Exponentiality not linearity is the way forward for proptech.

This is our second article on how the power of data will change the real estate investment landscape. In the first article we explained how ownership data can connect finance and property markets. Here we discuss how connecting the four quadrants of real estate could create what is essentially a tech company. Let us start by exploring the concept of exponentiality vs linearity.

“Seven and a half years into the Human Genome Project, scientists announced they had decoded only 1% of our genetic code. The project was budgeted for only 15 years. Sceptics said it wouldn’t work; it would take a century to complete. Ray Kurzweil – inventor, philosopher, futurist – had a different reaction. He said the genome was practically solved. And indeed, the mapping was completed in another seven years. The amount of data sequenced each year practically doubled […] This was because Ray Kurzweil realised the process was exponential rather than linear.”

–“Ray Kurzweil and Exponential Growth”, Russell Steinberg, 24 July 2014

This same concept of exponentiality applies to real estate data. When constructing a transaction database, it speeds things up if the asset, the buyer and the seller already pre-exist in the database. So just as with the genome project, time and effort invested in building these asset and investor tables makes adding each new transaction record more efficient.

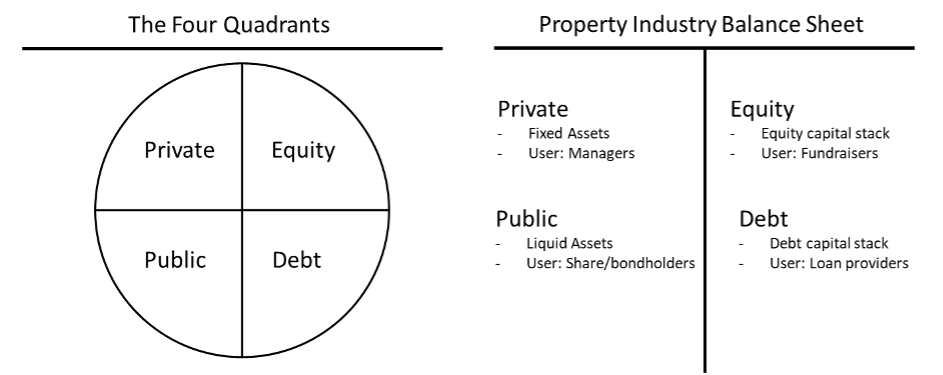

You will all be familiar with the term ‘the quadrants of real estate’ – private, public, equity and debt. These are often illustrated in pie chart format. We prefer to see it as a balance sheet with fixed assets (private) and liquid assets (public) on the asset side, and equity and debt on the liability side. Of course, the crucial difference is that whereas the company needs to have its balance sheet items rigidly connected, the depressing reality for real estate is that these four quadrants are currently anything but connected.

In our view, the concept of Big Data can radically alter this disconnect. Let us explain this mathematically. If each quadrant has one database unconnected to the others, one will have four output combinations (1+1+1+1=4). Now, if we can link these databases, then the number of output combinations is 16 (24=16). And if we add one connected database, that number becomes 32, not 5. This is referred to as exponential, as opposed to linear, growth. The result is that we can then create a relational database, with several connected tables, that can deliver a huge amount of data. So, what’s next?

The most important observation about data, which is often overlooked, is that the value of Big Data is not in the data itself but in the information that can be extracted from it. Often the real estate industry seems confused about alternative approaches when analysing data. Theoretically, there are two: from data to idea (induction) and from idea to data (deduction).

Induction is often used by tech companies that hoover up massive amounts of data and then apply algorithms to find relationships between the data. In our experience this approach, despite multiple efforts, has not been successful for real estate investment. The three main reasons for this are: the poor quality of existing datasets, the barriers that exist between the quadrants, and a lack of understanding of the wider investment world.

We believe that a more effective route is deduction. This calls for a well-designed database consisting of idea-driven tables – each filled with the relevant data. The analogy with the genome project is there, but with one complicating factor: real estate investment markets are dynamic and change all the time. Many of you will be familiar with the phrase ‘GIGO’ (garbage-in-garbage-out) in relation to models. In which case, the responsibility of guaranteeing the quality of data coming in and information coming out should fall upon data scientists – or in our case, investment analysts.

By combining information from all quadrants, an investor in one quadrant can make a better-informed investment decision

A good investment analyst must be able to look at data and compare it with the real world. But understanding the real world requires understanding the drivers of the industry, as well as having the associated skills to link information. The complicating factor for real estate investment is that a minimal understanding of all four quadrants is required – and given the siloed nature of these quadrants, important cross-quadrant research skills are likely to be scarce.

If you can achieve this, the benefits to investors are twofold: better descriptive and predictive outcomes. Firstly, by combining information from all quadrants, an investor in one quadrant can make a better-informed investment decision. A good example was in the immediate aftermath of the Brexit referendum, when UK REITs traded down over 30% but private market demand didn’t evaporate. Instead pricing indications were, at most, 5% down. Once these assets traded it was clear the public market was overreacting.

The second application is to use the available data to make forecasts. This may be bread-and-butter for equity and credit analysts, but less so for more descriptive property research. Combining the predictive analytical skills of financial market research with the detailed data sitting within property research could start a powerful revolution. Just imagine how useful a dashboard application for a specific market could be where you can view REIT consensus estimates, broker rental/yield forecasts and private and public market prices.

With a database design completed, the next stage is building a working data-feed mechanism and a digital storage facility; designing tools for analysing and adding data, as well as output products that deliver tailor-made information. This is exactly what tech companies do. Which is why we are convinced that by repeatedly repackaging the same data, tailormade solutions can be extracted for each of the typical quadrant users shown in the chart. And this is what delivers scalability – that magic word for tech VCs.

Just like the genome project and the eternal city of Rome, this will not be built in a day. It will take time. However, with the gift of exponentiality and the right analytical skills, a foundation can be laid for existing tech capabilities to take this to a revolutionary next level. This is new and doesn’t currently exist. But we believe that the race is on, and those who can muster the required skills will clean up.