The need for remote working and task automation to cut infection risk is boosting adoption, but proptech shouldn’t just be about damage limitation.

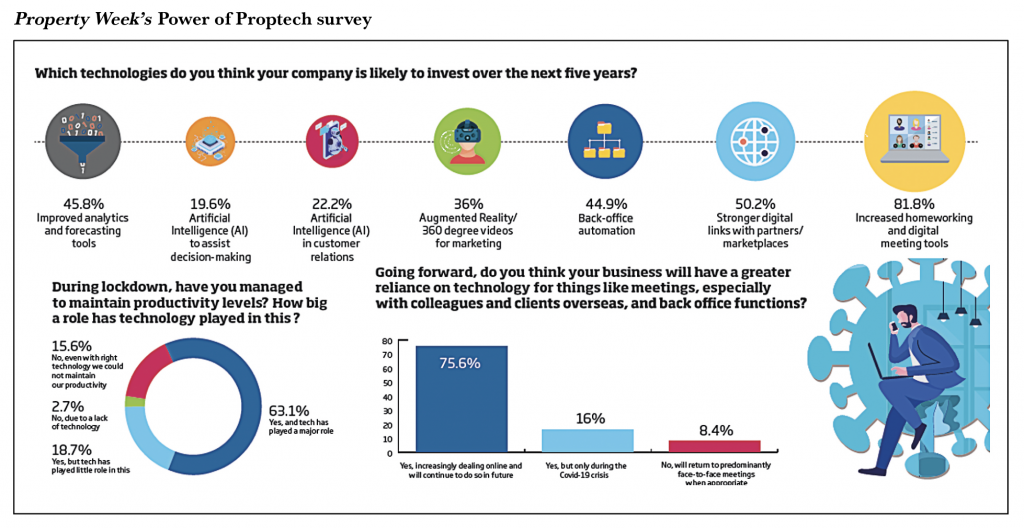

According to MetaProp’s recent survey, 89% of proptech investors believe that the current pandemic will accelerate adoption in the real estate industry. A hint as to the sheer weight of this transition comes from CBRE, which found that 88% of its European occupiers are now planning to make investments in technology to facilitate future remote working. Property Week’s Power of Proptech survey also highlights that 82% of real estate industry respondents are looking to invest in home-working and digital meeting tools in the immediate future, while the second-strongest preference (50%) is for technologies that foster stronger digital links with the marketplace.

However, these statistics represent only essential proptech adoption, required to replace previously manual and physical tasks and facilitate both remote working and a safe return to work or retail. For these technologies, the benefits are clear. In the wider proptech ecosystem the picture is not so good, with very low levels of funding currently entering the proptech market – investors appear to favour damage limitation rather than seizing innovative opportunities. This is evidenced by MetaProp’s finding that only 33% of investors are planning to make more proptech investments over the next 12 months, down from 64% a year ago.

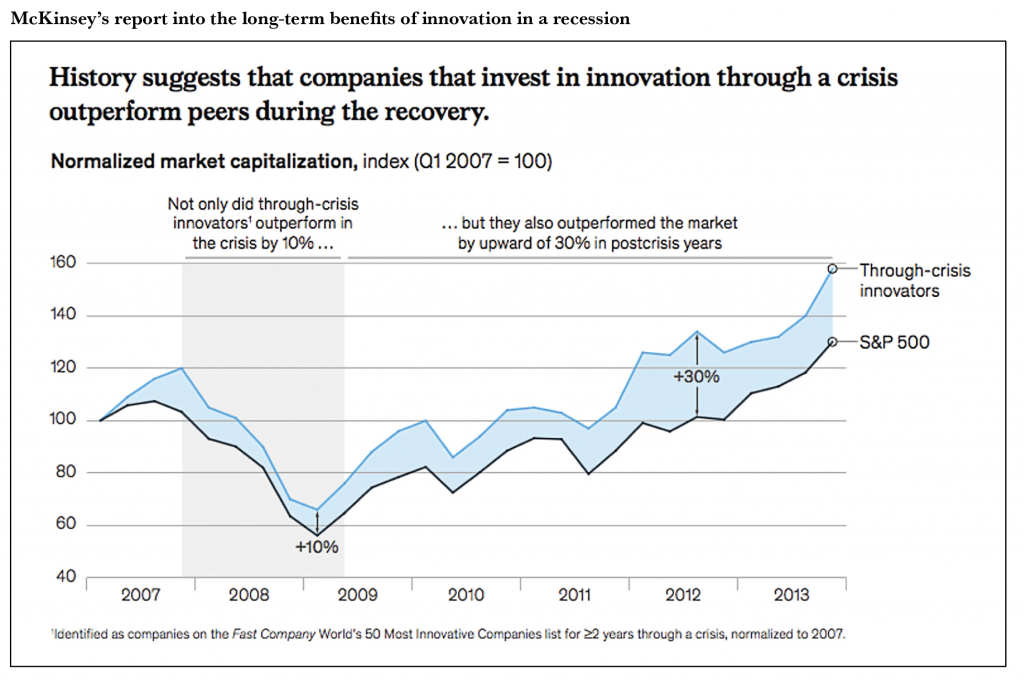

This indicates that the majority of real estate organisations are missing what could be their biggest opportunity to differentiate themselves, as history suggests that those who innovate during a crisis fare better coming out the other side. ‘How to Survive a Recession and Thrive Afterwards’, published in the Harvard Business Review, describes the processes that occur within a recession to encourage the adoption of new technologies. It highlights how employers are able to recruit workers with better computer-related skills due to increased unemployment, the ways that technology brings transparency into how and where businesses are affected by turmoil, and the falling opportunity cost of investing in new technologies as the returns from funding regular operations are reduced.

History suggests that those who innovate during

a crisis fare better coming out the other side

The extent to which companies thrive afterwards was revealed by McKinsey’s report into the long-term financial rewards of investing in innovation throughout a recession. It found that the world’s 50 “most innovative” companies not only outperformed the market by 10% at the bottom of the global financial crisis in early 2009 but were better able to accelerate their recovery during the economic prosperity that followed, and by 2012 were outperforming the market by more than 30%.

As if a 30% performance increase over competitors is not motivation enough to turn to innovation, the best-performing venture capital vintages are also probably being raised around now, according to PitchBook. It says investments in start-ups made at the bottom of any downturn and into the early stages of economic recovery are generally outperformers – when entry multiples are lower, competition subsides, and portfolio companies can benefit from macro tailwinds. This comes as positive news for us at Pi Labs, as we recently reached the first close of our third and biggest proptech-focused fund yet, which is already being deployed into start-ups as we continue to raise capital from global real estate players towards the final fund close in January 2021.

Never has there been a better time to invest in proptech. The global shift towards remote working and the desire to forge digital connections with clients bring a clear need for the adoption of technologies that offer digital alternatives to previously manual or physical tasks. An often overlooked and yet crucial fact is that where there is digital technology there is also digital data. The mass adoption of cloud-based, collaborative technologies in the wake of covid-19 will bring a digital revolution in the availability of once-analogue real estate data. This data can be leveraged by proptech start-ups to allow forward-thinking, innovative real estate companies to reap the rewards.