It spoke volumes of her promised fiscal approach ‘on becoming’ PM that Liz Truss cited Professor Patrick Minford as an ‘endorser’. Then, in light of revelations of just how far off-grid his eccentric views can be, team Truss distanced themselves from Minford. Bear in mind that during the time his academic contemporaries were performing crucial policy setting roles on the MPC and OBR, Minford was in the wilds of Wales until, that is, his rediscovery by the adventuress Truss.

Let me be very clear. Those who wish only well for the UK economy should have no doubt that the ex-chancellor should become prime minister. In the event that we do see Truss rise to Tory leader, be prepared to see a rise in gilt yields and a fall in the pound. Now, as much as I would prefer to see Sunak rather than the arrival of Truss in Downing Street, I almost certainly foresee her summarily dismissing Governor Bailey (he is short-dated whoever wins). I have no doubt this would add further to gilt yields and jolt the pound down. The sad truth is that Truss would make a monetary martyr of Bailey, a man who is in fact a monetary moron. Yes, I did write that, because he has proven as much in his ill-judged words and in his poorly timed actions.

“Despite Truss’s claims that she will save the UK from recession, the simple truth is that on its current course this economy will positively surprise. Surprise, that is, a consensus set by those who simply do not understand the UK’s strong fundamentals”

My unfavourable judgement of Truss is based entirely on the harm her stated economic policies would do to the UK. I write here not merely of the reckless looseness of the inflation-fuelling fiscal policies Truss is suggesting pushing through, but her confrontational stance towards a China whose future strong economic growth must be harnessed by the UK, not lost to it (something Tom Tugendhat and his ilk appear to be incapable of grasping). I should emphasise the point that, despite Truss’s claims that she will save the UK from recession, the simple truth is that on its current course this economy will positively surprise. Surprise, that is, a consensus set by those who simply do not understand the UK’s strong fundamentals. And although chancellor for barely two and a half years, Sunak proved himself and supported the UK’s economic fundamentals. Proved himself, that is, by navigating us so well and calmly through an existential period which could easily have sunk the UK economy. Indeed, such was his fiscal command through and post a lockdown period that was not of his making, but that he had to react to, one can be confident Sunak can deal with any shocks the UK experiences under his watch.

To those who claim Sunak made clear sizeable fiscal policy errors, I simply ask what precisely they were, for I could not find fault in any significant way. Yes, there were errors, but these did not come from No 11, but a Bank of England too tardy with lifting the base rate. On the topic of No 11, my wish is that on being elevated to premier, Sunak continues with Zahawi as his neighbour. For just as Sunak ‘got the fiscal right’ numbers, so did Zahawi with vaccine policy. Do not get me wrong. I was never in favour of closing the economy and turning the UK into what seemed like a nightmarish authoritarian state, but remember how Truss and Hunt – a man seemingly unable to accept his limitations – were among those who pushed for the nightmare to be deeper and longer.

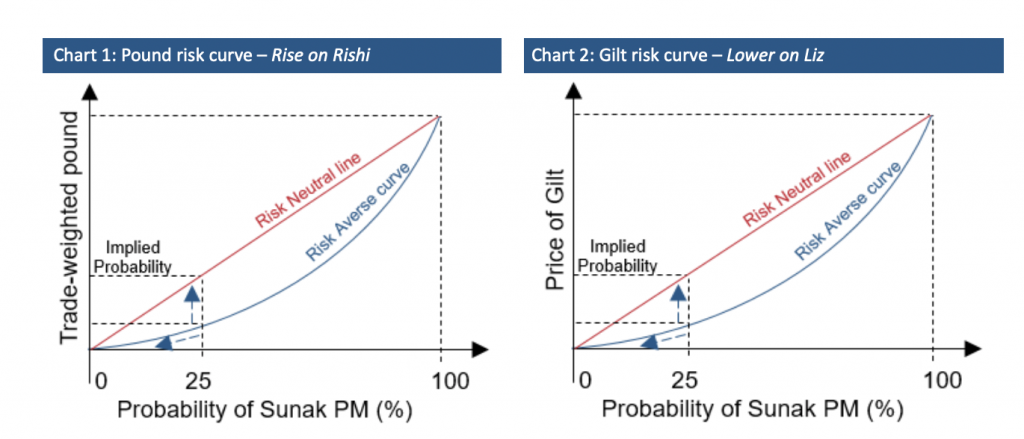

There will be those arguing that in the event Truss fails in her bid we will never know how ‘markets’ would have treated her. Well, since markets part price-in events which have a meaningful probability in the time up to the vote, we should expect to witness the rise of a risk discount in the pound and a risk premium in gilts. And, as the prospect of Truss rises and falls, risk pricing should rise and fall. In the fortunate event Truss fails (at present, a sub-20% chance, according to betting markets) we would see a rally in sterling and gilts (see charts 1 and 2). However, if she were to win, the partial risk pricing (an 80% chance) would become total – the pound falling all the more and gilt yields rising all the more. While this phenomenon is hardly unusual – it occurs ahead of any general election where the sides are polarised in their economic policies, viz 2017 and 2019 – it is, however, a modern rarity in relation to Tory leadership contests – viz 2016 and 2019.

Now, whatever markets might think, we might just see that Truss proves a revelation as PM, with her economic and wider policies proving precisely what the UK is in need of. Is this possible? Well, I’d say so improbable as to equate to zero.

I have made my confidence perfectly clear that if kept on its current course, the UK economy is at no risk of recession; a course Sunak would maintain as PM. It is however, not a course Truss is keen to continue on. Ironically, her argument for a new course is because she predicts recession without a sharp turn on the tiller. What we have then is a proof by contradiction. How can she be what the UK economy needs when she clearly does not understand how it works? We also have an irony here. Her arrival as PM would dial-up from zero the probability the UK economy falls into recession. So, to be clear, in Truss, I do not trust.

Let me close with what has up until now been the defining difference between Truss and Sunak: her Laffer (laughter?) curve insistence that tax cuts will drive economic growth rather than fuel inflation and his argument on fiscal probity to calm monetary conditions. Rather than simply argue that the ex-chancellor is perfectly correct, I want to consider UK tax in the round. Yes, it needs changing. Changing not in rates of tax being lowered, but the whole system being overhauled. Stamp duty needs to go and so too the Capital Gains Tax (CGT) exception for the sale of one’s home. Inheritance tax needs to end or at least be less of a devilish presence at the end of our lives. Council tax and business rates need significant reform, if not replacement. A new sales tax needs to come in for VAT and fiscal devolution is long overdue, allowing the likes of Scotland and Wales to self-fund for their public sector excesses. All these changes and more are best achieved under the stewardship of the ex-chancellor.

PS. Whereas Cameron made his bid to become PM by citing his inclination towards the Blairite model, the two candidates presently seeking to rise to premiership have invoked their belief in Thatcherism. All I will say is that given her flip-flopping, I have no doubt Thatcher would have had no time for Truss. As for Sunak, had Maggie had him as chancellor in her third term rather than Lawson, she would most likely have been rewarded with a fourth.