Destination shopping will return, says this writer.

Having had so much change forced upon us by this cursed viral crisis, we can all be forgiven for despairing that things will never again ‘settle down’. And yet they will, albeit at a different kind of normal from what we considered normal before; itself merely the latest in our ever-changing view of normalcy. With this in mind, I will spend a moment reflecting on the fast-moving journey the UK has made in relation to its adoption of e-commerce.

Before I consider how retail behaviour across the UK has changed dramatically since the pandemic denied us access to so many go-to retail and leisure destinations, I want to reflect back on the no less dramatic changes pre-coronavirus.

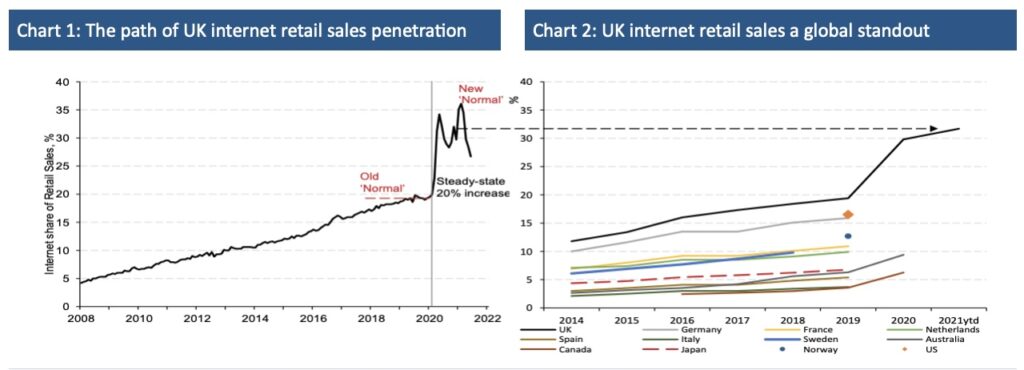

It is quite remarkable that as recently as 2008 less than 1/20th of UK retail sales were performed online. Within a decade, 1/20th became 1/5th, doing so thanks to an annual growth rate in online sales averaging 20%. However, having recorded stunning double-digit year-on-year percentage growth for over a decade, what we saw through 2019 was a slowdown in the pace at which internet retail sales increased. Such was this deceleration that in the closing months of 2019, and first two months of 2020, year-on-year growth in e-commerce fell to single digits – not that much greater than the growth of sales at bricks and mortar premises. The result was the internet share of UK retailing seeming to plateau at around 20%, albeit being considerably higher than practically every other developed nation. It was with the evidence of slowing internet sales growth that in February 2020 I began to give real credence to the idea that maybe we in the UK had reached our Peak Retail Internet Penetration (Peak RIP). If that was indeed the case, it would have brought a great deal of relief to landlords along high streets and across shopping centres, whose fortunes had been so compromised by our moving online rather than from store to store.

“With an abruptness that none could have anticipated, behaviours changed dramatically with our being hard locked out of so many retail and leisure venues”

If in early 2020 we had actually reached Peak RIP, this would have had considerable investment implications for all forms of existing real estate linked to the logistics of e-commerce, as well as developments in these. As we know, we never got to know if Peak RIP had been reached. With an abruptness that none could have anticipated, behaviours changed dramatically with our being hard locked out of so many retail and leisure venues.

Such was the explosive acceleration in e-retail post lockdown – touching growth of 80% at its highest – that from hovering just under 1/5th, the internet penetration of retail at its peak reached 40%. Since scaling that high the share has fallen, albeit still closer to 30% than 20%. To repeat, we were never

allowed to know whether e-retail’s lacklustre growth towards the end of 2019 and early 2020 was a mere pause before another burst of strength. This accepted, there must surely come a point where we do reach Peak RIP. This, of course, opens up the question of when and at what share internet retail might peak. From my perspective, I expect this to come sooner than many might otherwise suggest, with a share of around 25% my prediction; 20% higher than the seeming plateaux before the virus.

I must stress than in chronicling the changing normal in our retail behaviour, I have viewed it in aggregate and not in a nuanced way, contrasting how the internet has egressed into our spending between, for instance, grocery and clothing, or even clothing compared to footwear. This said, while precise peaks in RIP will vary across categories, all must have a peak. I am also aware that the UK does not include in its retail sales data the food and drink we consume on commercial premises and delivered directly to us. These two areas were vying with one another before this crisis, dark kitchens spectacularly winning out over mid-market restaurants. This seemingly one-sided fight led to marked changes in the values of commercial properties respectively much needed and unwanted. Indeed, since this crisis struck, these competing forms of consumer catering have recorded all the more spectacularly different fortunes.

“Consumers in the UK have been journeying from one steady-state behaviour to another with, as we well know a few notable shocks in between”

The point I am trying to make is that in all forms of UK consumer behaviour, beyond the strict National Statistics definition of retail, a peak in e-commerce will eventually be reached. And, while it might be reached later than I anticipate and at a higher penetration rate than I predict, it will reach a peak before the consensus expects and so it will come as an unwelcome surprise to those ill-positioned. The plain fact is that since 2008, consumers in the UK have been journeying from one steady-state behaviour to another with, as we well know, a few notable shocks in between.

This transition has, of course, caused seismic shocks under the UK commercial property market, favouring certain assets and specific geographies – viz warehouses across the Midlands – while forcing others into vacancy or repurposing, particularly so on high streets and shopping centres. While such repurposing is never effortless or costless, it is far less so than what was required when shopping centres rose on land previously occupied and dirtied by heavy industrial premises.

The reality as I see it is that our appetites for the high street and shopping centres will return as our buying online matures. This means we will inevitably reach a point where the fortunes of destination retail and leisure begins to improve, to the great relief of occupiers – many new arrivals – and long suffering and new landlords alike. When this inevitable improvement happens, it will do so against the backdrop of marked change – read reduction – in the availability of space; with many units repurposed to, say, residential. Alongside altered demand and supply conditions we will come to see entirely new rent arrangements within and across UK commercial property markets. There will, as well, have to be an entirely new taxation of commercial property, altered to reflect a new normal in consumer behaviour which existing taxation is woefully unfit for.

Let me close by reflecting on the wisdom of Heraclitus that the only constant in life is change. As much as the internet has and is changing our consumer behaviour, we will soon arrive at a point of its peak egress in that regard. If we are unprepared for this change it will be costly.