Historically, political party control of the US government has not had much bearing on investment performance of commercial real estate. However, NCREIF data (since its 1978 inception) shows that Democratic administrations produced somewhat stronger 10.4% average total returns on US institutionally owned property, while Republican administrations produced 8.6%.1 With Democrats ushering in a victory on election day for the presidency, and control of the Senate still undecided, (pending two runoff elections scheduled for 5 January in Georgia) we believe the impact of this regime change might be more substantial for commercial real estate than in the past due to the circumstances described below.

Three headwinds are accompanying the 2021 regime change that might prove to be powerful. First, the continuing covid-19 crisis; second, the ongoing recession associated with covid-19, and third, the accumulated challenges weighing on federal policies.

Containing the covid-19 crisis is a primary objective of the new administration. More than 12 proposed vaccines are in the final stage of testing, with two now producing results necessary for regulatory approval perhaps before year’s end.2 The challenge is to assure the public that the approved vaccines are safe, encourage vaccination without delay and facilitate distribution not only in the US, but globally. It is imperative that they ensure controls on the contagion during the months until the vaccines are approved and implemented. If successful, their efforts will strengthen and hasten economic recovery and with it prospects for CRE performance.

A Moody’s analysis comparing the Biden fiscal proposals with ongoing Trump policies estimates 0.5% per year stronger real GDP growth

Second, the new administration is facing an ongoing recession as a result of the pandemic. Control of the Senate would help the Biden administration implement anti-recession fiscal policies. A new Democratic majority in the Senate would likely provide more fiscal support for the unemployed, small businesses and state and local governments. This support would bolster economic growth until contagion is squashed and normal activities can resume. To the degree that these policy changes support longer-term economic growth, they would benefit CRE investment performance. In this regard, rebuilding infrastructure and addressing climate change might be particularly beneficial. If the Senate majority remains Republican, fiscal support and new fiscal policies espoused by Democrats will be hard, if not impossible, to achieve. A Moody’s analysis comparing the Biden fiscal proposals with ongoing Trump policies estimates 0.5% per year stronger real GDP growth associated with the Biden package.3

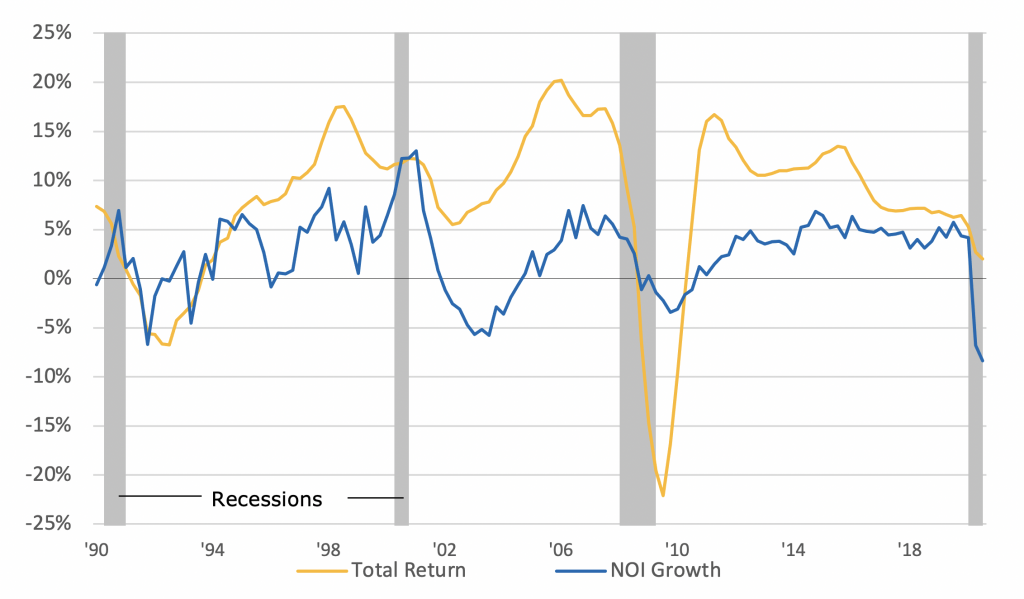

Recent macroeconomic and CRE data, as shown in the lower but still-positive third-quarter 2020 NCREIF total return performance in figure 1 below, offer very little insight into the outcome of regime change but do provide some insight into the baseline that is developing for the fourth quarter of 2020. During October, the force of recession was still evident in the flow of new unemployment claims, which is averaging more than 700,000 per week. On top of this, ‘pandemic unemployment assistance’, which is available to those not covered by state unemployment programmes or who have exhausted it, brought the total of unemployment assistance to 20.3 million for the week ending 31 October.4

Figure 1: NCREIF Property Index

Year-over-year change (1990 to Q3 2020)

Shaded areas indicate US recessions

Support of the unemployed dropped sharply at the end of July when the $600 per week subsidy to state unemployment compensation expired. As the result, US personal income in August was down 2.5% versus July but personal consumption expenditures still managed a 1% increase.5 Consumers remain generally pessimistic compared with pre-covid times, as shown in the University of Michigan October Index at 14% below the prior year. 6 At the same time, there are ongoing signs of a bounce-back from the depths of the recession earlier this year. This was reaffirmed by both the Institute of Supply Management manufacturing and non-manufacturing indices holding in above-50 ‘expansion’ territory in October.7

Forecasters polled in the Blue Chip Survey by Wolters Kluwer have been betting that further fiscal support will be forthcoming to moderate the GDP outcome for 2020 to -3.7% with a 4.0% rebound in 2021.8 Similarly, the US Federal Reserve’s projections, updated in September, show similar expectations with commentary from Fed officials stressing the need for further fiscal support.9 Yet, as of mid-November, no agreement appears to be forthcoming.

CRE investors are well advised to digest the uncertainty embedded in macroeconomic forecasts for this year and next. Available performance data through to the end of September shows that the recession’s impact is well under way in the retail property sector, where occupancy and net operating income (NOI) have been hammered since the end of 2019, and in industrial property, where the surge in covid-induced online shopping has been bolstering occupancy and NOI.

In contrast, apartment and office sectors are facing uncertainty as renters confront unemployment with uncertain prospects for support, and as office tenants confront working-from-home and recession-impacted uncertainties. Investor demand for property has been depressed but pricing remains surprisingly solid. According to Real Capital Analytics, US property prices were up 1.4% for the year ending in September.10 With US Treasury yields holding beneath 1.0% on the 10-year and stock prices frothy, US CRE remains attractive to global investors.

Footnotes:

1 National Council of Real Estate Investment Fiduciaries. September 30, 2020

2 McGill University. COVID-19 Vaccine Tracker. November 14. 2020

3 Moody’s Analytics. The Macroeconomic Consequences: Trump vs. Biden. September 23, 2020

4 Department of Labor. Unemployment Insurance Weekly Claims. November 12, 2020

5 Bureau of Economic Analysis. Personal Income and Outlays. October 30, 2020

6 University of Michigan. Surveys of Consumers. October 30,2020

7 Institute of Supply Management. Manufacturing and Services PMI. October 2020

8 Wolters Kluwer. Blue Chip Economic Indicators. November 10, 2020.

9 Board of Governors of the Federal Reserve System. FOMC Statement. Economic Projections. September 16, 2020

10 Real Capital Analytics. September 30, 2020