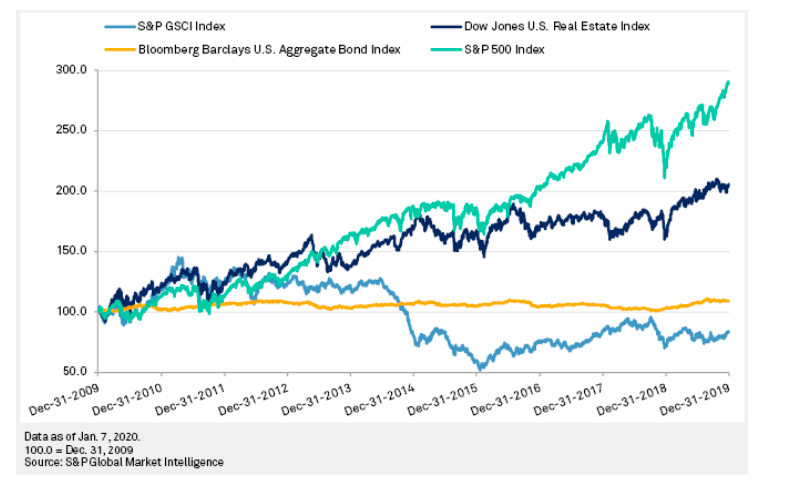

The most significant policy innovation during the 2008-2009 financial crisis was Quantitative Easing (QE); the central bank purchase of financial assets using printed money. During and after that financial crisis many investors who carefully avoided risk (i.e. who “went to cash”) were wrong-footed when government support of financial markets starting in 2009 led to rises in prices of equities and bonds. Widespread support of lending markets via QE started in 2008 (US), 2009 (UK), 2013 (Japan; they had been using QE since the ‘90s, but this was the first since 2008), and 2015 (EU).1 This boosted leveraged assets prices (especially commercial and residential property) over the subsequent 5 years (see graph).

Performance by Asset Class since 2009

Our purpose in linking forestry investing with “Monetary Finance” in this Commentary is to ensure that our readers are familiar with “MF”, as this policy innovation is likely to be as momentous over the next period as QE was over the past decade. This Section explores the questions “what is Monetary Finance?” and “what are its possible impacts on investment markets?”. Later sections will examine forestry investing in this policy environment.

MF occurs when government programs (such as income support for staff or businesses impacted by Covid-19) are funded by central bank printing those funds and lending them to the government, so that the government can deploy cash without having to raise taxes, or to tap the bond market directly. MF is relevant now because, as many economists and business leaders have noted,[1]support of financial markets through “traditional” measures like QE are not going to be effective when it is not the financial markets that are broken. It is the travel, food service, accommodation, events, education, and other industries that have been shut down by Covid-19. Governments did not hesitate to allow central banks to print money to support bankers in the period after 2008, and are now being encouraged to print money to help the staff and businesses in those industries (representing 10% to 30% of most economies) that have been “shut down”.

We can hardly expect governments to have scruples about helping out unemployed restaurant or travel industry workers using printed money, if those same governments were prepared to allow their central banks to print money explicitly and directly to come to the aid of hedge fund traders and property developers the last time around. Hence, with very little negative commentary in the media, MF is already happening. Fiscal stimulus packages of as much as 20%of GDP are now forecast for several countries including the US, the UK, Japan and New Zealand (Japan has already announced 21% [2]) for the year to March 2021. Of these, only NZ, starting from a position of unusually low government debt at 18% of GDP, has talked about funding these with government bonds (and NZ has itself just launched a QE program to print money to buy its own bonds – if these bonds are never paid back via taxes or sold into the private sector then this program, already QE, will become textbook MF). The US, for whom government debt was already over 100% of GDP before the crisis,[3]are not even pretending they are going to raise taxes or issue bonds to fund this spending. At least for the moment (and why would this change), these expenditures will be funded by printed money. This practise is “Monetary Finance”. Expect to hear much more about it in the coming years.

Some commentators believe MF will be inflationary. Currently there are fewer goods on which to spend money, while income support ensures people have similar amounts of cash, so prices may rise. Others argue that the shock to demand has been so great that recipients of government support may increase their savings, outweighing, any demand increase, and causing deflationary pressure. Our view is that conditions are indeed deflationary right now (although we may see price increases in sectors where supply chains have disrupted). The real risk is neither conventional deflation nor inflation; the risk is that people eventually lose faith in the (printed) currencies themselves. As more and more countries introduce negative interest rates[4], cash and near cash (such as bank deposits) become less attractive as a means of saving. As people lose faith in cash as a store of value, they may start to panic buy gold, safe equities (such as tech stocks), farmland and other real assets.

As Adam Fergusson pointed out in his 1975 book “When Money Dies”[5]on the German hyperinflation of the 1920’s, a far worse thing than a mild inflation due to an excess of demand over supply is “the price of money” plummeting as investors lose faith in it. While we are certainly not saying this WILL happen, we see a risk beginning to emerge that it may. Extraordinarily large amounts of money are already being printed and given to the wider population, and even larger amounts are likely to be printed as governments try to restore the prosperity of 2019. This Monetary Finance phase of economic history may lead to collapse in investor faith in one or several currencies.[6]

In fact, aspects of this are already happening. This is the reason that, in our view, dividend paying defensive stocks like Microsoft, a “real” inflation-proof asset, are trading so well. It is a much better investment than a currency that is being actively debased. It is in this context that the rest of this Commentary will focus on Forestry. What are the characteristics and prospects for this real asset in the forthcoming phase of economic history?

PRINCIPLES OF FORESTRY INVESTMENT

Forestry investment may be analysed as a bundle of the following exposures:

- Biological Growth– Trees grow each year and thus produce annual increments of timber (Mean Annual Increment or MAI). Furthermore, as trees increase in size they increase in value because they can be used for

higher value end products (smaller trees are pulped, larger diameter trees produce progressively more valuable saw-timber). Trees not cut due to unfavourable pricing in the various timber markets can store and grow their value on the stump. Harvest decisions were modelled by foresters comparing growth rates with discount rates (a typical forest management approach might be: “harvest each stand when value creation from growth falls below the cost of capital”). More recently, as we will discuss further below, there are now also options to monetise un-harvested forests through sale of environmental services (esp. carbon credits or conservation easements). - Multiple Product/End Uses– A forest is made up of different species, densities, age classes and pruning regimes, each of which can be harvested for multiple products. For example, pulpwood (for a variety of qualities of paper), wood chips, or saw-timber. The prices of these products have low correlations with one another as they are not substitutes; they have different uses. Forest managers vary their husbandry to optimise these outcomes.

- Relatively Stable Values– Depending on the age of the forest, the value of the land on which a forest grows may represent as much as 80% (or, closer to harvest, as little as 20%) of the value of a forest estate. Forestry land values are not as volatile as timber prices, responding to different market cycles. Thus, land value is a contributor to portfolio stability.

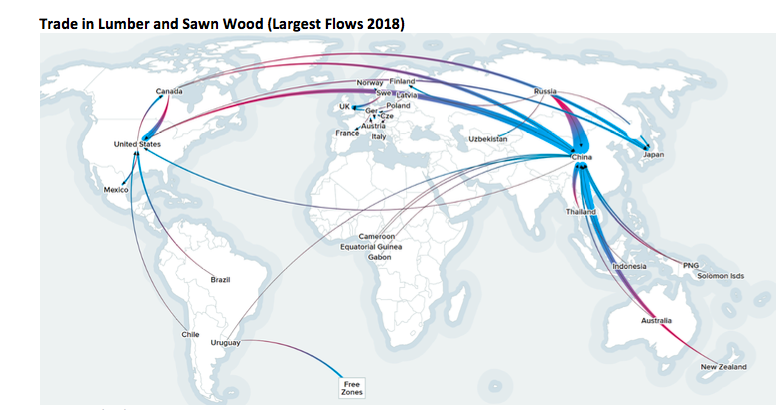

- Demand for Wood Products– When investing in forestry, the future market for timber is the key risk. Access to markets becomes the key metric. For example, at Craigmore, we try to avoid buying any forest more than 100 km from either a deep-water port or processing facility. The southern U.S. softwood timber industry has a vibrant forest products industry, which means that forest properties are usually within trucking distance of multiple processing facilities. Similarly, New Zealand is a leading exporter of softwood timber to China, Japan and Korea (see graphic). It serves multiple markets avoiding single customer risk.

- Ongoing Operational Costs – post establishment, forestry properties are not cost intensive and portfolio-level cash flows can be smoothed (or otherwise optimised) via mixed age portfolio construction, and the investor-directed management and harvest plan.

- Carbon Sequestration– Forestry has a positive environmental and sustainability footprint. It is one of the only asset classes which is carbon neutral or negative (carbon constitutes ca. 50% of the dry mass of trees and when timber from these trees is used in housing, the carbon remains stored for the life of the building).

This carbon value of forestry properties is seldom included in mainstream forestry valuation methodologies (except in New Zealand, which includes net carbon gains on post-1990 afforestation in its Emissions Trading Scheme). These carbon credits are currently trading at around NZ$25 per tonne.[1] Foresters in those regions that follow NZ in developing explicit markets in forest environmental services may expect this to lift values of currently unforested land suitable for conversion to “carbon forestry”. Land-use change to forestry has been a source of significant gains to investors in marginal hill country land in New Zealand.

FINANCIAL RETURNS OF FOREST INVESTMENT

Although in the short-term forestry should not be thought of as “low beta” (forests produce commodity inputs to industry, so stumpage prices normally vary with the business cycle) over the long term this asset class has proved itself a resilient and inflation-proof store of value. The most widely quoted forest returns index (“NCREIF” in the US) has shown 12% average annual returns over the past 20 years.[2] This is likely to overstate pure forestry returns as the expansion of, for example, the city of Atlanta created significant “land-use change” returns to forest owners in the US South. However, it is an advantage of forest land investment, that a “higher and better use” may come along for the land.

The US returns from forestry, excluding land use change, are similar to those that Craigmore generated for investors in our first Forestry Fund, now redeemed (net 39% return to investors to a weighted 6-year redemption).

Analysts anticipate growing demand for softwood timber in the Pacific region.[1] Yet no net new timberland is being established. In fact, timber resources are declining with the harvest of the effectively non-renewable Siberian resource.[2]

CONCLUSION: WHAT ABOUT FORESTRY IN THE ERA OF MONETARY FINANCE?

Almost all fiat money systems eventually succumb to severe inflation (or debt defaults in the case of those who issue their bonds or other obligations in a foreign currency – think of Argentina). To be fair, the pathways to these excess money-printings are normally “paved with good intentions”. Imagine you are a leader faced with addressing the economic, social, and political consequences of Covid-19. On the one

The choice, put like that, is relatively easy. Even the Germans will do some of it (just as they relented and allowed a lot of European Central Bank QE to effectively be printed to assist Greece, Italy and elsewhere over the past 10 years). But what will be the consequences? And especially what will be the consequences in those countries which print more than the Germans and Kiwis are likely to do?

Optimists will say that, correctly judged, these policy interventions may perfectly balance deflation and inflation, and thereby “bridge” the economy through to its post-Covid state. However, and this has been the problem with past over-printing of the money supply in response to shocks (think e.g. of US$ inflation following the 1970’s oil shock), the Covid-19 shock has been so severe that Craigmore’s concern is that we face years of unprecedentedly large policy innovations (most of them involving Monetary Finance) before economies begin to replace the jobs and activity levels we enjoyed in 2019. And that economic activity was already precarious with high levels of corporate, financial sector and government leverage used to get us to there.

If the above analysis is correct then, given the choice between allowing a melt-down in GDP (in which case all investments, including forestry, may be mediocre) and “printing” GDP to return it to normal levels via MF, we believe the latter far more likely. Investors who are not aware of this, and simply “going to cash” may be caught out in the way that careful investors were in 2009 and thereafter.

If this is the case then, given the unprecedented quantities of money that will be printed, real assets such as forestry (and farmland, and gold, and shares in non-cyclical companies) are likely to become havens for savings in the years ahead.

It follows that forestry investing later in 2020, and 2021, may be a very good idea.

In the aftermath of the last economic crisis, some institutional investors chose to dispose of forestry assets to address liquidity problems triggered by the rapid fall in the value of their financial assets. There are early signs that a similar rebalancing is already underway. That trend, combined with distressed sales of some properties, including in Europe,[1] means that good quality forests may be easier to secure, and returns should be higher than they might have been. The investor may also benefit from future demand for environmental services.Craigmore has held an Expert Forum discussing Forestry and Monetary Finance and featuring a panel of practical foresters and forest owners. The panel consisted of Forbes Elworthy (Founder, Craigmore Group), Kari Kangas (Timberland Portfolio Manager, United Bankers Asset Managers), Che Charteris (CEO, Craigmore Group), and Matthias Graf von Westphalen (Principle Owner, Westphalen Estate and Founding Partner, GlenSilva GmbH). The discussion was moderated by Hubertus Prinz von Sachsen-Coburg and Gotha who is the managing member of the Ducal Saxe-Coburg and Gotha Family Foundation. If you would like access to the video recording of the Expert Forum please contact investorrelations@craigmore.com.

Josef Naegel and Forbes Elworthy

References

1www.theguardian.com/business/2015/jan/22/quantitative-easing-around-the-world-lessons-from-japan-uk-and-us

[2]For instance see: Dalio, Ray (2020); ‘The Changing World Order’ Chapter 2: Money, Credit, and Debt; webpage here

[5]The ECB, Switzerland, Sweden, Denmark and Japan currently have negative central bank rates; see www.bloomberg.com/quicktake/negative-interest-rates

[61]Fergusson, Adam (1975); ‘When Money Dies: The Nightmare of the Weimar Hyperinflation’

[7]The pound being an obvious candidate. The euro could also come under pressure although in its case for more complex reasons. Even the mighty US dollar is likely to experience capital flight, especially if as seems possible the Fed takes US dollar rates negative. Less of this would be from the USD into other paper currencies (although that may happen); more likely a flight into real assets of the types discussed.

[8]Comm Trade Carbon, last sale as at 11 May.

[9]NCREIF for the period from 1999 to 2019, annual average compounding.

[10]http://www.fao.org/3/i0350e/i0350e02a.pdf

[11]Siberian timber would take 100 years or more to re-grow to be valuable, relative to 25 to 30 years for

[12]The Spruce Bark Beetle outbreak in Central Europe and various windstorms have caused significant damage to European forests and severely depressed the timber market. This will impact softwood log and lumber markets over the next 2-5 years and may cause distressed sales.