- Though a correction in values is firmly underway for European commercial real estate markets, we believe the worst is yet to come. This also means the best buying opportunities are not just around the corner.

- The gradual ramping up of higher debt costs on portfolios is a limiting factor for a quick recovery. By the end of 2025, we estimate that the all-in interest rate for a hypothetical portfolio could reach around 3.7%, which is on par with 2013 levels – that’s just four years to unwind eight years of debt cost reductions.

- This may force interest coverage ratios to acutely low levels. Owners facing a refinancing shortfall in 2023 will need to add more equity, seek new equity investors, or default – with poorer quality assets looking most exposed.

We expect advanced economy policy rates to peak this year as supply-chain bottlenecks ease and inflation falls back to near-target levels, which should gradually alleviate pressure on real estate pricing. We still think that supply-side developments will push down core inflation, particularly in goods, where easing bottlenecks, inventory unwinds and lower commodity prices should all weaken pipeline price pressures.

Despite that, recent ECB communications have become more hawkish, suggesting that both inflation and policy rates could stay high for longer – above our own baseline view. According to the ECB’s December projections, eurozone inflation will average 6.3% in 2023 and remain above 2% until 2026. Using the ECB inflation and output projections as inputs to our Global Economic Model suggests policy rates will reach 3.3% by end 2023 and 2.3% by end 2024.

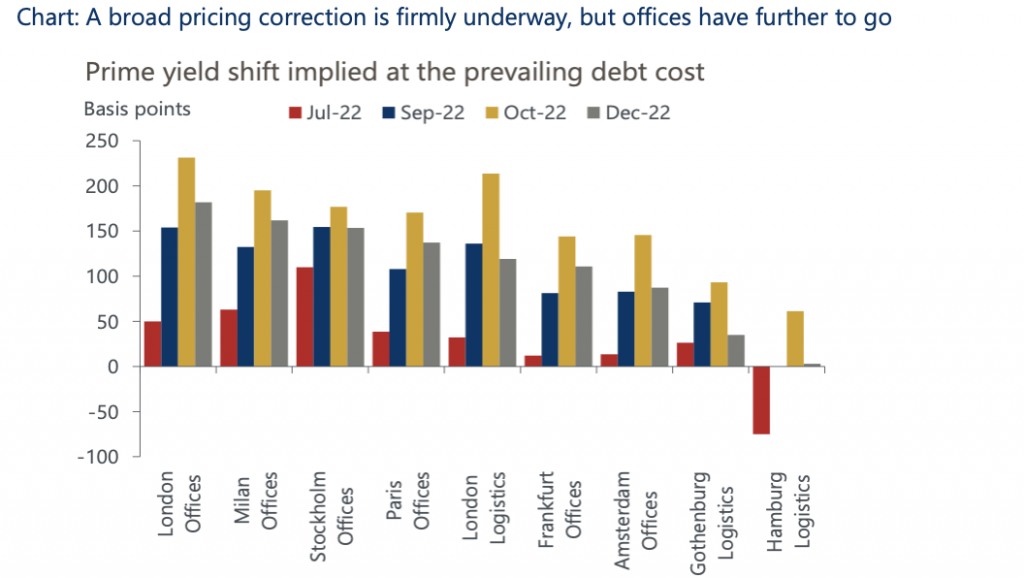

The key transmission channel for real estate is the cost of debt. Our updated analysis on the yield shift implied by debt costs (for a leveraged buyer using 50%-60% LTV) indicates that a pricing correction is firmly underway (see chart).

Overall, our December update suggests a smaller yield correction will be needed than the October projection. That said, our December analysis still indicates a further pricing correction ahead of around 30% for major European office markets (except London), but with better news for the logistics sector, which looks to have largely re-priced already.

It’s also true that overall loan-to-value ratios appear modest in this cycle relative to the past, but there are pockets of concern where LTVs appear to be higher and the use of leverage is more opaque. In particular, private equity LTVs appear to be around 20ppts higher than average in the real estate industry. Also, little is known about the use of indirect leverage (at company or special purpose vehicle level) or subscription credit lines (against dry powder), which could amplify risks.

For those carrying more debt, real estate could yet become a ticking time bomb due to the gradual and lagged impact of higher rates at the portfolio level. A typical loan term for an income-producing asset is five years, thus we assume that 20% of outstanding debt would refinance at the market all-in interest rate each year. In reality, this is likely to be lumpier due to the large lot sizes of individual assets.

This simplification illustrates the lagged transmission of higher interest rates through to debt costs for asset owners. At the end of 2022, portfolio interest rates were equivalent to 2018 levels, but even as the five-year swap rate falls in 2023 (our baseline), the portfolio interest rate continues to rise. By the end of 2025, we estimate the portfolio interest rate will reach around 3.7%, which is on par with 2013 levels – that’s just four years to unwind eight years of debt cost reductions.

This may force interest coverage ratios to dangerously low levels, while owners facing a refinancing shortfall in 2023 will need to add more equity, seek new equity investors or default. Poorer quality assets look most exposed.

Does the potential for policy rates to move even higher and for longer become a game changer for real estate debt costs? We think the answer is no, at least for now. Our analysis suggests that the incremental impact of higher rates is marginal unless accompanied by a sizeable shock. The all-in interest rate at portfolio levels is already on a steep upward trajectory that is unlikely to change without interest rates falling back towards historic lows.

Either way, real estate corrections can be a double-edged sword as they also present opportunities to acquire assets at a steep discount. But timing is crucial. Recent high-frequency valuation data from the UK signals a deceleration in the rate of capital value decline at the end of 2022, though monthly data can be volatile. But eurozone 10-year government bond yields and five-year swap rates ended 2022 near their October peaks, suggesting that from a relative pricing and debt affordability perspective there is still further re-pricing to come.

So, we remain cautious about cycle timing and believe that buying opportunities are not imminent. The gradual ramping up of higher debt costs on portfolios is a limiting factor for a quick recovery, with the additional downside of higher-for-longer rates dragging on sentiment.

That said, as we get more clarity over the future path of inflation and interest rates, real estate pricing pressure should alleviate. Still, we don’t think the swing will be quick. By our assessment, a return to real-terms capital value appreciation on an annual basis is unlikely until 2024.