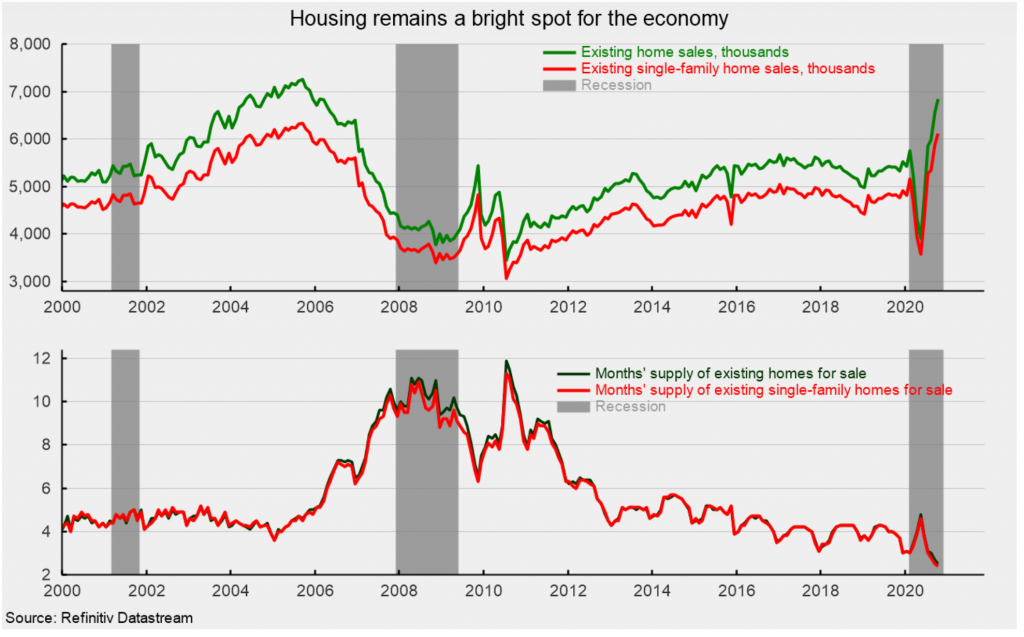

Sales of existing homes rose 4.3% in October to a 6.85 million seasonally adjusted annual rate. Sales are now up 26.6% from a year ago and are at their highest level since November 2005 (see top of first chart).

Sales were up in all four regions in October: sales were up 1.4% in the West and are up 22.8% from the year-ago level; sales rose 3.2% in the South, the largest region by volume, leaving that region’s sales rate 26.5% above the year-ago pace; sales gained 8.6% for the month in the Midwest and are 28.1% above the October 2019 rate; and sales were up 4.7% in the Northeast, and were 30.4% below year-ago levels.

Sales in the market for existing single-family homes, which account for around 90% of total existing-home sales, rose 4.1% in October, coming in at a 6.12 million seasonally adjusted annual rate. From a year ago, sales are up 26.7%. The October pace is the fastest since November 2005 (see top of first chart).

By region, sales for existing single-family homes all posted gains for October: sales were up 1.6% in the West and are up 22.8% from the year-ago level; sales rose 2.8% in the South, leaving that region’s sales rate 26.1% above the year-ago pace; sales gained 8.4% for the month in the Midwest and are 28.1% above the October 2019 rate; and sales were up 4.1% in the Northeast, leaving sales 32.8% above year-ago levels.

Condo and co-op sales posted a 5.8% rise for the month, leaving sales 25.9% above the October 2019 pace. Sales came in at a 730,000 pace for the month versus 690,000 in September.

Total inventory of existing homes for sale fell 2.7% to 1.42 million in October, pushing the month’s supply (inventory times 12 divided by the annual selling rate) to 2.5, a new low, from 2.7 in September (see bottom of first chart). For the single-family segment, the month’s supply also fell, to 2.4, also a new record low (see bottom of first chart), from 3.8 in September, while the condo and co-op month’s supply fell to 3.6 from 3.9.

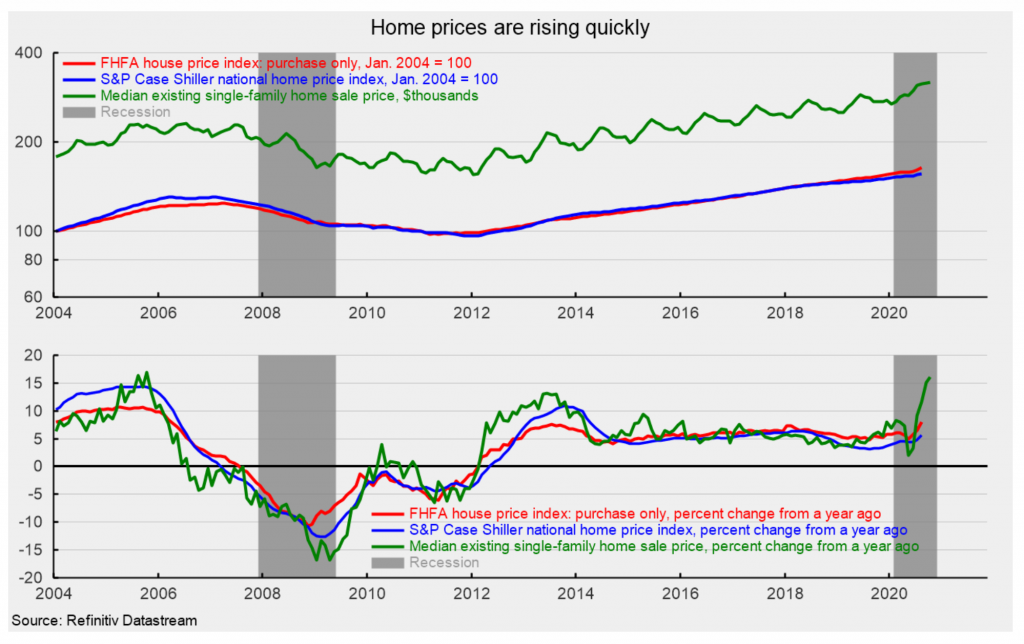

The median sale price in October of an existing home was $313,000, 15.5% above the year ago price. For single-family existing home sales in October, the price was $317,700 (see top of second chart), a 16.0% rise over the past year (see bottom of second chart), while the median price for a condo/co-op was $273,600, 10.3% above October 2019. Though unemployment remains high and the outlook for the labour market and the broader economy remains highly uncertain, near record-low mortgage rates and surging demand for housing are supporting a strong recovery for the housing market. Only time will tell if these conditions will continue, but for now the housing market remains one of the brightest areas of the economy.

This article was originally published by the American Institute of Economic Research.