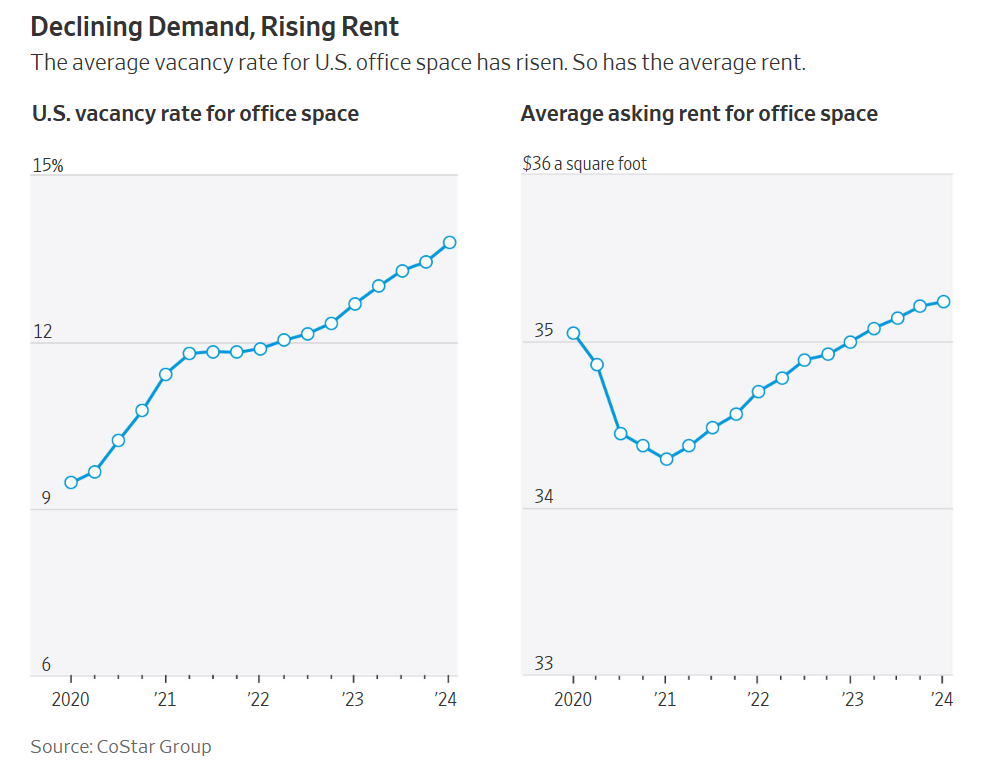

According to the Wall Street Journal, the U.S. office market faces rising vacancy rates, abundant sublease space, and increasing defaults. Despite these challenges, office rents remain resilient, as landlords are reluctant to lower prices due to the potential impact on property values and loan covenants. Landlords are offering generous concessions to new tenants, such as expensive build-outs and extended rent-free periods, to justify the elevated rents. As David Bitner, head of global research for Newmark Group, explained:

“Landlords who cut rents significantly to fill empty space ‘would significantly reduce the appraised values of their buildings.'”

However, the market’s future remains uncertain, with businesses occupying significantly less space than before the 2020 recession and further negative absorption expected. As pre-pandemic leases expire, companies with hybrid work strategies may reduce their office space requirements, putting downward pressure on the market.

Despite these challenges, there may be positive implications for Office REITs. Well-capitalized REITs can acquire distressed properties at discounted prices, positioning themselves for long-term growth. With lower acquisition costs, these REITs can offer competitive rents and attract tenants, potentially gaining market share.

Furthermore, the shift towards hybrid work models may drive demand for higher-quality office spaces that facilitate collaboration and employee well-being. Office REITs that invest in modernizing their properties and adapt to changing tenant preferences could command premium rents.

While the office market faces near-term challenges, the long-term outlook for Office REITs is not entirely bleak. Those that navigate current conditions, capitalize on acquisition opportunities, and adapt to changing tenant demands may emerge stronger and well-positioned for future growth. As the market resets and rents align with market realities, Office REITs with high-quality assets and strong tenant relationships could benefit from the sector’s recovery.

This article was originally published by Armada ETF Investors and is republished here with permission.