hinders the prospects for the UK’s 12 regions to capitalise on our demands to have all manner of things delivered into our hands, wherever we happen to be.

After all, while the surge in e-commerce we have seen through the strictest forms of ‘lockdown’ will subside, this extremely labour intensive aspect of our economic behaviour will remain elevated. And less there be any doubt that just because we are ordering ‘from the clouds’, the goods and services we demand in this way do not simply drop into our laps. The journey they make to reach our doors involves a great many more hands at work than were we to go and collect ourselves.

The reality, in fact, is that in the months immediately before coronavirus struck, in ‘BC’, evidence was building that the egress on brick and mortar retail of online channels, had plateaued, seemingly come to something of a peak – a growth pause? – at a share of 20%. Then all of a sudden Covid struck and what appeared to be a stable(ish) 20% of online sales dramatically surged higher. Once we are able to reflect on reliable data After the Dislocation (‘AD’) wrought by coronavirus, there is every reason we will see online having moved to a steady state share of at least 30% of our retail consumption, a 50% rise over what had appeared to be the BC peak in e-commerce.

The simple truth is that their topography and comparatively low population densities, as well as relatively skeletal motorway networks, do not favour Scotland or Wales, and indeed England’s far South West, in being logistical hubs. For this ‘honour’, we see Central and Northern England (CaNE) as being perfectly positioned.