For many involved in real estate, problems such as a lack of affordable housing or excessive contributions to global carbon emissions are now becoming obvious. Accordingly, two-thirds of real estate investors are looking to increase their allocation to ‘sustainable properties’. This changing investor demand coupled with tougher regulations and new financing initiatives has led to a realisation in the real estate industry that poor ESG performance will damage future returns. However, only now that the industry is turning its attention towards rectifying these material issues has it discovered that ESG problems are far more systemic, rooted in the misaligned and opaque ESG reporting standards and accreditations adopted to govern the industry.

There is remarkable confusion surrounding how the real estate industry benchmarks and rewards ESG performance. Investors are looking for reliable objective evidence that the projects they fund are genuinely sustainable. However, the nature of real estate as an unregulated industry means that there is no obligation, nor indeed a common standard, through which organisations are required to disclose their ESG performance, nor to pass on design or operational consumption data, both of which could be used to improve future asset performance under new ownership. Subsequently, a maze containing 20 mainstream, subjective portfolio level accreditations and over 600 asset level accreditations makes it hard to identify what constitutes good ESG performance and the true ESG risk profile of assets is almost impossible to attain. Such are the pitfalls of the current ESG benchmarking system that less than 1% of the global commercial building stock has been certified.

In March 2021, we held a design thinking workshop which uncovered six everyday questions to which real estate owner and operators have failed to find solutions, resulting from this lack of ESG data transparency. These are:

- How can we consolidate and analyse ESG data?

- What standardised social data should we collect?

- How can we promote the responsible use of buildings by occupiers?

- How do we stay ahead of changing environmental reporting requirements?

- What upgrades should we perform to prevent obsolescence?

- How do we provide the skills and education needed to enhance ESG performance?

Critically, ESG is not a stationary concept and is forever evolving as new scientific discoveries and technological advances make incorporating more objective measures of previously subjective metrics possible through the utilisation of digital technologies. These once irrelevant and impossible-to-measure metrics will become the future drivers of value and, inevitably, new accreditations will emerge focusing on these scientific discoveries and value drivers. In turn, real estate companies will need to stop focusing on minimising their ESG impact to meet regulations and targets and begin to focus on maximising their ESG value.

Digital first benchmarks such as WiredScore’s Smart Score, The Smart Building Certification, RESET and AirRated, coupled with government mandated, real time, operational energy performance ratings such as NABERS, will begin to provide the market transparency required for the industry to increase its ESG performance. Real Estate companies will soon stop fixating on connecting ESG investing to financial value calculations, and will begin to invest and report upon ESG outcome metrics purely for better ESG outcomes. Indeed, real estate has recently begun to realise the benefit of doing just this, with the next wave of sustainable buildings going beyond sustainable certification to target net zero carbon.

Commercial real estate companies that can reliably report strong ESG performance will be in a much better position to gain access to better, cheaper capital looking to deploy under new sustainable mandates

To fulfil these emerging non-financial reportin requirements will require better data with which to analyse and identify the financial drivers of ESG investing, and thus the need for better measurements and attributions delivered through emerging technology. Commercial real estate companies that can reliably report strong ESG performance will be in a much better position to gain access to better, cheaper capital looking to deploy under new sustainable mandates. However, even though the increased number of asset managers that will only finance sustainable buildings has meant that the cost of debt capital for green buildings is now lower than non-green buildings, a lack of data and resources required to collect and report impact metrics is currently the biggest barrier to real estate firms wanting to issue green debt.

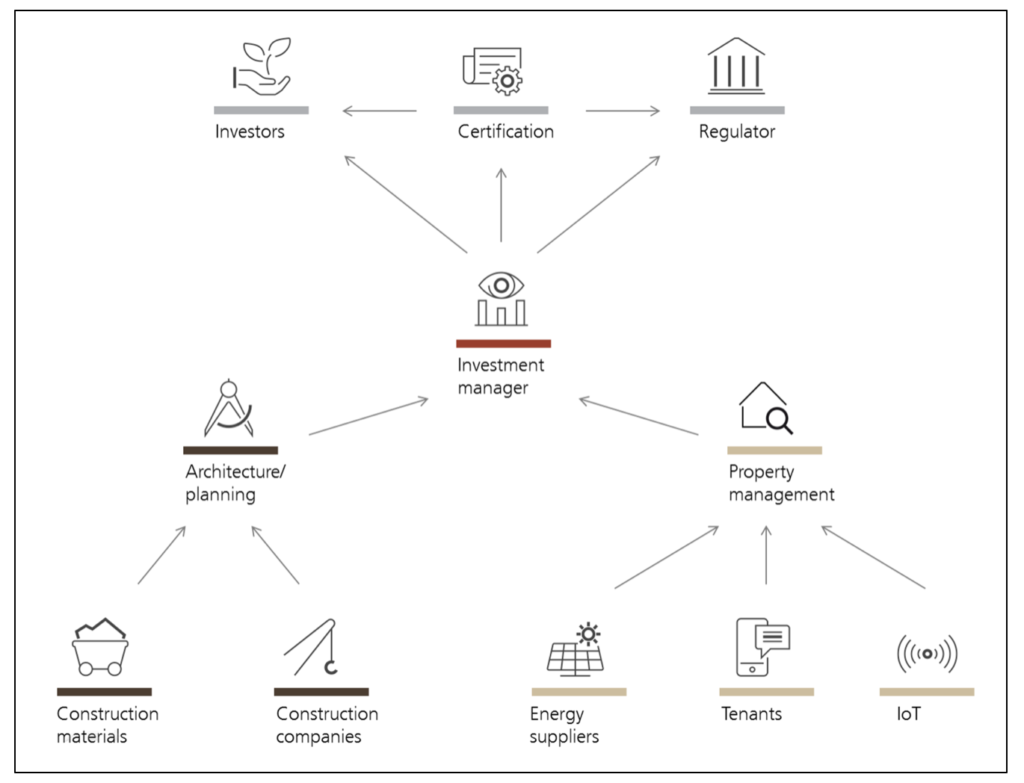

Through widespread adoption of emerging technologies in areas such as smart buildings, IoT and the concept of digital twins, the disjointed data flows caused by current manual reporting processes will be eliminated. Such bottom-up technology adoption will provide the ESG transparency which investors will begin to demand, while tools now exist to automate their collection, presentation and analysis. Those better-resourced firms have chosen not to wait, building these capabilities in-house, tailored to their investor reporting requirements. The enhanced insights provided will begin to move the market and reveal those ESG metrics which are deemed most valuable.

A technology driven ESG reporting structure

Critically, technology overcomes many of the problems of single-moment-in-time, manual interpretation and reporting of incomplete ESG data that currently plagues the industry, by automating the collection of real time, standardised, unbiased, digital data into a single software. It will take a network of these emerging real time, digital measurements to be integrated into transparent, standardised ESG reporting structures, feeding objective and empirically founded accreditations to reveal the ESG performance increase of undertaking certain sustainable upgrades. As this data becomes more readily available, equity and debt providers will stop questioning whether a company or building is sustainable, and look instead at all relevant transition and physical climate risk data to identify where on the transition spectrum a company or building is positioned, and the pace at which it is moving towards sustainability.

Those real estate firms which adopt outcome-based targets and are able to deliver comprehensive, bottom up, granular, real time, automated and transparent ESG reporting will be those most likely to secure the influx of institutional finance targeting sustainable assets.The evidence is compelling: a real estate investment strategy must go hand in hand with a PropTech investment strategy. Any firm that tries to decouple the two will not only face severe consequences from regulators, but also significant barriers to fulfilling the ESG goals of future investors and being given the capital they need to do their work.

This is an overview of Pi Labs latest report Transparency Through Technology, available at www.pilabs.co.uk/insights