Keep your eye on the far horizon, says this writer.

Real estate owners and users are not short of business challenges right now. Climate change, energy use and carbon emission; growing wealth disparity and diverging demographics, coupled with migration, leading to densification and urbanisation; housing shortages and concerns about social impact; the global financial crisis, caused by real estate and still not out of the system (how will QE resolve?); global health issues, including the need to improve our approach to senior living; and, on top of all of these, data digitalisation and the fourth industrial revolution.

We are becoming more and more familiar with a range of new technologies. These include web delivered and phone-ready apps; autonomous vehicles, drones and flying cars; artificial intelligence, machine learning, deep learning (big data); robotics; virtual reality, augmented reality and computer-aided design; blockchain, distributed ledger technology and quantum computing; sensors and controls; and GPS and GIS.

For property professionals, is this a challenge or an opportunity? Well, it’s an opportunity, of course. If we boil these issues down to the basics, the world of property is being shocked by three mega factors: climate, health and tech. The global climate crisis needs immediate action, carbon emissions need to be reduced and the built environment is reckoned to produce 40% of emissions. The Covid crisis made us all aware of the need for healthy buildings – not just places where we are safe from infection, but buildings with good air quality, showers, cycle racks and places to re-charge, and (given the apparent reluctance of many to return to the office full time) places that encourage productivity and effective collaboration. Finally, the fourth industrial (tech) revolution seriously damaged the retail property sector and has thrown a lot of risk at the office market due to the apparent effectiveness of home-working technology. It has focused investors’ attention solely on beds (residential), sheds (distribution warehouses), eds (schools and universities) and meds (health centres, medical offices, life sciences buildings).

The end of the rainbow?

Professional UK property investors are on the lookout for beds and sheds, and increasingly for harder-to find meds and eds. The golden triangle for meds and eds is the London-Oxford-Cambridge one. Over the summer, a FTSE 100 property company asked me if I could help find some life science/medical property deals for them in Oxford. My reaction – which I didn’t share with them – was that they are bit late to the party. It does make me wonder about the opportunities in this space for the more adventurous Oxbridge colleges.

Operational leverage – and risk

Effectively, tech has created an over-supply of retail and office space where there was previously a perceived shortage. This has weakened the position of many landlords, who are being required to accept less attractive income streams: shorter leases, turnover rents and the need to provide services (like co-working space and cafes) creating operational leverage – more risk.

This is where technology is a help, at least for the more thoughtful property owners. Digitalisation has created platforms, apps which act as information bridges between property managers and property occupiers (think hotels).

We spoke to a large central London office landlord, who expressed an understanding of the need to collect data about their customers – but what data? And, more embarrassingly, which customers? Like so many institutional owners, these relationships had been subcontracted to property managers. Inviting a hotel group CEO to join a round table with the office owner, we learned a lot. We heard about the hotel’s B2C business, such as private travellers, short stays, meals, services, all described by big data sets. We heard about the hotel’s B2B business – meetings, conventions, gala dinners, again all described by big data sets. And we heard about the hotel’s platform business – Booking.com, Tripadvisor, etc – again all described by big data sets.

There is a lot of understandable talk about increasing operational intensity in office buildings. As office owners and managers provide co-working space, cafes, cycle stores, showers, yoga studios and farm shops, their operating costs rise from what was previously very little under an FRI lease to a larger burden. Effectively, these become fixed operational costs if the building empties. That’s a straightforward hike in risk as the net cash flow becomes increasingly leveraged. I think that may have happened to a few shopping centre owners too.

The successful property owner/manager/operator of the future will use technology to provide healthy, or smart, buildings; to measure environmental performance (energy use, carbon emissions); and to understand the need and preference of his/her customers. This is not a development to be afraid of – after all, it’s how AirBnB became a unicorn.

“The prospect of unicorn status naturally attracts entrepreneurs and VC investors alike”

The scramble for funding

The prospect of unicorn status naturally attracts entrepreneurs and VC investors alike. The latest PILabs accelerator intake has turned away hundreds of applications to focus on just six or seven PropTech hopefuls. The REACH UK class of 2021 – seven startups with a residential flavour – graduated at the end of the year, having been selected from a similarly crowded field. There is no doubt that tech will change the property world. How much money we will all make or lose is yet to be seen.

Success for a PropTech firm will eventually – in the very long run – be measured by profitability. Well before then there will be other ‘successes’ and milestones – achieving revenue; raising a seed round; getting series A, B and C funding. These milestones are all about keeping the company alive while it develops its tech stack to the point where it has some value, deterring local competition.

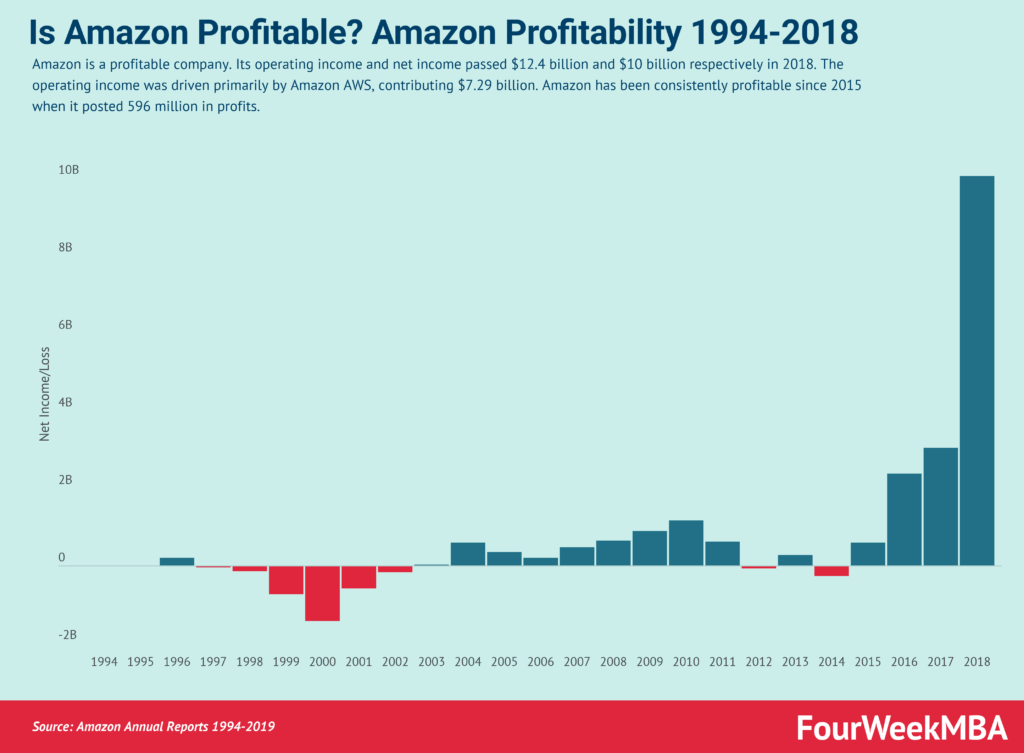

We have to be patient. After all, it took Amazon 20 years to be profitable, but nobody was calling Amazon a failure pre-2015. On the other hand, I’m unlikely to be alive to see my investments flower or my carried interest paid out – unless health tech makes some more rapid advances.

I’m gambling on my niece’s husband and others in his field. He has given up being a surgeon to be a health tech entrepreneur because he believes robots will be much better than humans at undertaking the procedures he trained seven years to perfect. Let’s hope he, and a lot of others, work fast.