Sectors and stocks that are loved, hated, and everything in-between.

Goldman published a hedge fund trend report, and while the signal is low, it’s still a roaring good time.

- hedge funds are tilting towards healthcare (and away from financials)

- the most important stocks (or PMs get paid to pick these?! My 11 year-old could do that)

- old loves (most concentrated) and new faves (new owners)

- the most-hated, newly-hated, and yesterday’s news

Goldman Sachs put together a report on Hedge Fund trends, and it’s pretty fun.

Keep in mind that (a) the information is lagging; and (b) it doesn’t capture synthetic positions (e.g. via options, swaps, or futures), so it’s far from a perfect picture, but it still gives a high level indication of what hedge funds like (and what they don’t).

There are 40 charts in the report, but I pulled out the best 12 for your infotainment.

Hedge funds like healthcare

Apparently, Random Walk is not the only one who sees healthcare as a recession-proof, secularly-growing, trillion dollar stream of goods and services.

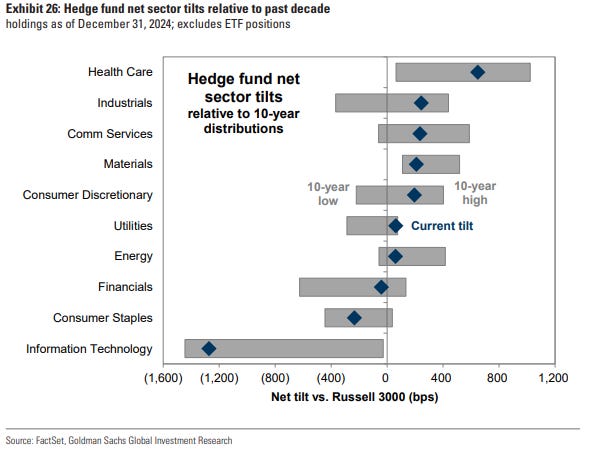

The “tilt” to healthcare (i.e. allocation relative to the Russell 3000 index) is larger than any other sector:

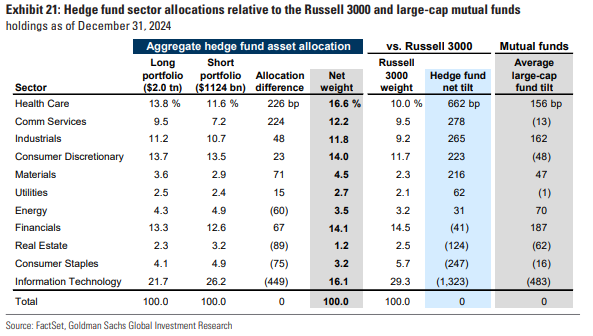

Healthcare constitutes 17% of total net exposure, which is ~6.6 percentage points more than the index.

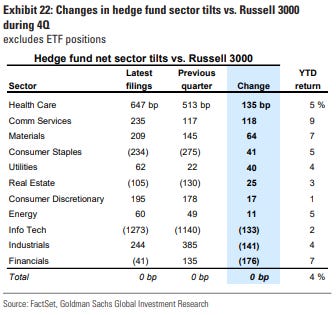

Healthcare allocation was already high, but it got even higher in the latest read:

Hedge funds’ net tilt grew the most in healthcare, comm services, and materials.

By contrast, funds rotated away from Financials, Industrials, and Info Tech (which is really not popular for funds, relative to the index).

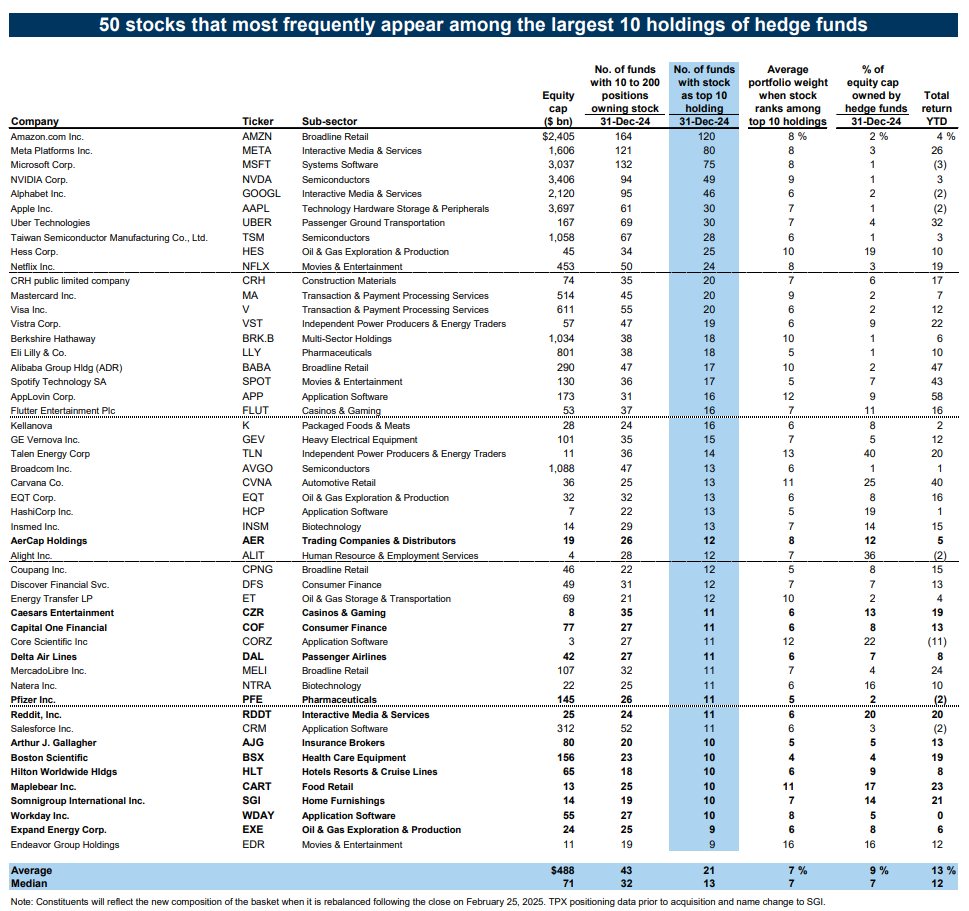

The most important stocks

The stocks that are most loved by hedge funds, are the stocks most-loved by most people, unsurprisingly.

These are the “systemically important” names, in that they are most likely to appear among the largest 10 holdings for hedge funds:

Amazon, Meta, Microsoft . . . and, well, it’s murderers row.

You might wonder why hedge fund managers are getting paid quite so much to invest in such diamonds-in-the-rough like, “Apple.” There’s an answer, I’m sure, but it’s too long and complicated for normal people to understand. It’s really not until you hit the #11 spot (the building materials conglomerate, CRH CRH 0.00%↑ ) that you get a non-brand name on the leaderboard.

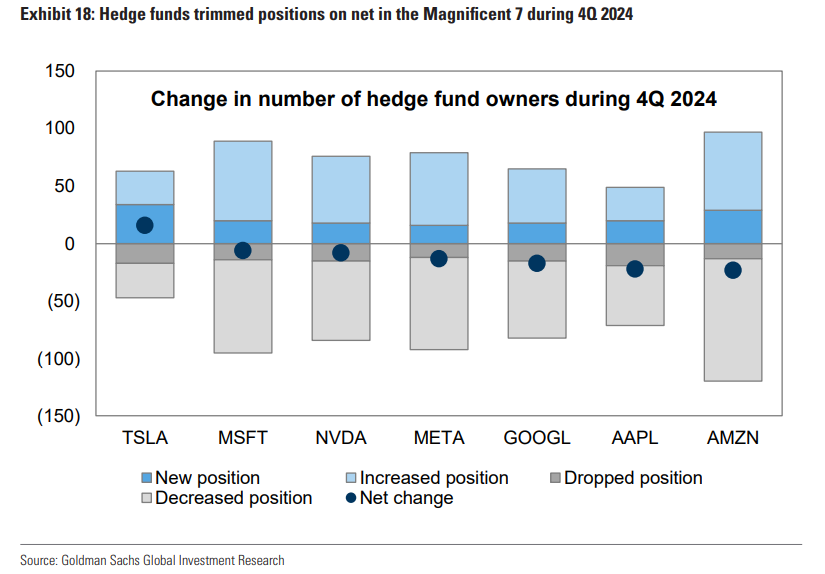

In fairness, Hedge Funds did trim their exposure to the Mag 7, ever-so-slightly:

Only Tesla had a net-increase in HF owners during Q4.

I guess that’s a Trump trade?

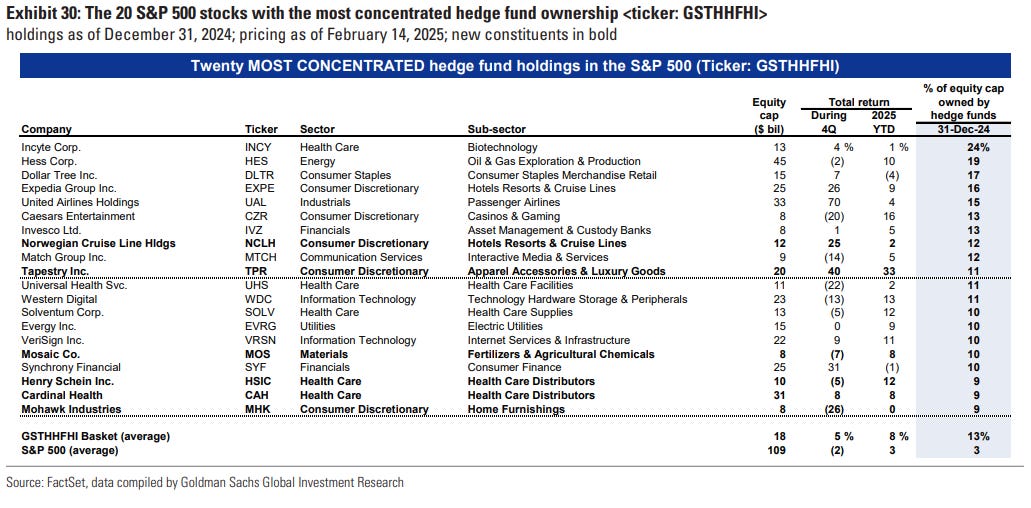

Old loves, and new favorites

If you want a list of stocks that are uniquely loved by hedge funds, Goldman’s got that too.

These are the stocks with the highest concentration of hedge fund ownership:

- Tapestry TPR 0.00%↑ is a surprise name there, with 11% of the marketcap owned by HFs. The apparel brand generated a nifty 40% return over the past year.Good for Kate Spade and ladies shoes and bags, I suppose.

- Verisign is a ridiculous, high margin business that has some kind of monopoly on domain registrations, for reasons that I do not fully understand.

- Henry Schein HSIC 0.00%↑ is a trendy healthcare supplies distributor because healthcare supplies cost way more than they should (due to regulation).

Those are the names with the most concentrated HF ownership that jumped out at me, but I don’t really have anything terribly insightful to say.

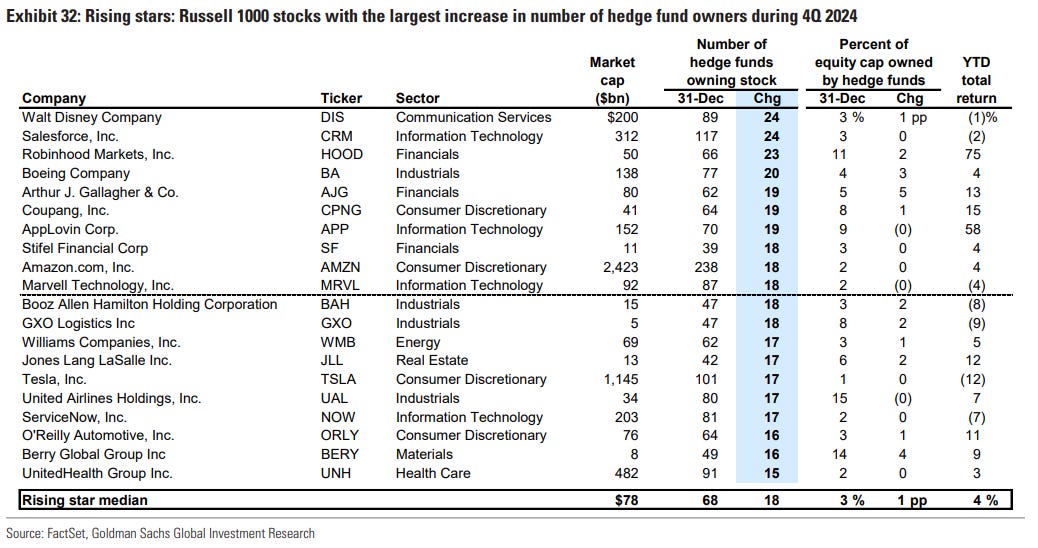

In terms of which stocks have the most new hedge fund owners, i.e. the new favorites or “rising stars,” it’s an unusual mix:

- Walt Disney DIS -0.15%↓ is the new crowd favorite, with Salesforce CRM -0.02%↓ and Robinhood HOOD 0.91%↑ right behind.

- Robinhood is an easy one (although I’m surprised that Coinbase wasn’t also on the list—Coinbase was actually a popular short, per below).

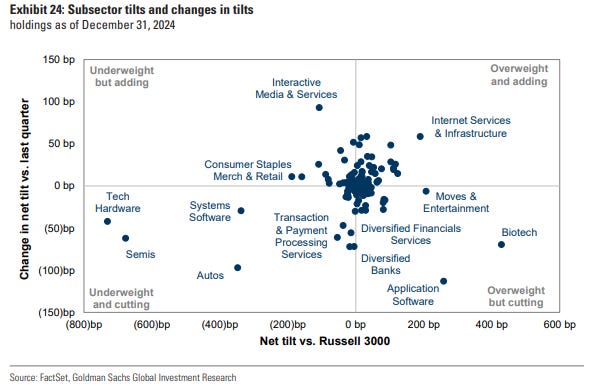

- ServiceNow NOW -0.12%↓ is an old Random Walk favorite, riding an AI app-layer-for-enterprise tailwind (similar to Salesforce). In general, Hedge Funds have shifted their AI emphasis from infrastructure bets to app-revenue bets (and therefore avoided much of the DeepSeek freakout).

- Boeing presumably got so hated, that now it’s loved again.

- JLL JLL 0.00%↑ is a surprise . . . hedge funds calling the bottom on real estate? Something else?

Those are the “rising stars,” or new faves.

Most-hated, newly-hated, and yesterday’s news

What about the former faves?

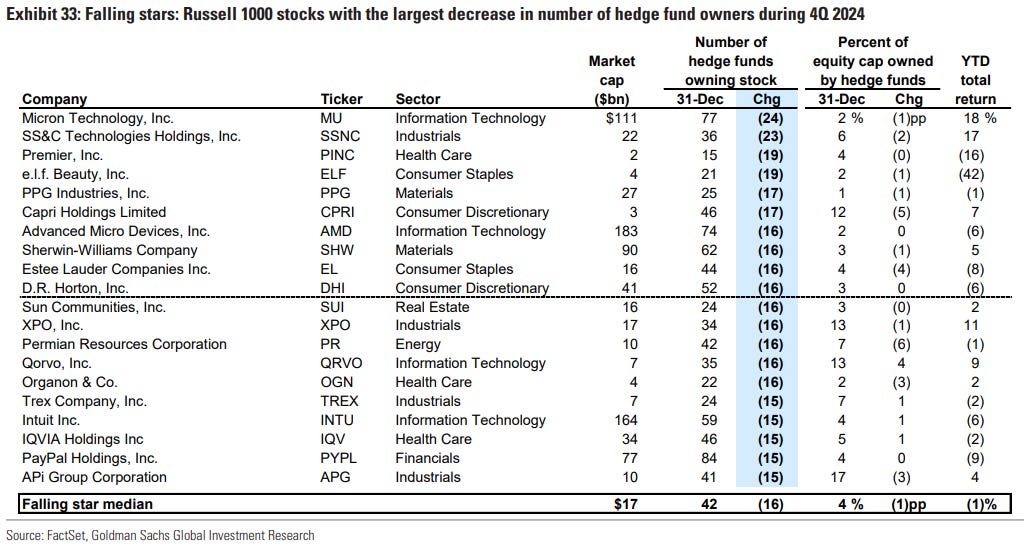

If Walt Disney et al has the greatest increase in hedge fund owners, then these are the stocks that are yesterday’s news:

Hedge funds lost interest in some of the bigger semis names, and home-builder and builder-adjacent stocks, as well.

Some high flying consumer discretionary stocks, like the beauty brand, e.l.f. ELF 0.00%↑ lost its sheen, as well. No real surprises there. Ulta ULTA 0.04%↑ is on deck.

In terms of the “most hated” stocks, i.e. largest short interest as a percent of marketcap, Goldman’s got those too.

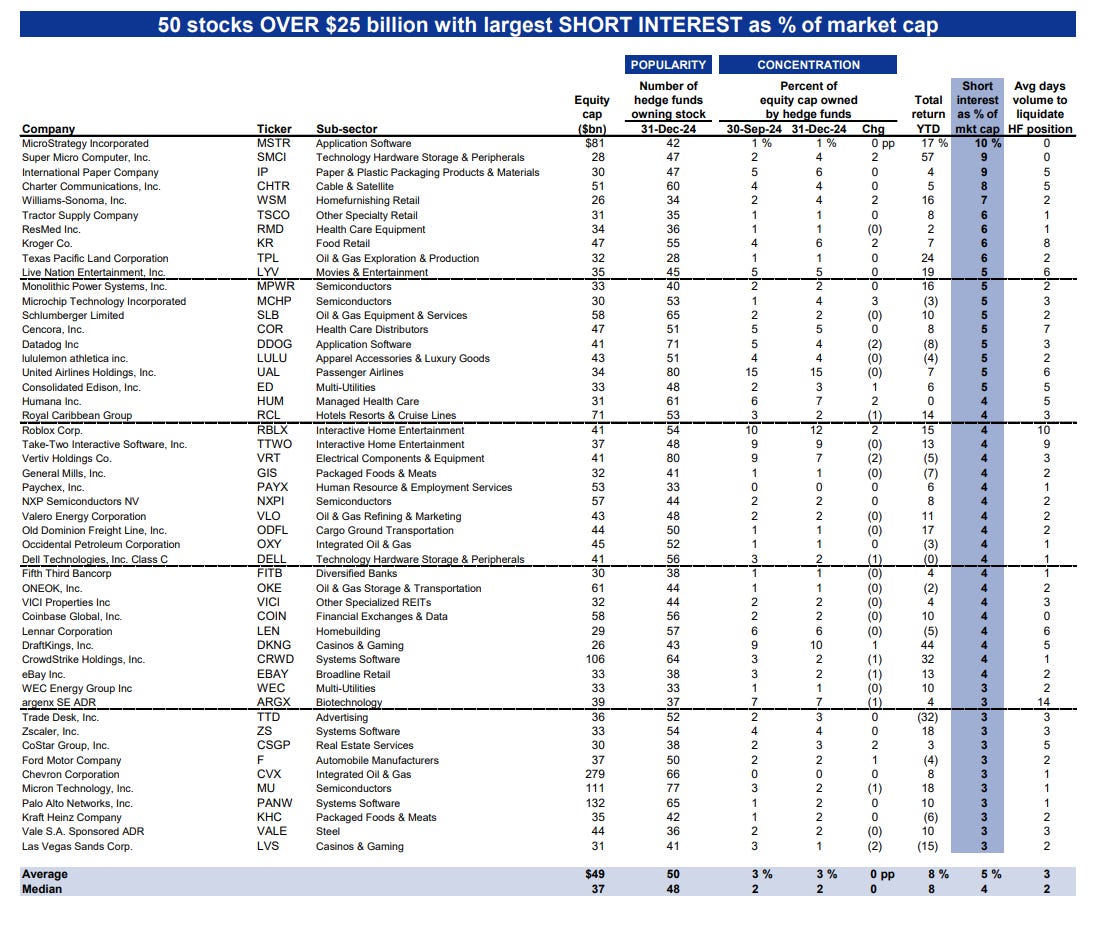

$25B+ most-hated:

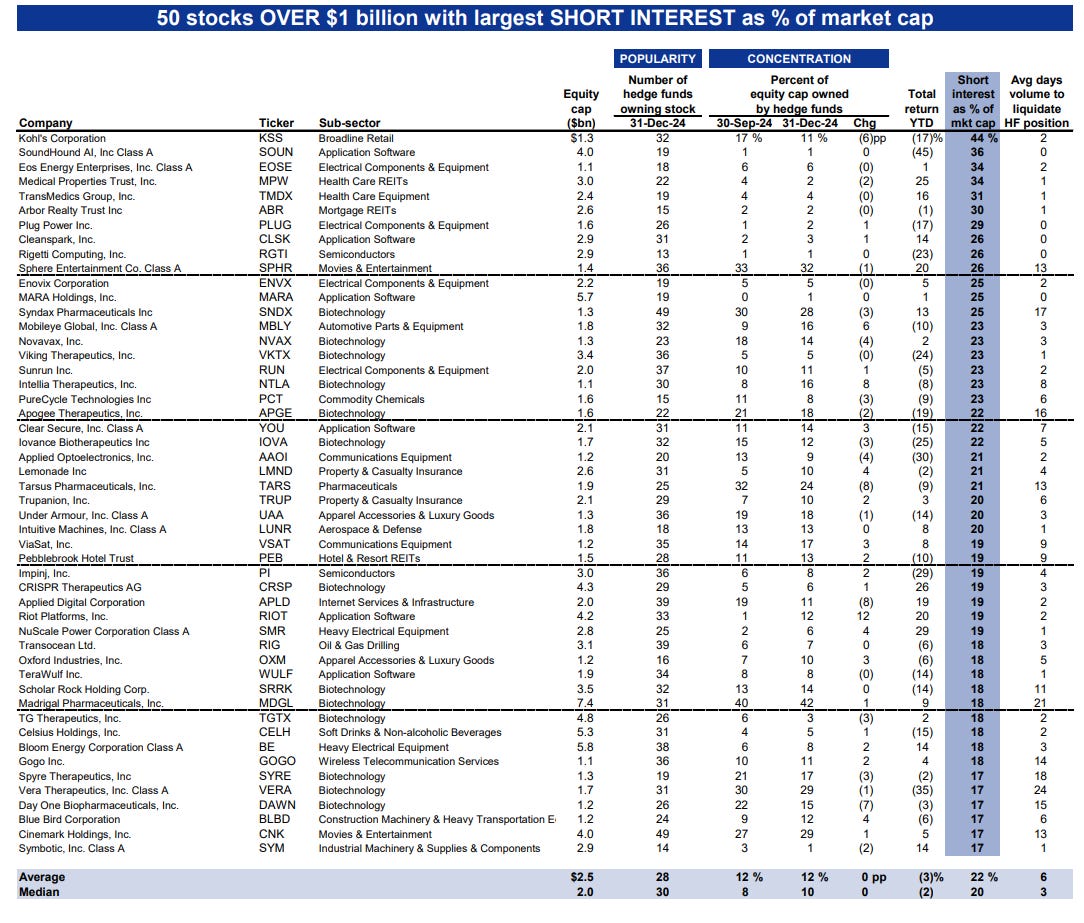

$1B-$25B most-hated:

- Big bets against Saylor’s MicroStrategy MSTR 1.55%↑ Bitcoin absurdity, so that’s good.

- There are a surprising number of energy names on the shorted list too, presumably betting on lower energy prices.

- The liquid cooler rockstar, Vertiv VRT -0.42%↓, got DeepSeeked (and the feeling is that liquid cooling specifically is less important, outside of a subset of data centers).

- Bet against THE SPHERE SPHR 0.00%↑ at your peril! 20% ytd returns, with 26% short interest. What kind of a monster would bet against a giant entertainment globe, anyway?

In general, most of these make-sense, as either shifts away from overpriced tech and industrial, deceleration for overpriced discretionary, and/or cyclical moves from homebuilders and/or energy.

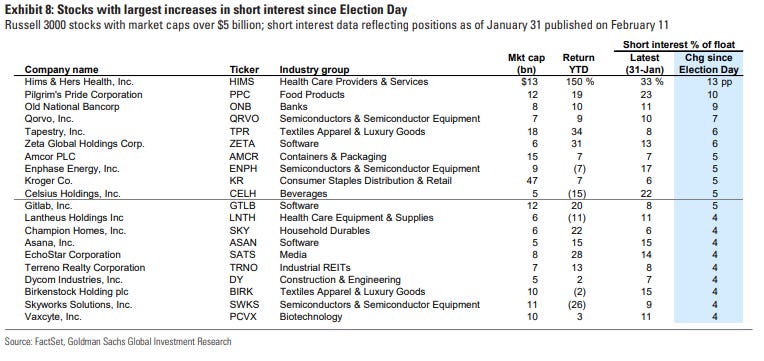

And finally, for the newly hated, names here’s the leaderboard for largest increase in short-interest since Election Day:

Again, nothing terribly surprising on the new shorts list:

- Hims HIMS -0.22%↓ was selling compound GLP-1s because of the “shortage” that just got un-declared (as everyone apparently anticipated)

- Pilgrim’s Pride PPC 0.00%↑ is a poultry processor, so bird-flu adjacent

- Tapestry again…concentrated HF ownership and a popular HF short. Could be hedging or could be HF-on-HF violence. Idk.

But why the beloved value grocer, Kroger KR -3.03%↓? Kroger reports soon, so we shall see.

That’s it.

Just some fun charts on what the biggest, baddest stockpickers were picking (for or against), at least until recently.

This article was originally published in The Random Walk and is republished here with permission.