So why are homebuilders so sad?

In today’s dispatch:

- home prices hit an all time high

- strangely, no one wants to build new homes, and homebuilders are sad

- discounts everywhere, but not in the indexes

- the indexes are a little hazy, and that’s ok

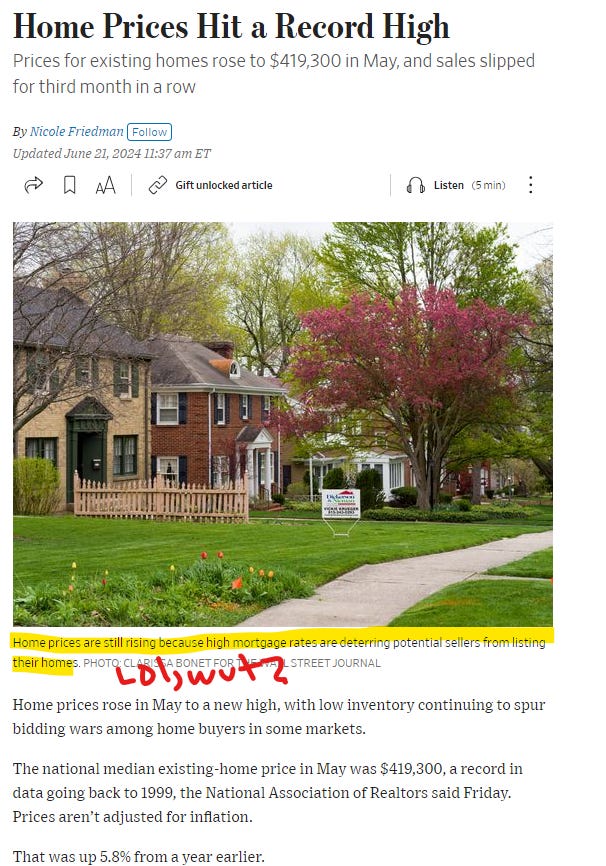

Last week, you may have seen a headline like this:

Home prices hit a record high!

Home sales, however, continued to plummet. Presumably, home prices are so darn high, that sellers just can’t be convinced to sell.

Can you believe it?

Prices are so high that no one feels like building new homes

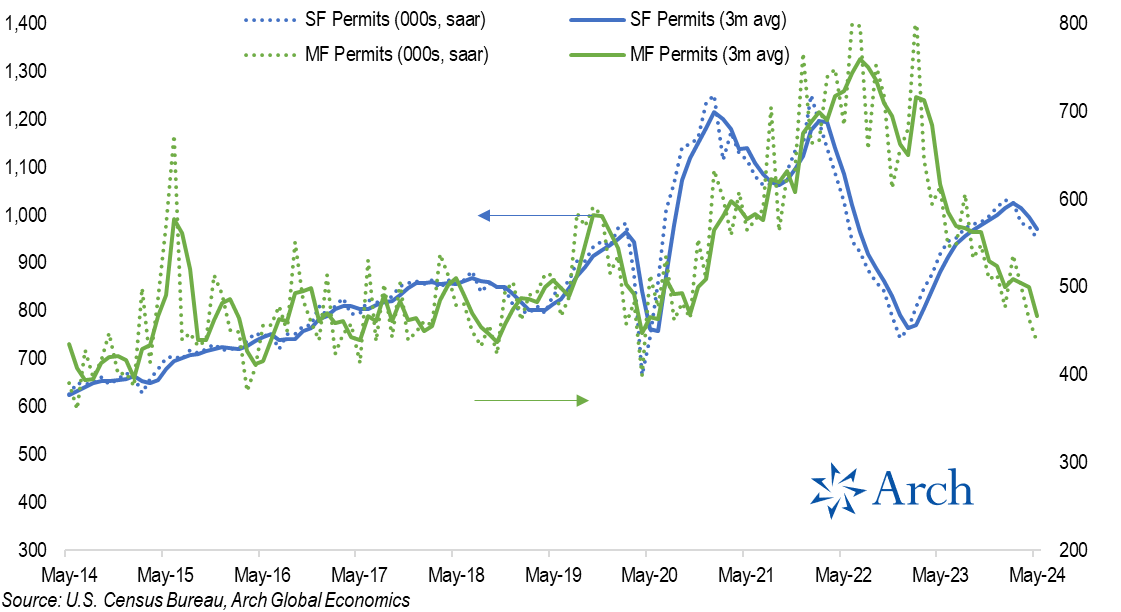

You might have also seen some data like this . . . building starts for both multifamily and single family have rolled over:

Single-family starts have joined multifamily on its downward slope.

I think the only reasonable inference is that home prices are so high, that no one wants to build houses either!

Prices are so high that builders are gloomy and offering discounts

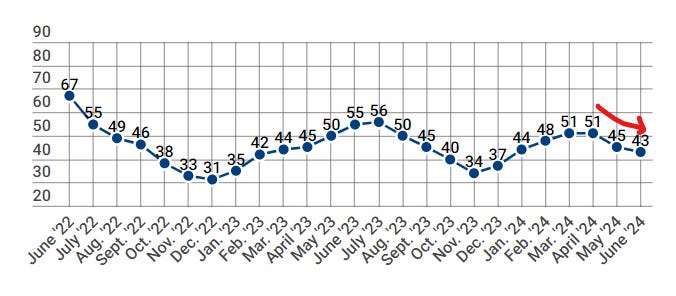

Indeed, home prices are so high that homebuilders are becoming downright gloomy in their sentiment:

Homebuilders are probably just upset that they can’t keep homes for themselves and watch those values skyrocket to the moon!

Why sell when values just go up, up, up?

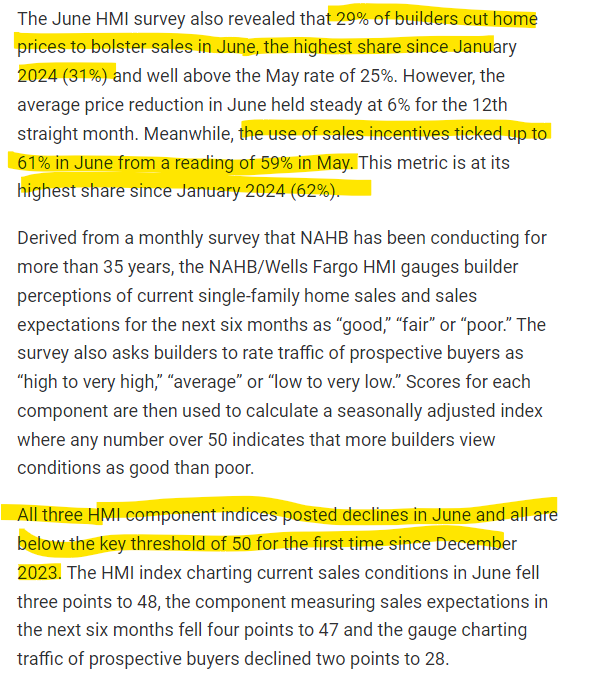

With all time high prices, builders did a special discount giveaway to help the less fortunate:

61% of builders used incentives and 29% cut prices, because they feel badly that prices are so darn high!

One of the largest homebuilders, Lennar LEN 0.00%↑, with ~$9B in home-selling revenue, was feeling so blue about skyrocketing home values, it decided to cut prices by ~5%

Lennar reported a 5% decrease in the average sale price of homes delivered.

Stupid $42B publicly traded homebuilder. No one told them that home values were at all time highs.

They probably need better brokers.

Used homes > New homes

Or maybe it’s just that homebuyers have lost their taste for brand new homes.

That’s why new builds are dropping in price, while all the other homes are hitting all time highs.

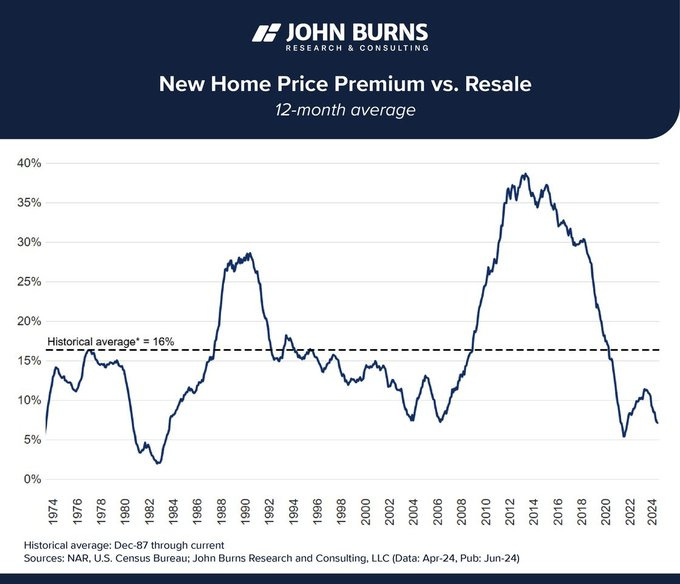

You see, what buyers really prefer is older, already-lived-in homes:

The new home premium is almost back to the pandemic low.

Vintage chic is all the rage, when it comes to homebuying. New construction is so last year.

No, all of that is ridiculous. The indexes are lying to you, but that’s ok

I apologize for all the sarcasm.

It’s a little much, even for me, but I have only so much tolerance of willful blindness.

Look, y’all already know what Random Walk thinks about the home prices and the indexes. Indexes can’t measure what doesn’t trade, and what’s not trading, isn’t on the sidelines because buyers are just too eager.

To the extent lenders (not owners) are locked-in on 30 year mortgages, that’s not keeping owners from selling. That doesn’t even make sense. What’s keeping owners from selling is that buyers cannot afford the asking price.

That homeowners have the luxury of waiting is a very good thing. That people don’t need to sell is, in fact, a sign of strength (even if the banks have massive unrealized losses on their balancesheets to show for it).

But still, if someone said that “well, AI startups are still getting insane multiples, so it’s reasonable to infer that all the other startups are also appreciating, even though fewer and fewer deals are getting done,” you probably would admire their optimism, but perhaps not their analysis.

Again, this does mean that a housing apocalypse is nigh. That seems pretty unlikely, in fact.

It does mean, however, that home values are not appreciating—sure a select few that sell might be a tad higher than before in certain undefeatable prestige markets where a small handful of rate insensitive buyers say “f-it, we’ll pay” (and the real price is likely lower with post-sale concessions, and the like).

But when homes actually do sell? Well, the builders are telling you what prices look like: they’re coming down by ~5%.

That’s not so bad.

This article was originally published in Random Walk and is republished here with permission.