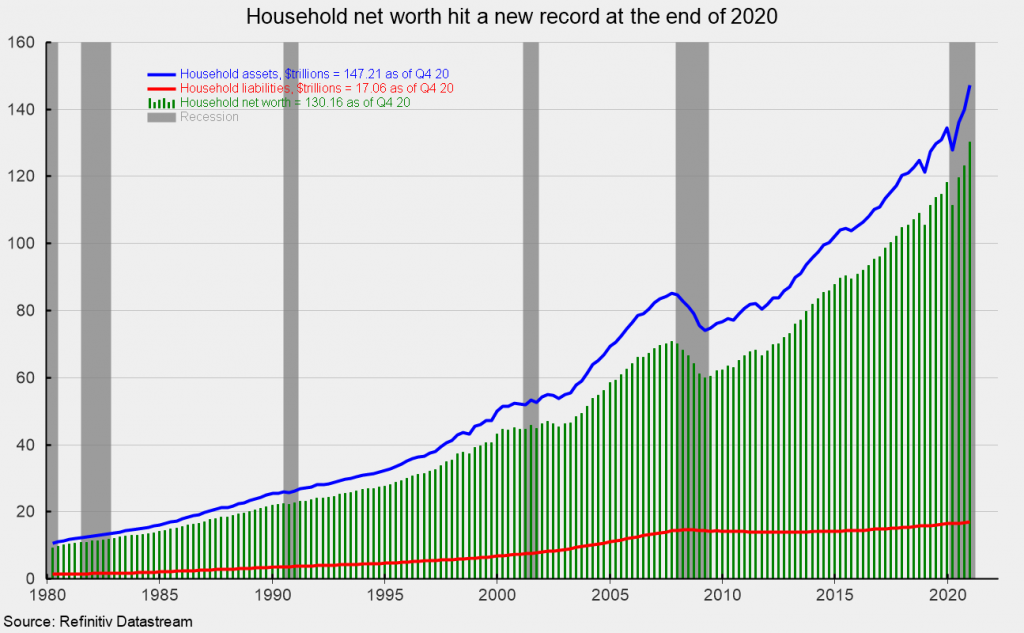

Despite the pandemic, restrictive government policies, and the worst economic contraction in history, US household net worth rose again in the fourth quarter to a new record. Household net worth rose to $130.155tn, up 5.6% from the previous record of $123.229tn in the third quarter, and 10.1% from $118.220tn at the end of 2019 (see first chart). Total assets rose to $147.2tn while total household liabilities increased 1.8% or $297.3bn, to $17.057tn (see first chart).

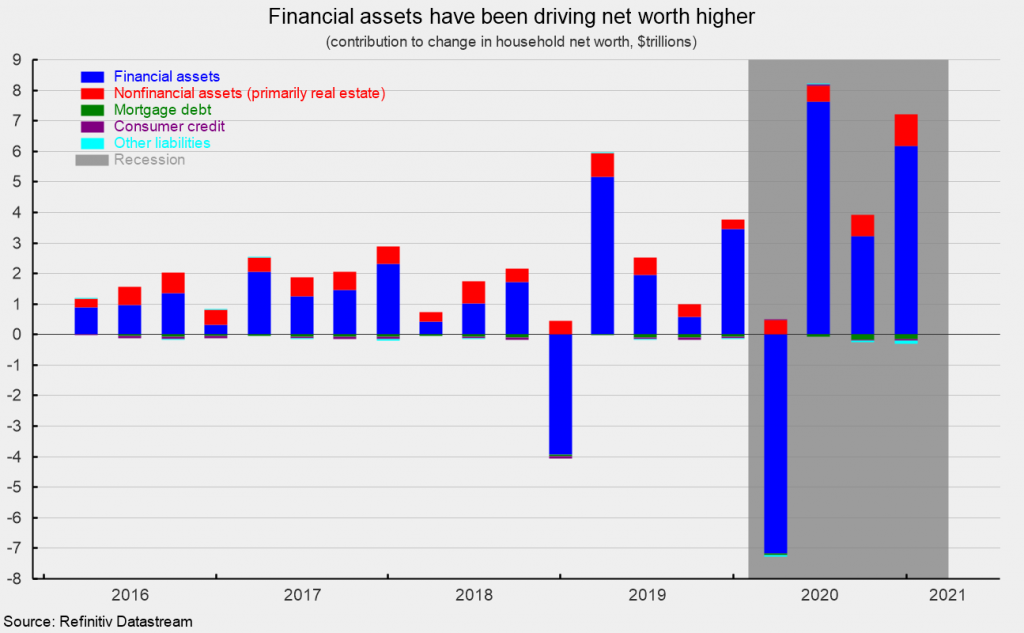

Total assets consisted of $104.6tn of financial assets and $42.6tn of nonfinancial assets. The gain in total assets was due to a 6.3% increase in financial assets which contributed $6.2tn to the increase in net worth (see second chart). Within financial assets, equities led with a 14.1% rise. Non-financial assets rose 2.5%, contributing $1.0tn to net worth (see second chart). Within non-financial assets, real estate led with a 2.6% rise. The change in total liabilities was led by a $148.9bn, or 1.4%, increase in mortgage debt to $10.9tn, while consumer credit increased $44.5bn or 1.1% to $4.2tn (see second chart).

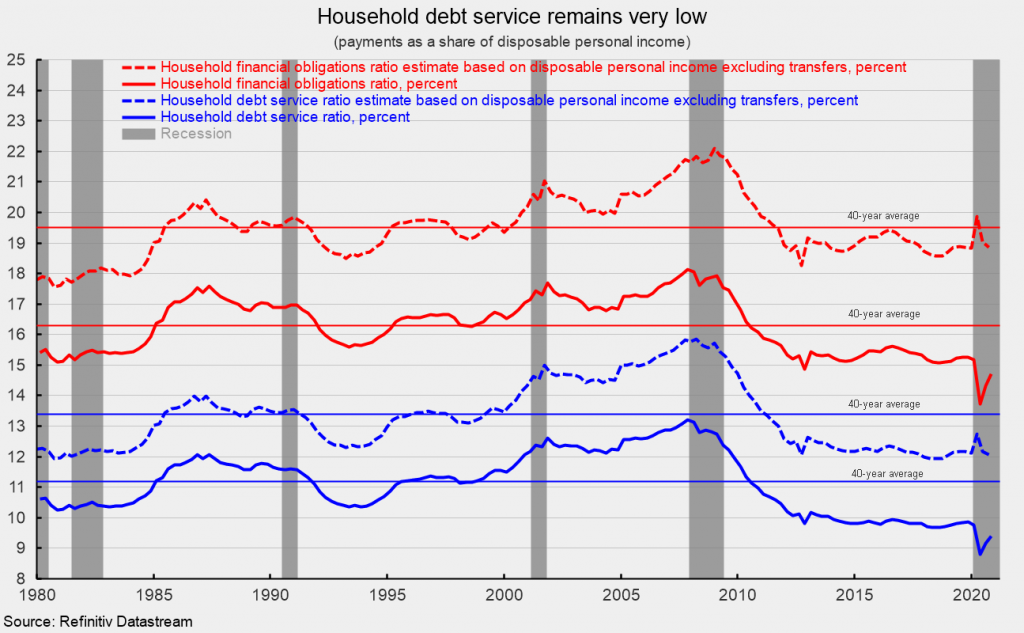

Two key measures suggest that household balance sheets are generally healthy. As of the fourth quarter, the financial obligations ratio (monthly payments for financial obligations as a share of disposable personal income) was 14.71%, up from 14.32% in the third quarter. Like many economic statistics, these numbers have been heavily distorted by the pandemic, lockdowns, and government payments. Excluding the government transfer payments, financial obligations would be 18.9%, down from 19.0% in the third quarter. Both measures remain well below their 40-year average through the end of 2019 (see third chart).

Household debt service (a narrower measure that includes just minimum monthly debt payments) came in at 9.7% for the fourth quarter, up from 9.2%. Excluding the government transfer payments, debt service comes in at 12.1%. Both of these measures are also well below their 40-year average (see third chart).

These data show that despite the damage done to the economy by the government lockdowns, in aggregate, household balance sheets are relatively strong. However, across the various cohorts of households, financial health varies widely. Some households have been severely impacted by lockdowns, particularly small business owners and low-wage workers in retail, travel, hospitality, and food services industries.

This article was previously published by the American Institute for Economic Research and is here republished with permission.