In these ever more so “uncertain times” on both sides of the Atlantic and in parts elsewhere, there is a great deal of international capital seeking safety. There is also so much wealth desirous of diversification from the traditional destination of the dollar; and NO, BITCOIN IS NOT THE BLOOMIN’ ANSWER.

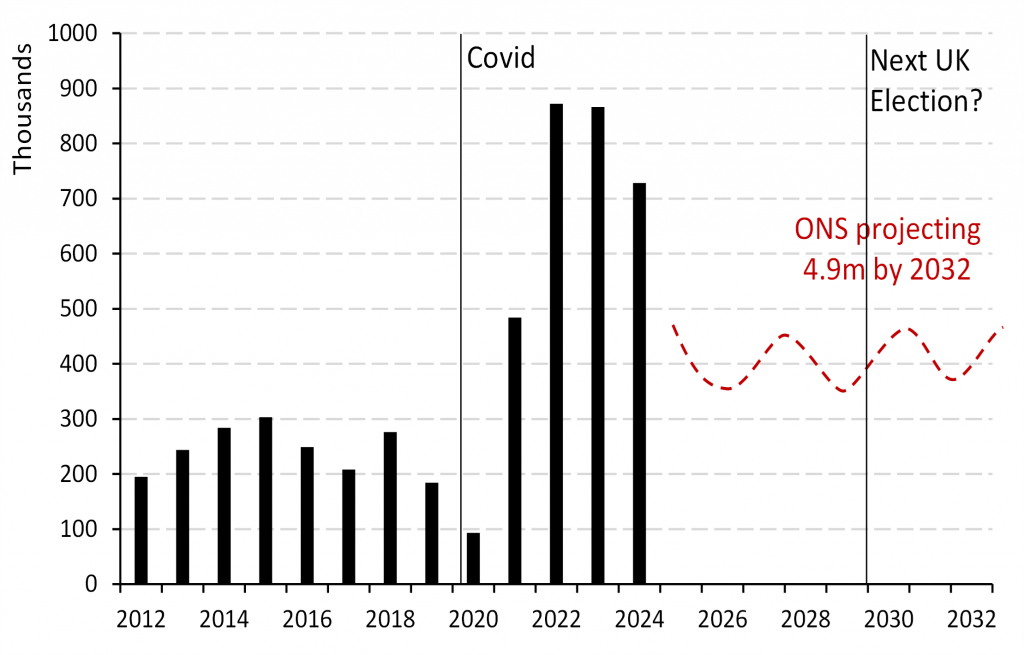

Not only is there financial capital searching for a safe economic home, there’s also a great deal of valuable human capital, looking for the same thing. In both very much linked instances, the UK and specifically London, continues to be viewed as an attractive draw; doing so even if some within it, don’t quite value their luck in being “invested” here. As for “the exodus of non-doms”, be in no doubt, putting aside the highly charged issue of those who enter “informally”, the UK has very much a revolving door into it, for formal approved inflows. To be clear, the ONS estimates – rather conservatively (sic) in my opinion – a c5m increase in the UK’s population from now until 2032, driven mostly by net-migration (see Charts 1 and 2).

Chart 1: Net UK migration

Chart 2: Net UK migration: marked Brexitstential change

So, to everyone voluntarily turning their back on the UK and exiting in a huff, I will say this: You’ll notice as you revolve out, a sizeable queue of those keen to come in to replace YOU. Please be in no doubt, long before light bulbs have had a chance to go cold in homes vacated by the few opting to leave the UK, a new tenant will have taken possession; with many others from “outside”, disappointed to have been outbid.

Now, the presence and growth of an ever-growing international demand dimension for UK residential property is why traditional valuation and affordability measures are woefully anachronistic. And this is the reason why the Royal Institute of Chartered Surveyors (RICS) need to reassess how they assess affordability. For what rules used to reliably work regarding house price to earnings multiples for Britons alone, are no longer credible in offering the pathfinders/warnings of looming “house price reversals”. To repeat, the reality, whether you accept it or not, is that UK residential property is no longer the domain of only Brits. And as such homes will become ever more expensive for us Brits and so defy each fresh claim of a looming sharp pricing correction. Global demand for UK homes has and will continue to overwhelm “local” supply.

Normally when capital rushes somewhere which has a freely floating sovereign currency, the latter moves higher, and as it does, begins to slow the process of asset price inflation. And in this regard, not only is the pound “unloved”, but London happens to share the same currency with the rest of the UK; a currency that seems to withstand moving higher, even as investment capital comes into it.

Now, just imagine for a moment a Capital currency for the Capital, let’s call it the COCK, and how it would have performed had it existed. There cannot be much doubt that with its strong economic fundamentals the COCK’s exchange rate would have risen impressively in most dimensions, against the euro, even the dollar, and very much so against the currency of the rump UK; let’s call it the PUNT. Obviously, whilst all across the UK face the same interest rate, a notional COCKney and PUNTer, would have carried different interest rates.

Had there been a COCK, it would like the Swiss franc, have “enjoyed” an interest rate lower than the PUNT. This would have fuelled property price inflation in the Capital, but also the carry-trading or arbitrage of capital from the Capital to the “Regions”. Remarkably this centrifugal flow of money outwards from the Capital is happening and set to accelerate; a theme on which I will repeat later.

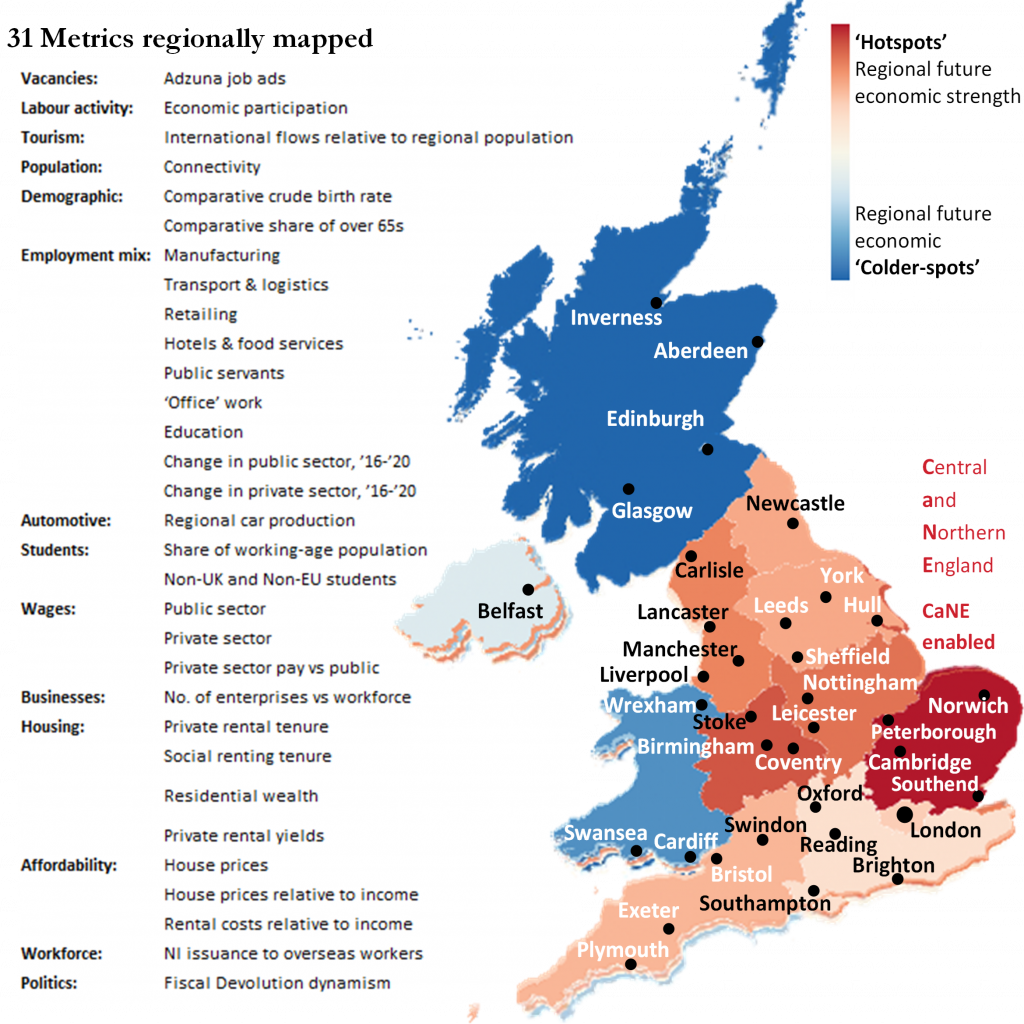

In short, if asked where I expected the HIGHEST TOTAL RESI RETURN ACROSS THE UK I would answer thus. It might be very wise to take your COCKney’s and give them a PUNT on highly returning CaNE (Map 1).

To REPEAT, if asked where UK resi-values and rents will rise most in percentage terms, MY CALL, IS CaNE, and allot of people know that.

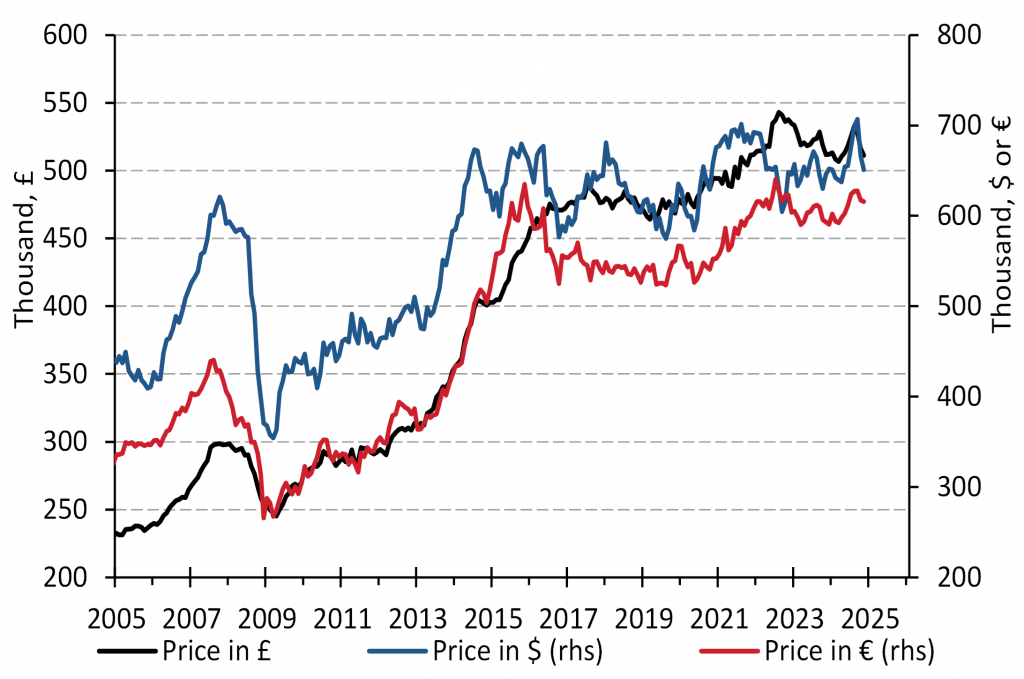

Please see UK property from an international pricing perspective

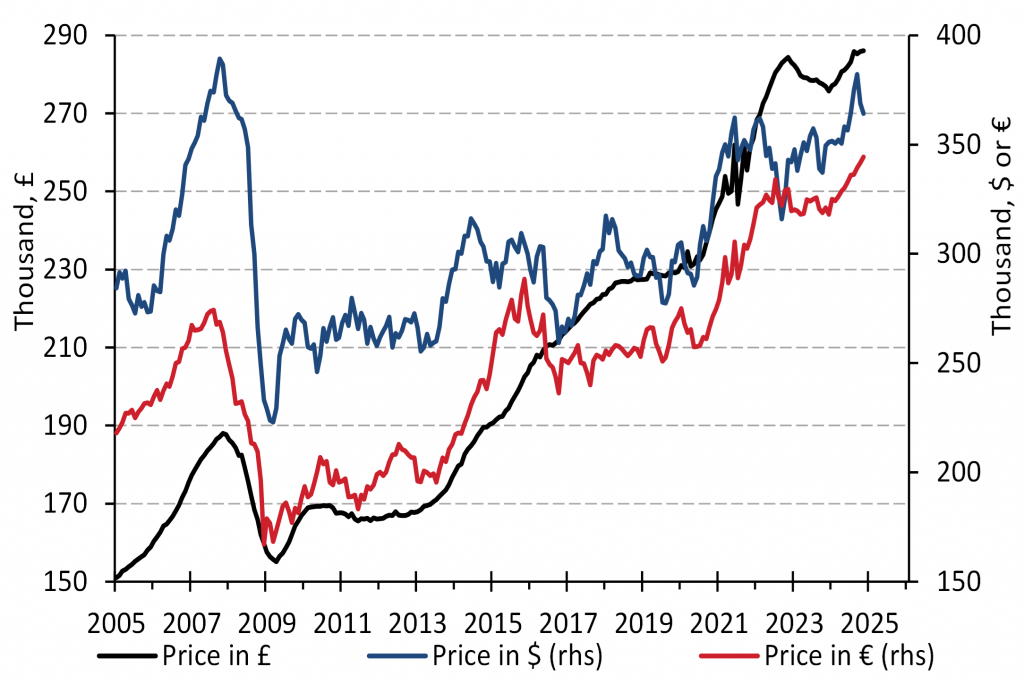

Chart 3: London house prices in £, $ and €

Chart 4: UK house prices in £, $ and €

Let us contextualise UK home prices in an international setting. Doing as such by considering the “value” of London (Chart 3) and more general UK residential prices (Chart 4), measured in the euro, and the dollar; the latter the de facto currency across much of the developing and resource world.

Having as it were repurposed the price of UK homes away from pounds to dollars and euros we see that from the perspective of these denominations London and UK housing more widely became a very great deal more affordable – down more than a THIRD in dollar terms – in the wake of the GFC, which in fact, wasn’t Global, but very “localised” to UK/Europe and the US, I digress.

So not only did the nominal £-price of UK property fall in the wake of the “GFC”, but the pounds reversal, made monetary matters so much more attractive to buyers from abroad; that the UK base rate was slashed and kept close to zero for TOO LONG, only fuelled the appetite of BRITS to buy homes and rent them out.

Following the “GFC”, UK property became more affordable to “foreigners” with each further FX’in reversal “suffered” by sterling; notably its shock shift downwards in the wake of the shock Brexit Referendum Result and indeed before it the anticipation that it might well (sic) actually happen.

The reality is that every time the FX market has “HAMMERED THE UK”, it has acted to set the auction hammer down strongly on foreign buyers out-bidding Brits for UK residential, and indeed real estate more widely. So as for the pound falling further, well if it does, so UK property will only become that much more affordable to those opportunistically paying in euros or dollars. In the event however, the pound goes the other way, then those with homes in the UK, paid for in euros or dollars brought into the UK from overseas, will on translation, consider their purchase a rather wise one.

Let me focus for a moment on those accounting in US dollars

We need to remember that a great many dollar-denominated investors exist beyond the shores of the United States. These have traditionally saved in that unit because they happen to largely earn in it: the dollar still thus far, the pre-eminent resource numeraire. The point I would stress is that this pricing state will not continue, because the “dollar commonwealth” will begin to fragment, just as the sterling-commonwealth once did. And just as HONG KONG and its dollar departed the latter so it will exit the former, and very possibly this year.

There will no doubt, be those claiming that even if London property prices continue to rise, those across the rest of England will not enjoy the same “good fortune”. Well, that claim will fail to come “good”. For as London’s property owners see their notional property wealth increase, a growing number will choose to capitalise on this by relocating out of it to what one might call CaNE – Central and Northern England. And in opting to “buy far more for much less”, sellers of London property will create inflation ripples outwards from it. Moreover, if the ONS is correct in anticipating the significant number of arrivals to the UK – many carrying valuable human and financial capital, and/or wealthy students – one should expect these not to settle exclusively in London, but to diffuse widely across England; study or work that is far and wide.

Map 1: UK by Parts: Best market to buy? My call is CaNE