WACC is an acronym that stands for “weighted average cost of capital” and this is one of the most important metrics we use in the REIT sector.

The WACC is similar to the required rate of return that an investor expects from his investment in a certain project. The WACC is a useful finance tool that companies and investors can use to make better decisions on how they allocate their money.

Most great companies offer some unique competitive advantage that protects them and allows them to earn high returns on capital for many years into the future. While there are many advantages that define a company’s moat, I consider the WACC to be one of the most important (metrics).

Within the Net Lease REIT sector, I consider WACC one of the best methods to measure profitability, because it’s simply a “spread investing” business.

Simply put, cost advantage is the key for any business, because it allows the company to provide goods or services that undercut their rivals on price, helping them sell more.

In other words, being a low-cost provider generally allows the company to achieve fatter profit margins. The WACC simply balances near-term earnings per share growth with long-term value accretion, and this can be very useful to investors.

The company’s low cost of capital is the most important competitive advantage in the net lease industry because it

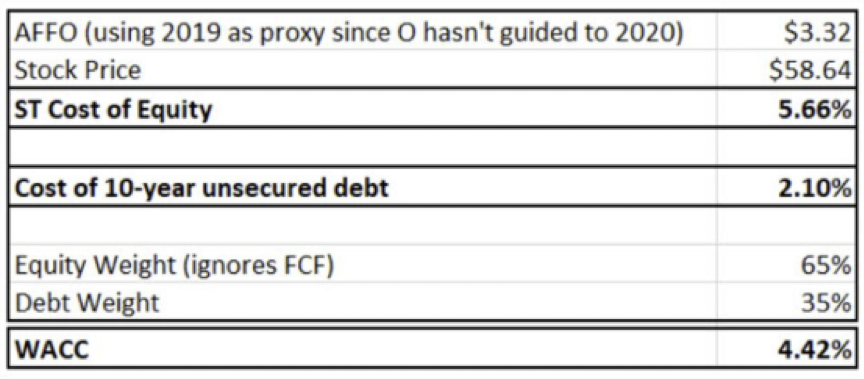

WACC Model

In reality, Realty Income’s WACC is actually lower than that because it uses free cash flow instead of equity. Cash has a 0 percent nominal cost). As you can see, this is an impressive competitive advantage for “The Monthly Dividend Company.”

The spread on the short-term WACC is required to generate accretion and we all know that Realty Income is unwilling to sacrifice quality to generate wider spreads. In other words, the company doesn’t have to chase yield as it can be extremely more selective in acquiring the highest quality tenants.

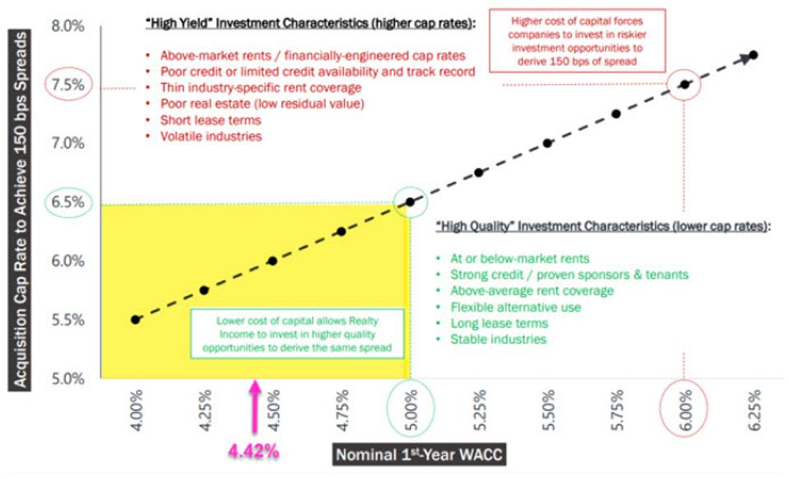

WACC Chart

REALTY INCOME INVESTOR PRESENTATION

The shaded yellow rectangle is the “sandbox” that Realty Income plays in. The company has the low cost of capital advantage so it can buy at lower cap rates with

- At or below market rents

- Strong credit / proven tenants

- Above-average rent coverage

- Long Term Leases

- Stable Industries

Realty Income has higher quality tenants and most importantly, the company can grow its dividend through good times and bad. And the reason for that is because the company has the “cost of capital advantage”.

Given this stage in the pandemic, we believe that investors should pay close attention to underlying fundamentals, and that includes an emphasize on the sources of revenue that each REIT is generating.

Now is not the time to chase yield, and we that’s precisely why we are TRIPLING DOWN on HIGH QUALITY Triple Net REITs. We believe that it’s very likely that many corporations will look to the Net Lease REIT sector to monetize real estate holdings and those with the lowest cost of capital advantage should thrive.