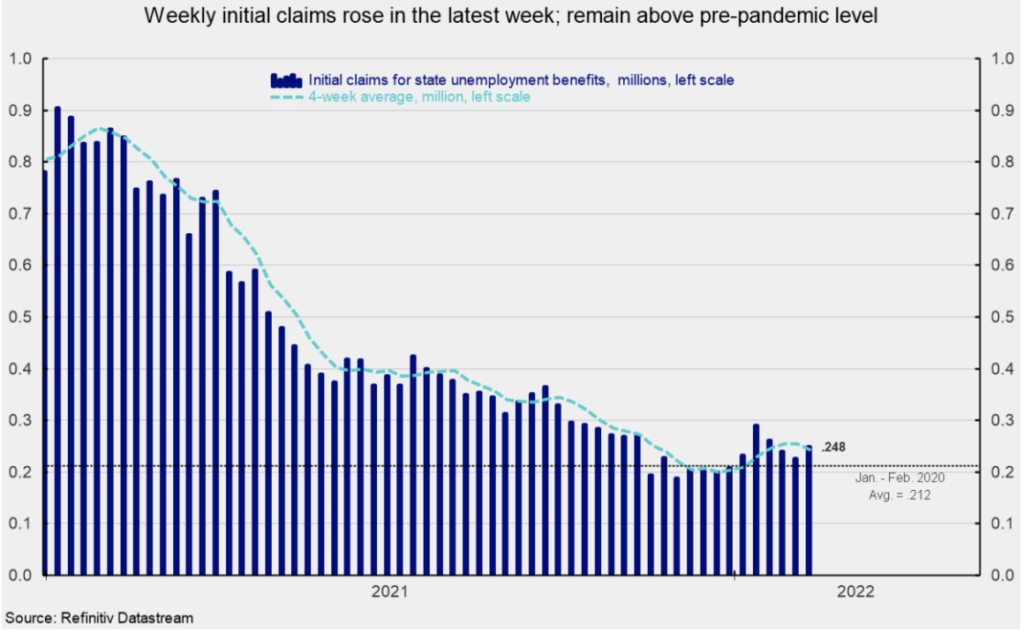

Initial claims for regular state unemployment insurance increased by 23,000 for the week ending 12 February, coming in at 248,000 (see first chart). That is the first increase following three weekly declines. Over the past 13 weeks, claims are up in seven weeks and down in six. The level over the past six weeks remains above the average in early January and February 2020, prior to the pandemic surge. However, by long-term historical comparison, initial claims remain very low.

The four-week average fell in the latest week – the second decrease in a row and the largest decline since 11 December 2021 – coming in at 243,250, a drop of 10,500. Weekly initial claims data continue to suggest the labour market remains very tight.

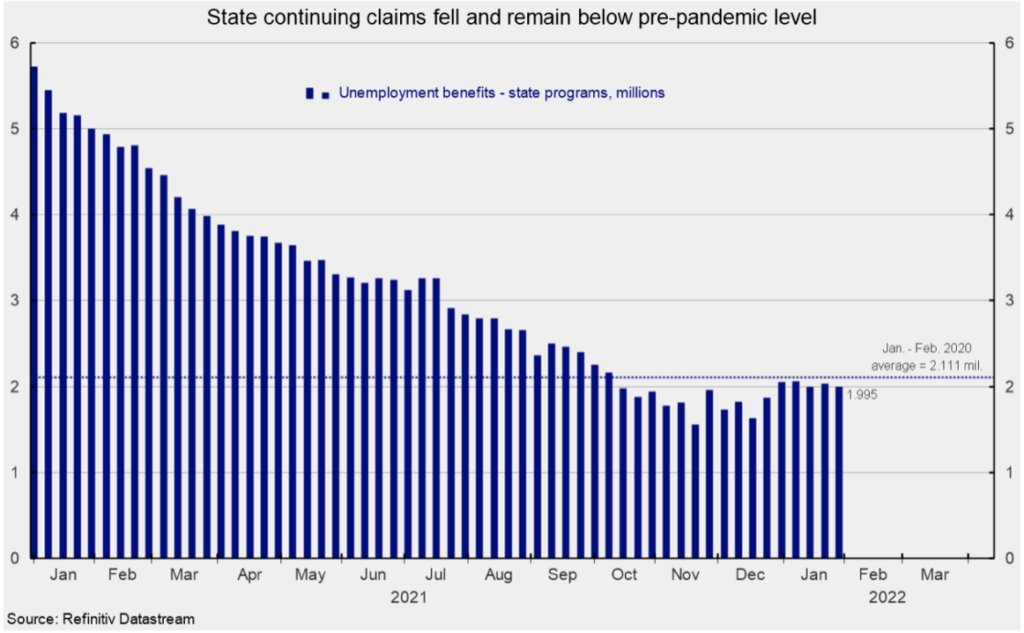

The number of ongoing claims for state unemployment programmes totaled 1.995m for the week ending 29 January, a drop of 35,244 from the prior week (see second chart). State continuing claims appear to be settling into a range just below their pre-pandemic level of 2.111m (see second chart).

Continuing claims in all Federal programmes totaled just 68,830 for the week ending 29 January, a drop of 1,051. For January and February 2020, the average for Federal continuing claims was 34,174. Though the current numbers are above the pre-pandemic average, they are just a fraction of the 16.6m peak and largely reflect the end of the emergency Pandemic Unemployment Assistance programme and the Pandemic Emergency UC programme.

The latest results for the combined Federal and state programmes put the total number of people claiming benefits in all unemployment programmes at 2.064m for the week ended 29 January, a drop of 36,295 from the prior week.

Despite some volatility over the past few weeks, initial claims remain at an extremely low level by historical comparison. The recent wave of new Covid cases may have been a contributing factor to the volatility over the past few weeks. Still, the overall low level of claims combined with the high number of open jobs suggest the labour market remains very tight.

Continuing labour shortages, along with materials shortages and logistical issues, are likely to continue to hamper the recovery in production across the economy, though declining new Covid cases should allow businesses to refocus on increasing output and ease some materials shortages and logistical bottlenecks. However, the overall shortage of labour may continue for some time and remain an obstacle to significant increases in output.

Originally published by The American Institute for Economic Research and reprinted here with permission.