An economic outlook.

The global economy is constantly in motion, with various factors influencing its trajectory. From inflation to trade relations and political events: where are we heading and where do we stand?

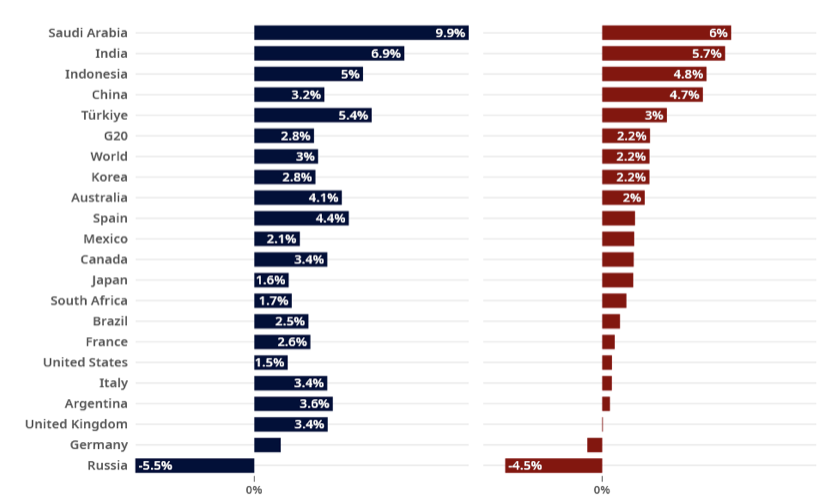

Economically speaking, we are experiencing a significant slowdown due to a combination of factors such as efforts to curb rising inflation through monetary policy adjustments, adverse financial conditions and disruptions caused by the ongoing geopolitical events. According to the recent World Bank report (https://blogs.worldbank.org/developmentaltalk/global-economic-outlook-five-charts-0), the global economy is projected to have one of the weakest growth rates in the past 30 years this year, surpassed only by the economic downturns caused by the pandemic and the global financial crisis. The International Monetary Fund is projecting weak economic growth.

Source: OECD Economic Outlook, Interim Report September 2022

The case of soft landing

Although governments succeeded in decreasing the inflation rate substantially within their rate hikes, none has clearly achieved a soft landing yet. This difficult position is influenced by commodity exposure and ongoing monetary tightening. However, early hikers appear to be doing better than others. According to Goldman Sachs’ macro-outlook, we could see some important resilience in early hikers’ countries, such as Brazil. However, economists are expecting a mild recession in Europe, mainly influenced by energy bills. Meanwhile, we would notice an ease in global supply-chain pressures, thanks to the reopening of China. Therefore, we could expect to see an improvement in market performance in China.

How supply-chain pressures were influencing the cost of living

Supply-chain pressures can lead to inflation if they cause an increase in the cost of goods and services. This can happen if, for example, there is a shortage of raw materials or a disruption in the transportation of goods, which raises the cost of production. The previous lockdown in China, and the geopolitical turbulence in Taiwan, raised the cost of production significantly, due to supply-chain disruptions. As a result, companies may pass on the increased costs to consumers in the form of higher prices, leading to inflation, which was the case.

How inflation is influencing the labour market

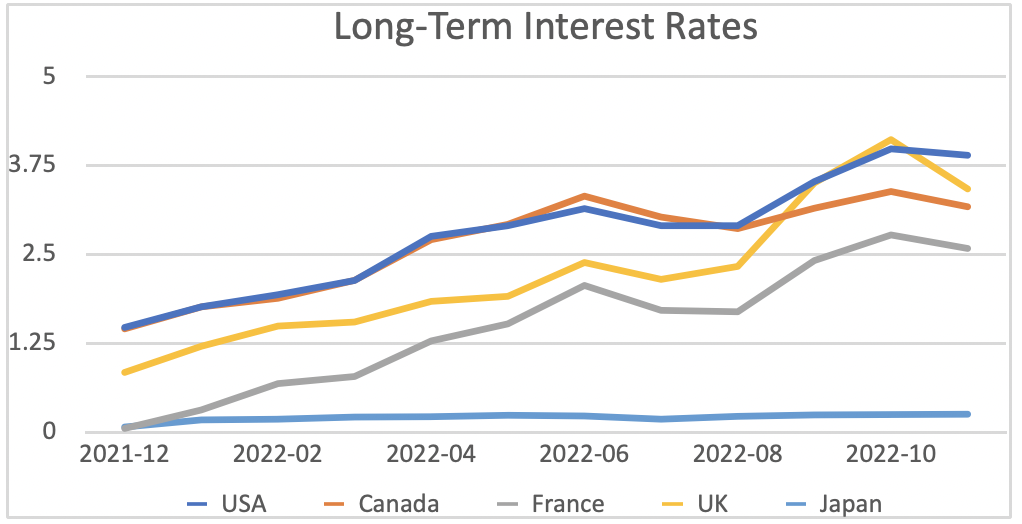

The rise in inflation put pressure on the labour market by reducing purchasing power, which eventually influences economic growth and unemployment levels. Changes in monetary policy aimed at controlling inflation, by raising interest rates (see figure 2), impacted hiring and investment decisions, and thus affects the labour market; not to mention the news about recent layoffs in some companies.

Source: OECD (2023), Long-term interest rates (indicator)

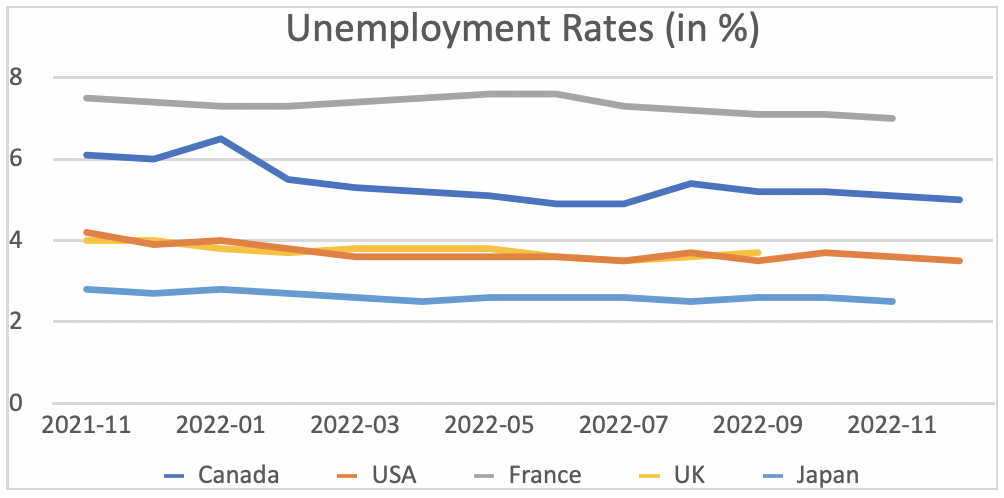

Despite this, the labour market appears to be remarkably strong (see figure 3). However, it is likely to decline in the future. The uncertainty is around how fast and severe the decline will be. Generally speaking, the labour market is still tight and adding wages pressures to compensate for inflation. Eventually, this is being priced in goods and services. The hope is to align the demand and supply in the labour market, with the least number of job losses, to reduce inflation to comfortable levels.

Source: OECD (2023), Unemployment rate (indicator).

The optimistic scenario

The precedent year has been challenging on all levels, to all market participants. Free money is no longer a choice and a new playbook is required to tackle such an environment, as stated by the recent outlook of BlackRock.

There are a wide variety of options for people to protect their capital from deteriorating due to increased costs of living. According to the recent economic outlook of HSBC, a proactive plan is a must, to ensure an optimistic future. People need to shift from spending on liabilities (which could worsen their credit line) into investing in high-rated bonds, as a primary step. They could discuss with their financial advisors on building recession-resistant portfolios that focus on quality stocks and partial inflation hedging. Next and foremost, the recent geopolitical situation marks the importance of geographical diversification.

Finally, we would like to recall that while it is true that certainty is not an option, the essence of risk management relies in making things less uncertain. We hope that by providing a global perspective we could help people, consumers and investors, to be less uncertain.

Disclaimer: This document is provided for your information purposes only and should not be relied upon as investment advice. The information contained within this article is intended for general circulation to The Property Chronicle audience and it has not been prepared in light of any of your personal circumstances (including specific investment objectives, financial situation or particular needs) and does not constitute a personal recommendation, nor should it be relied upon as a substitute for the exercise of independent judgment. The publication’s publisher and its authors assume no liability for any action(s) taken by the publication’s subscribers or other market participants, in particular not for losses or damages, direct or indirect, from taking investment action.