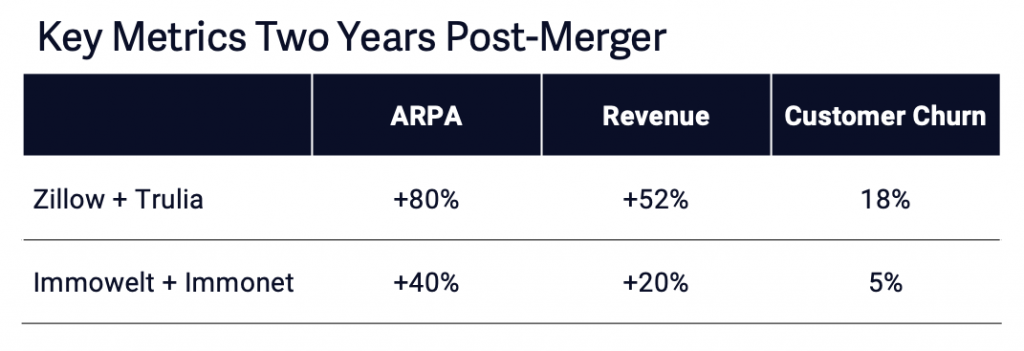

Zillow and Trulia in 2014. Immowelt and Immonet in 2015. When massive real estate portals join forces, it is for one reason: market power. These mega-mergers of leading real estate portals highlight the power of market dominance through greater reach, greater pricing power, and accelerated revenue growth.

Germany: Immowelt and Immonet

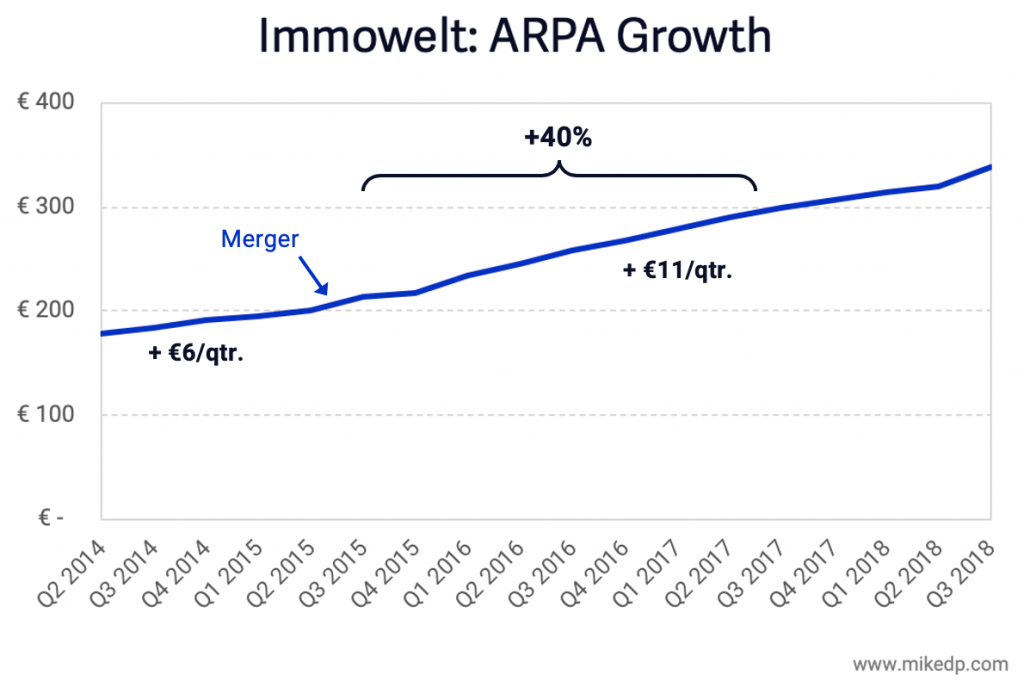

In 2015, Axel Springer brought together Immowelt (IW) and Immonet (IN), the #2 and #3 real estate portals in the German market. The combined entity managed to increase ARPA (average revenue per advertiser) 40 percent over the following two years, with only 5 percent customer churn — a noteworthy achievement.

The merger allowed the combined entity to nearly double the pace of ARPA growth from €6/quarter pre-merger to €11/quarter post-merger.

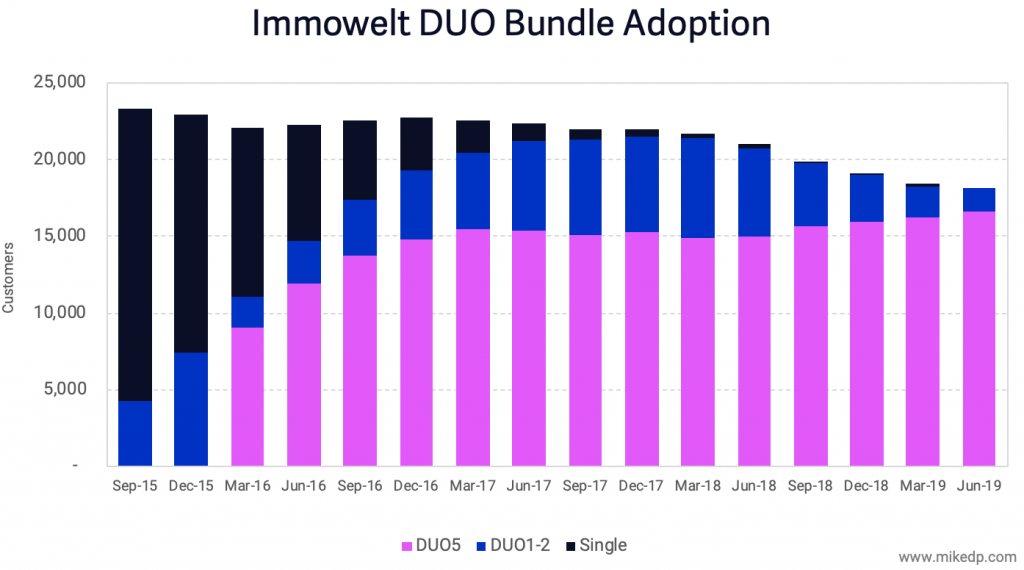

The key to Immowelt’s success was a strategy of forcing customers to adopt a more expensive DUO bundle (one contract, two portals), whereby listings appear on both sites. After 18 months, an impressive 85 percent of customers had adopted the DUO bundle, rising to 99 percent a year later — all with minimal customer churn.

In 2018, Immowelt began converting customers to a more expensive DUO5 (five listings) bundle. Over the subsequent two years, customer churn increased to 19 percent while ARPA growth remained high at 33 percent.

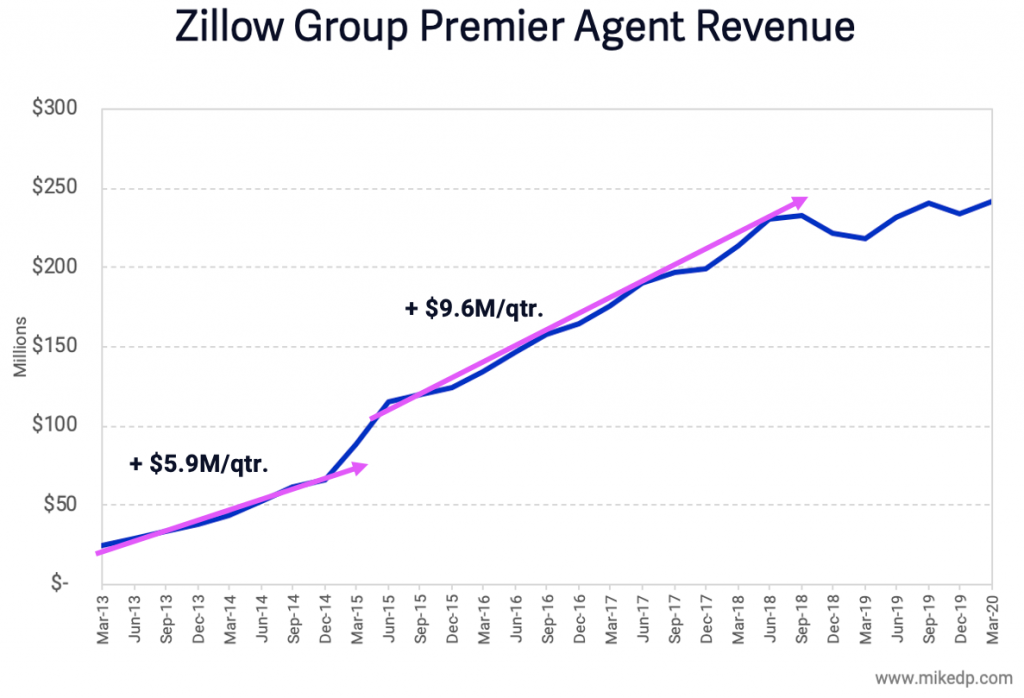

Supercharging Zillow’s Revenue Growth

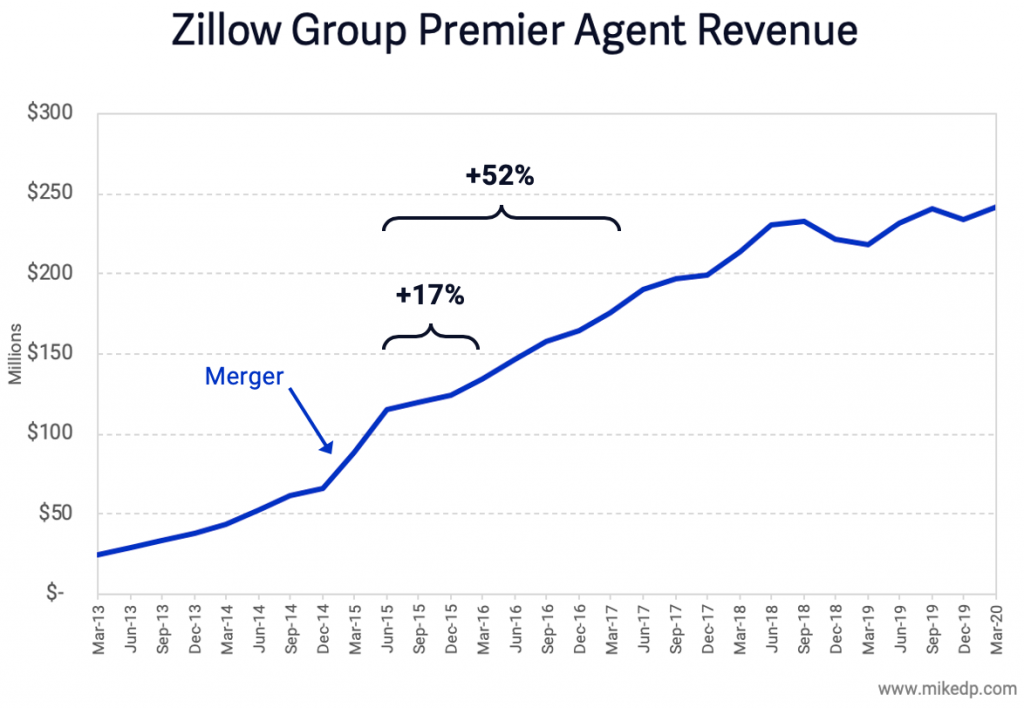

The merger of Zillow and Trulia was the catalyst for strong revenue growth at the combined entity. In the two years following the merger — and after consolidating the revenues of both businesses — revenue increased a massive 52 percent.

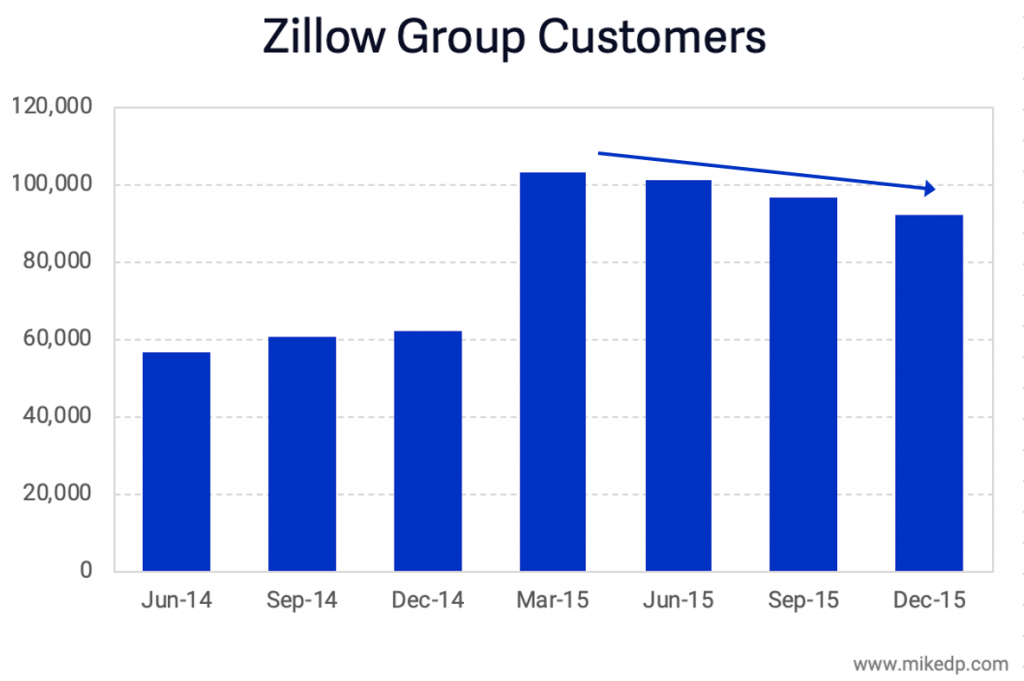

In the case of Zillow and Trulia (and similar to Immowelt and Immonet in Germany), post-merger revenue growth was driven by ARPA and not an increase in paying customers. In the year following the merger, and after the customer bases were consolidated, the number of paying customers dropped by 11 percent while ARPA increased 42 percent.

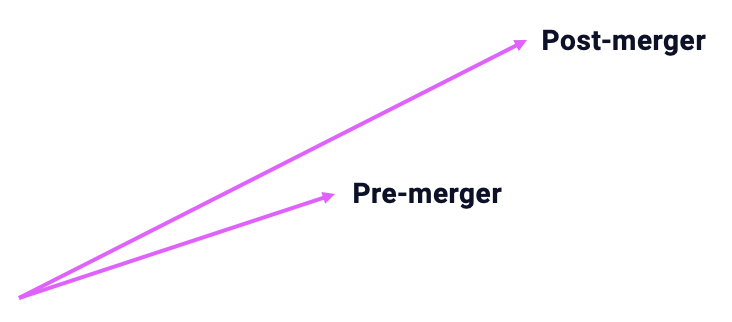

The merger increased the market dominance of the combined entity, and allowed Zillow to increase its pace of revenue growth over the following three years.

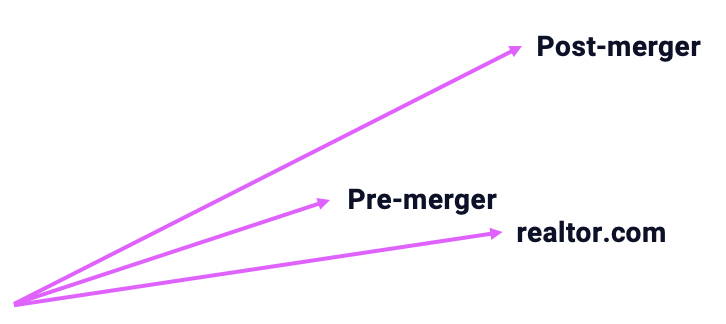

The slope of the line — the increase of revenue coming into the business, not as a percentage, but in absolute dollars — materially shifted post-merger. Pre-merger, Zillow added an average of $5.9 million in new revenue each quarter; post-merger it averaged $9.6 million.

(And just for fun, here is realtor.com‘s corresponding revenue growth after its acquisition by News Corp in 2014, adding an average of $2.8 million in new revenue each quarter. There’s a premium to being the market leader.)

More Money, More Value

The mergers allowed both groups to materially grow revenue, primarily through ARPA increases, at an accelerated pace.

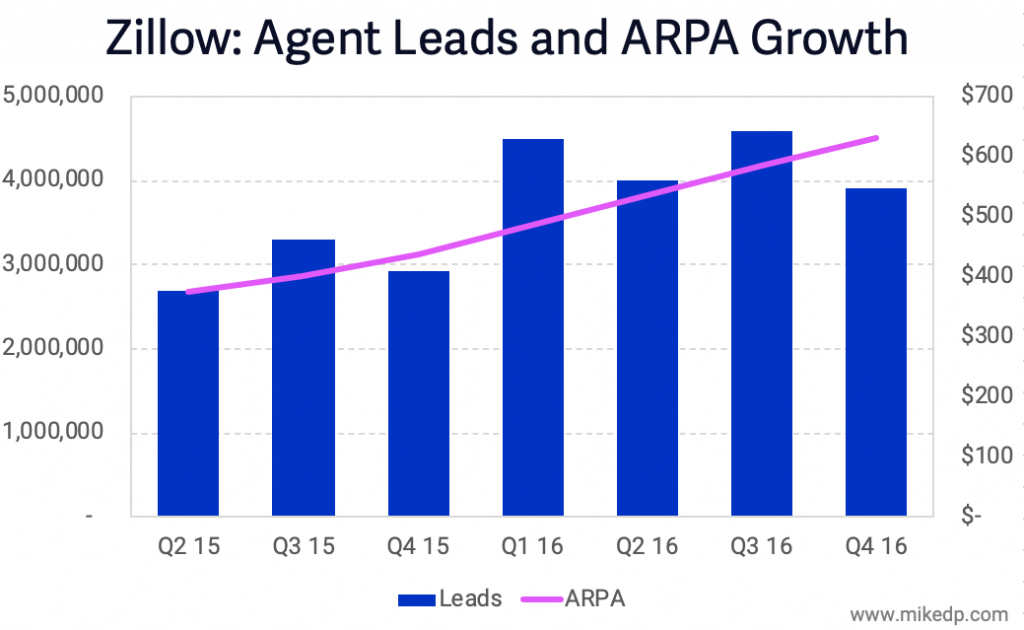

While prices did increase after the mergers, it came with a corresponding increase in customer value. The combined entities were able to deliver more exposure and more leads for their customers. Zillow’s increasing ARPA was closely matched by an increase in leads.

While ARPA increased 42 percent in the year after the merger, it was coupled with a 48 percent increase in total leads and an 11 percent decline in customers. The net result was a drop in the average price per lead.

Zillow’s customers were paying more, but they were paying more for increased value.

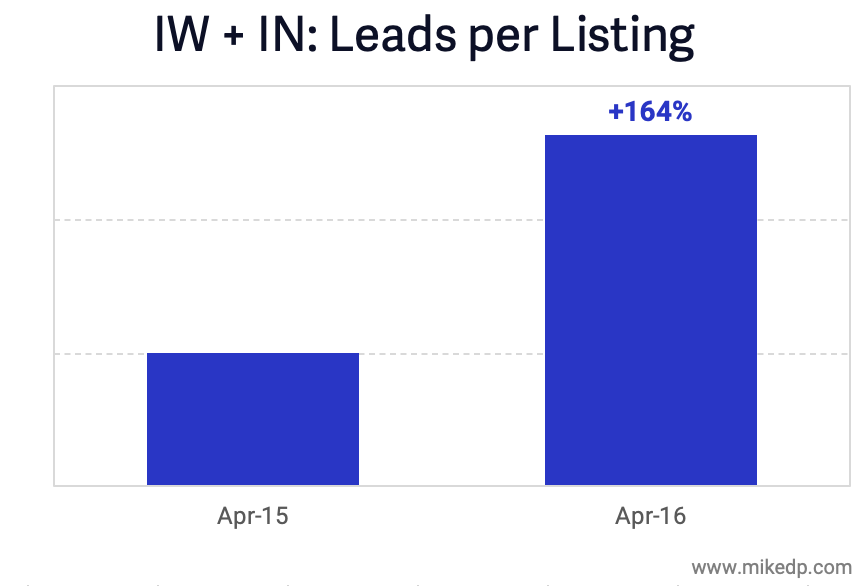

The case was similar in Germany. Internal research showed that, on average, customers that advertised on both sites saw the number of leads per listing more than double. Customers were paying more, but were deriving more value.

The merger of two real estate portals consolidates market and pricing power within one organization — allowing it to quicken its pace of growth. But in the cases above, an increase in prices was accompanied with a corresponding increase in value, arguably a good deal for customers and consumers.