The investment drama of a-weighting currency change.

I was presented very recently with a piece of investment bank ‘research’ that made a bold change in recommendation. The piece heralded the first time in five years that the particular firm’s ‘strategy’ team had gone ‘overweight the UK equity market’, having recommended being ‘short’ for practically the entire period since the Brexit Referendum.

For those of us who have persistently maintained the UK has been cheap not despite Brexit but because of it, this capitulation was not merely a long time coming, but very much a contributor to our frustration. For even when fundamentals suggest one thing, if there is a large enough body of ‘deniers’, fundamentals cannot fail to be subverted. In few instances has this been more the case than the general negative mood towards UK equities. After all, the reality is that if enough of those influencing markets are of an opinion then that opinion cannot fail to be self-fulfilling, however devoid of fundamental fact it might be. JM Keynes articulated this point far better than I have or can.

Rather than focus in what follows on the earnings and valuation fundamentals favouring UK equities across the vast breadth of the FTSE250, I want to reflect on a curious corollary from the ‘research’ cited above. So, what is my reflection on ‘strategic’ and historic change of tune towards UK equities?

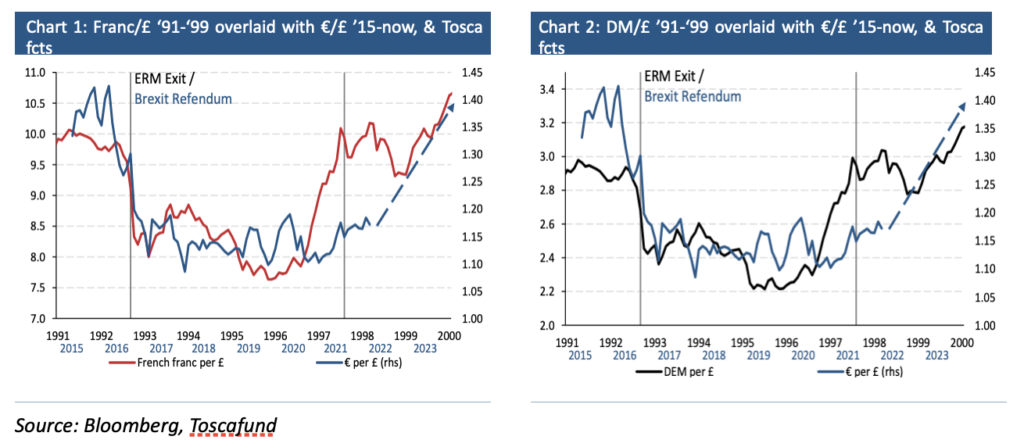

Those expecting the pound to continue to wallow, or indeed weaken, will believe the FTSE100 is, ceteris paribus, a far better place to be invested in the sterling equity space than the more localised FTSE250, which is generally negatively exposed to sterling weakness. There are others like me, convinced sterling is poised to do what it did from late 1996. After four years of weakness following its shock ERM exit in September 1992, the pound gapped-up impressively – see charts 1 and 2.

With the Brexit referendum now more than five years behind us, I believe the UK economic backdrop from 2022 will be very much – if not more – favourable, than it was from 1997. This time around the UK can look forward to enjoying a boot-strap uplift helped by a strong Chinese economy, something absent back in 1997, given the latter was still five years off from entering the global macro-economic stage; a stage on which it now stars. If I am right, the FTSE250 must be the place for notable upside action in UK equities.

Consideration of the fortune of the UK economy cannot be made without considering where it will sit or, rather, see its seating shifted by Beijing, in the constellation of currencies around its own ever more economically and financially dominant yuan. The reality is that currencies in and growing within China’s management basket must become ever more present as central bank reserves there and elsewhere. Conversely, those losing out cannot fail to lose what status they may have as reserves. With this in mind, let us reflect on how matters have changed over recent years with regard to Beijing’s currency management and what this helps tell us concerning currency futures.

From 1994 until 2005 – when threatened with tariffs unless matters changed – the yuan was firmly pegged to the US$. Thereafter and until 2016, the PBOC employed singularity in managing the yuan; focus was entirely on controlling its movements relative to the US$. From then it broadened matters by including another dozen currencies, taking the US$ weighting down to 26.40%. A year later the basket was broadened further still, taking the list of currencies in it to 24; the US$’s weight lowered to 22.40%. Matters remained as such for three years, after which weights changed again: the US$ demoted again to 21.59%.

Now, while one cannot be certain that another reweighting looms, we can be sure there will be more to come and comparatively soon. When change comes, I am convinced that not only will the US$ suffer more dilution, but so too the yen; a decline that will only weaken them in all dimensions. In so far as it moves higher, I expect the dollars of Canada, Oz, NZ and Singapore to gain, and so too sterling, all to the benefit of their capital accounts. As for the Hong Kong dollar, its own management has to change in a way that the HK$ no longer sits in the yuan’s currency management basket, but has its own and almost certainly the same.

If I am correct, then the pound will have yet another reason to strengthen through 2022 and beyond. Another reason, that is, in addition to the yield the Bank of England will add to it as it embarks on an economically sensible policy of lifting the base rate beyond c1.75% by 2025. Even ahead of these events unfolding, be in no doubt that a growing number of investors around the world will anticipate them by buying into the pound and widely across the FTSE250.