Ask any real estate investment manager about their main drivers of long-term performance, and they will likely present their Megatrends overview, though it may go by a different name. This will cover the enduring factors that most influence demand through cycles.

If pushed to pick what is their most important of these drivers that will define the next cycle, my guess is that most will select Technology and the Environment. And never have I seen two trends push so profoundly and urgently in opposite directions as they do in the case for data centres.

“Any sufficiently advanced technology is indistinguishable from magic,” Arthur C. Clarke

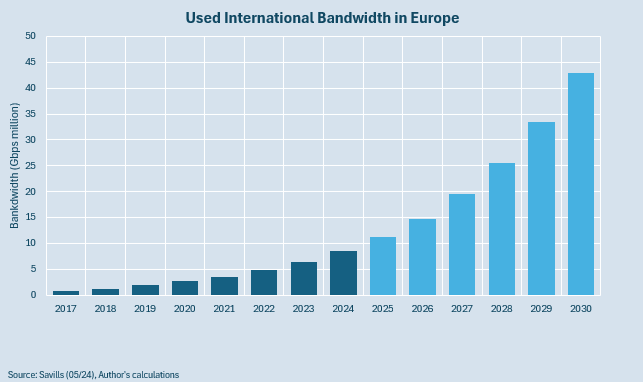

Technology represents the positive demand side of the debate, and the story is not particularly complicated. The chart below shows the rapid historic and projected growth in data bandwidth usage in Europe. In truth, I could have plotted any number of other indicators that tell the same story: data centre floorspace, number of autonomous vehicles, market size of A.I. etc. As the Internet of Things grows ever larger, demand for data centres is only going one way.

This is remarkably compelling as an investment case. After all, we cannot be so certain as to future occupier demand for any other real estate sector. In fact, demand for most other sectors is actually being negatively impacted by the evolution of technology, as it tends to shift occupier demand from physical to virtual spaces. Consider the rise of online shopping, remote work, virtual education, movie streaming, and online gaming as examples of this.

There are two caveats to this considerable growth in demand for data centres which I rarely see mentioned by commentators on the data centre sector, which I explore below.

“Silicon Valley is a mindset, not a location,” Reid Hoffman

The first is that many data centres violate the most fundamental real estate adage of them all; Location, Location, Location. Whilst securing an optimal site is crucial for those data centres servicing major corporates where any latency is problematic (e.g. stock exchanges or credit card companies), the majority of workers will not notice whether the data centre their employer uses is near a major internet exchange or not. It could be located thousands of miles away in the Arctic, where much-needed cooling is naturally more efficient. Most businesses are simply not that dependent on having the very quickest data transfers.

“The idea of a personal communicator in every pocket is a pipe dream driven by greed,” Andy Grove (1992)

The second is that the sector may become a victim of its own success. Moore’s Law, coined in 1965 and later amended, states that the number of transistors in an integrated circuit doubles approximately every two years. This observation has largely held true for decades, which is remarkable in the field of technology, where other notable pioneers, such as Bill Gates and Steve Jobs have themselves woefully underestimated changes in their own industry.

As processors get smaller, the data centres of today should be able to handle considerably greater bandwidths within the same physical space. And we haven’t even touched upon the growth in virtual computing or the eventual commercialisation of quantum computing, and how these will affect both supply and demand.

And yet, regardless of the above argument that demand may be curtailed by elasticity of supply, I would continue to claim that the size and growth in demand for data centres will be a trajectory unlike any we’ve ever seen.

“It’s gonna be a great environment for my little girl to grow up in,” Kill Bill: Volume II

What about our second inexorable trend; the Environment? This represents the negative demand variable. Investors have been getting ‘greener’ for many years now.

Is it fair to say that the current political direction in many countries is typically in favour of softening both regulation in general, and the reaction to the climate crisis more specifically.

And yet I do believe that the environmental drivers of occupier demand will broadly withstand this political reversal. My reasons are as follows (also see Impact Investing: Here today, but gone tomorrow? for more detail):

- The younger generation, which comprises an increasing proportion of the workforce and consumer base, are the most dedicated supporters of pro-environmental issues. Corporates appealing to this demographic, either as shoppers or employees, will therefore continue to take their environmental credentials seriously.

- As a result, institutional investors are seeing environmental factors drive performance. They will try to capture this performance, whether or not they themselves believe Environmental issues to be important from a moralistic point of view.

“It’s not easy being green,” Kermit the Frog

So just how green are data centres then?

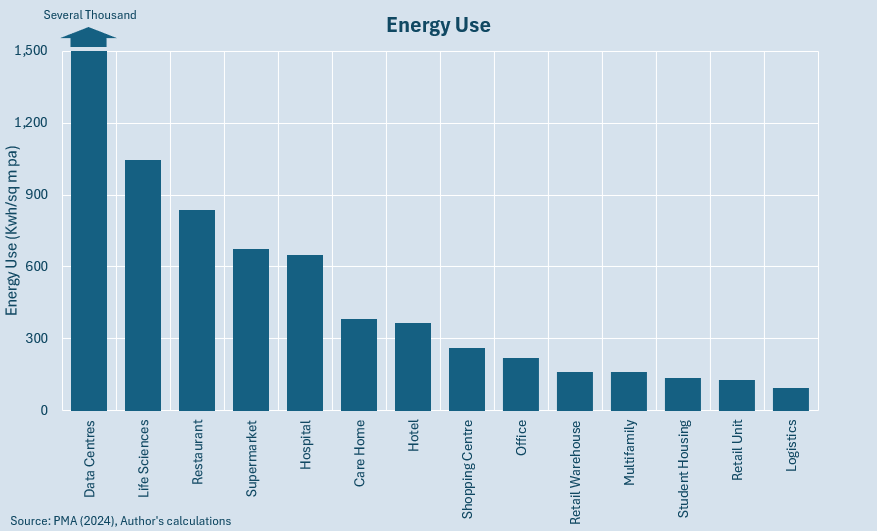

They use more energy for their size than any of the other sectors. And, according to the International Energy Agency, power generation is the largest source of carbon dioxide emissions in the world. Given that they expect energy consumption by data centres, A.I. and cryptocurrencies to double between 2023 and 2026, this is hardly welcome news for sustainable investment strategies.

Ultimately, their poor environmental performance may deter some institutional real estate investors.

“I never worry about the problem. I worry about the solution,” Shaquille O’Neal

The good news in this regard is that the data centres’ emissions problem is not a new one, and so new regulations have been introduced specifically to target this. Some of the best and brightest minds are working on reducing data centres’ energy consumption. Ironically, A.I. is actually adept at coming up with solutions to the problems demand for it itself is causing, by optimising usage within data centres.

We should have confidence that this will pay dividends. In a rather pleasing mirroring of Moore’s Law, we have the lesser-known Koomey’s Law. Coined in 2010, this observes that computing energy efficiency doubles approximately every 18 months. This means that, for a given amount of computational work, the energy required decreases significantly over time.

And where energy cannot be reduced, using emissions more efficiently is another option; for example, recovering the waste heat that data centres produce to warm nearby buildings.

“Then you do have a choice,” Inception

With these in mind, for environmentally-aware real estate investors that do not wish to miss out on the data centres boom, there are three options:

- Pass the buck: While optimistic, it’s possible that advances in technology and grid decarbonisation could mitigate the emissions issue within a few years.

- Take a portfolio view: Not all assets will be able to hit their green targets. Make up the negative environmental hit from data centres on greener assets elsewhere in the portfolio.

- Be active: Avoid the least energy efficient data centres, and stay at the forefront of efforts to make data centres as sustainable as the latest technology permits.

This article was originally published in My R. E. Education and is republished here with permission.