Most real estate value is created at the urban level, but some of the most expensive cities in the world are the least well-functioning. So, it does not follow that improvements in the ways cities are run will flow directly into increased real estate value, but they might.

Big data techniques are increasingly being adopted by city governments to improve the urban environment and reduce the cost of doing so. The initial results are very encouraging from an urban perspective. Whether big data mean big gains for real estate owners is less clear.

Big data has three dimensions: Volume, Velocity and Variety.

Volume: big data is large—often measured in petabytes or more.

Velocity: big data is frequently generated continuously, in or near real time. Twitter posts, cell phone location data, and information from weather and air quality sensors are examples.

Variety: big data comprises numbers, text, images, video, audio and other kinds of data. Analysis needs to be flexible enough to deal with any mix of types.

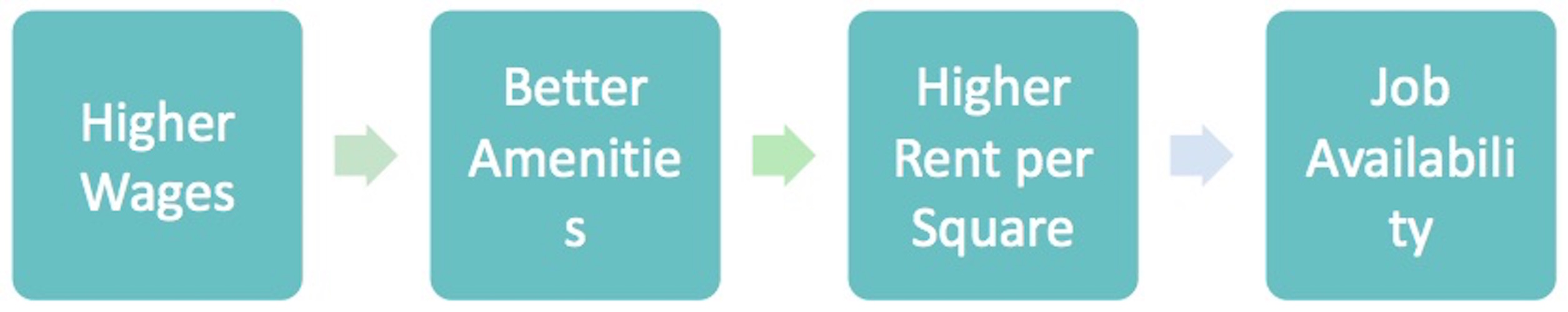

According to Glaeser, Kolko and Saiz rents in any location are a direct function of wages, jobs and amenities. Where big data can generate productivity or amenity gains in cities there will be a proportionate rise in real estate values.

Productivity Premium + Amenity Premium = Rent Premium

Urban big data is comparatively new, so the scope of initiatives pursued in different parts of the world varies widely. Below are some examples.

City Examples

Impact on City & Real Estate Values

NEW YORK CITY, NY, USA:

The Health and Human Services Connect initiative allows clients to walk into different agencies without duplicating paperwork. It allows the city to save costs, provide better services and even fraud.

SANTA CLARA, CA, USA:

The drought in California prompted Santa Clara to retrofit its municipal irrigation system with sensors to more efficiently manage limited water supplies. The system is expected to save 180 million gallons of water.

LONDON, UK:

Transport for London (TFL) uses ticketing data to build travel patterns across its rail and bus networks. This information helps in improving the network and assessing the impact of closures and diversions.

YINCHUAN, CHINA:

Yinchuan is a smart city pilot project in China, with features such as facial recognition on buses, grocery delivery via apps and an online portal connecting doctors with patients.

RIO DE JANEIRO, BRAZIL:

IBM has designed for the city an operations center that integrates data from 30 different agencies. These provide a foundation for public safety services, including an early warning and evacuation system for Rio’s favelas.

SPAIN:

Spain’s tax agency analyzed data from unmanned drones surveying 4000 municipalities. It discovered 1.69m properties paying insufficient taxes on new construction, expansion and pools. The initiative brought in 1.2bn euros in additional taxes.

The data, for big data analysis is derived from a wide array of sources. Many cities are undertaking the digitization and compilation of existing administrative data, such as property tax records. Sensors in roads and buildings measure such elements as flows of people and cars, air quality, light availability and temperature. Apps on iOS or Android platforms can be used by citizens to input data, for instance on road conditions. Smart devices, such as inhalers used by asthmatics, can provide sophisticated up to the minute data on air quality. Big data techniques allow, data sets to be geocoded and integrated.

Our understanding how big data affects cities, which is not yet complete, is key to predicting the real estate outcomes. There are at least four effects:

- Improved or more efficient municipal services, which boost rents or are capitalized into real estate values. People move to locations with better or cheaper municipal services so values will rise—particularly in the residential sector. This is potentially a citywide effect, though there may be specific local impacts if city government is fragmented, as it often is.

- Better information or operating environment for local firms leading to higher profitability. Higher rents would occur in the commercial clusters, particularly if, for reasons of land use planning or natural geography new supply was restricted.

- Smaller-scale placemaking initiatives to improve pedestrian flow, security and safety, or usage would have positive localized value effects (although increased usage of public facilities might sometimes generate negative effects for local residents).

- A more efficient urban transport system, which is a focus of many big data initiatives, is probably key to broader based value. It has several positive effects, including higher residential values in the city periphery and suburbs, and around specific transport nodes.

If the city level benefits of big data are positive but localized, the global pattern of adoption shows unexpected results. Asia for instance, with its rapidly rising standard of living but tendency towards autocracy is furthest ahead in the adoption of big data techniques, particularly the use of sensors at the urban level. In Africa, the highly advanced state of mobile telephony, is allowing big data techniques to improve transportation in the informal sector. Although super star cities in the West, for instance New York, are moving ahead in the utilization of big data for city management, pressure on budgets, as well as well-founded concerns about privacy stand in the way.

Investors could make gains from aligning strategy with city big data initiatives, but as always with real estate, a localized case by case approach is required.

Urban Big Data, City Management and Real Estate Markets, the full report, can be accessed at: https://mitcre.mit.edu/wp-content/uploads/2018/01/URBAN-DATA-AND-REAL-ESTATE-JAN-2018-1.pdf