While institutional investors of the 1990s preferred passive investment vehicles with a diversified portfolio of multiple real estate sectors, recent real estate investment strategies have shifted from diversified REIT portfolios to specialised ones. In particular, specialised REITs have been validated as a superior real estate investment strategy compared with their diversified counterparts on both investment performance and interest rate risk management dimensions, according to a new analysis published in my PhD thesis and recent journal articles.

Pacific Rim specialised REITs

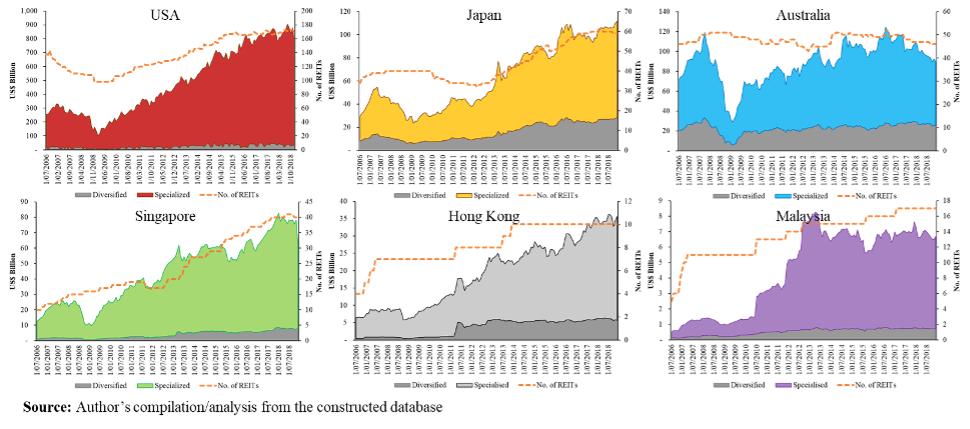

In the Pacific Rim region, a dominant role of specialised REITs has been seen in the US (the percentage of specialised REITs to composite REITs was 95.2%), Japan (75.2%), Australia (74.1%), Singapore (91.9%), Hong Kong (83.5%), Thailand (93.6%), Malaysia (85.6%) and South Korea (97.3%) between July 2006 to December 2018, according to my constructed database, with consideration of survival bias. The only two exceptions are New Zealand (49.2%) and Taiwan (36.0%).

The largest specialised REIT market in the region was the US (US$772.5bn in 2018; a 326% increase since 2006), ahead of Japan (#2; US$83.4bn; 388%), Australia (#3; US$64.4bn; 123%), Singapore (#4; US$54.9bn; 472%), Hong Kong (#5; US$29.9bn; 489%), Thailand (#6; US$10.1bn; 31,573%), Malaysia (#7; US$5.9bn; 1,540%), New Zealand (#8; US$4.0bn; 646%), Taiwan (#9; US$0.9bn; 144%) and South Korea (#10; US$0.9bn; 515%).

Players of Pacific Rim specialised REITs are American Tower Corporation (US; infrastructure; US$69.9bn in 2018), Prologis (US; industrial; US$37.0bn), Equinix (US; data center; US$28.3bn), Equity Residential (US; residential; US$24.3bn), Link REIT (HK; retail; US$21.4bn), Scentre Group (Australia; retail; US$14.6bn), Goodman (Australia; industrial; US$13.6bn), Nippon Building Fund (Japan; office; US$8.9bn), Dexus (Australia; office; US$7.6bn), CapitaLand Mall Trust (Singapore; retail; US$6.1bn).

In opposition, players of Pacific Rim diversified REITs are Vornado Realty Trust (US; US$11.8bn), GPT (Australia; US$6.8bn), Stockland (Australia; US$6.0bn), United Urban Investment (Japan; US$4.7bn), Orix JREIT (Japan; US$4.6bn) and Suntec REIT (Singapore; US$3.5bn). As data series for hotel, healthcare, infrastructure and data centres are too thin for analysis in all markets in the region, these sectors will be categorised as specialty REITs.

Investment performance of Pacific Rim specialised REITs

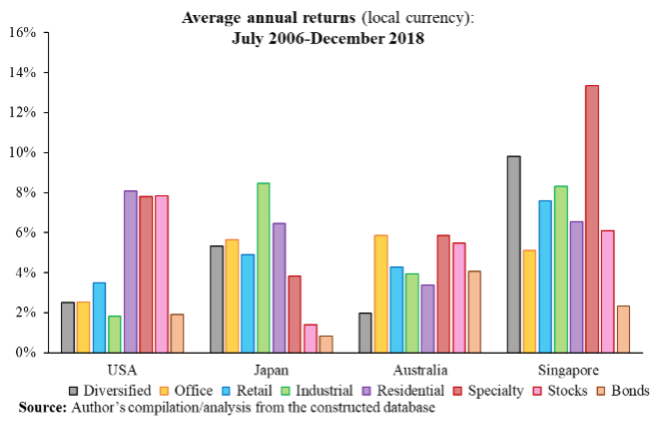

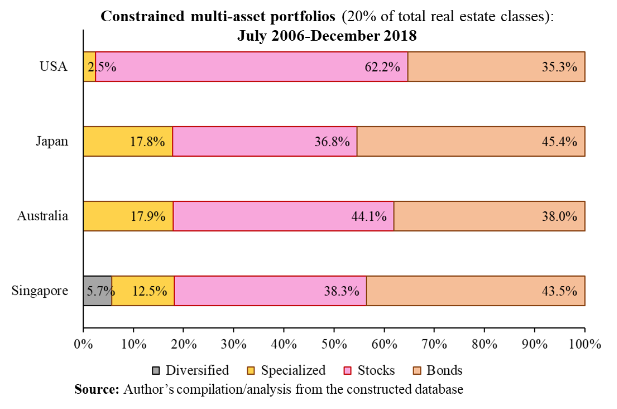

Specialised REITs generally delivered higher average annual returns than diversified REITs and the major asset classes across the US, Japan, Australia and Singapore. In the respective constrained domestic multi-asset portfolios, specialised REITs in the US (an average allocation = 2.5%), Japan (17.8%), Australia (17.9%) and Singapore (12.5%) played a more significant role than diversified REITs over the last 12 years. These findings confirm the added-value role of Pacific Rim specialised REITs in multi-asset portfolios in these four markets, with strong portfolio diversification benefits for international real estate investors seeking portfolio diversifying in each case.

Interest rate sensitivity of Pacific Rim specialised REITs

In terms of the interest rate risk management, Pacific Rim diversified REITs were empirically more sensitive to changes in the level and volatility of both three-month and ten-year interest rate series than specialised REITs. This may be attributed to a diversified REIT portfolio including multiple real estate sectors (for example, office, retail, industrial, residential, hotel, healthcare, data centre, infrastructure). However, the lower exposure to interest rate risk of Pacific Rim specialised REITs may imply a stronger interest rate risk aversion and hedging actions. These are particularly valuable to international real estate investors constructing and managing portfolios with REITs in the Pacific Rim region, to reduce or hedge interest rate risk exposure.

In brief, these research findings have demonstrated the REIT specialisation value in the Pacific Rim region from both investment performance and interest rate risk management dimensions.

What next?

The research findings have several significant listed real estate investment implications:

1. The emerge of REIT specialisation value in the Pacific Rim region from both investment and interest rate risk management dimensions suggests that institutional investors (such as real estate mutual funds, private equity funds, insurers, pension funds and sovereign wealth funds) seeking listed real estate investment exposure in the region should consider including specialised real estate sectors, rather than their diversified counterparts, in their local, regional and international portfolios.

2. While there is a misconception that a diversified REIT portfolio can often diversify the investment risk, real estate investors should acknowledge that diversified REITs were empirically more susceptible to interest rate changes than specialised REITs in the Pacific Rim region. This may indicate that specialised REITs had stronger interest rate risk aversion and greater hedging benefits than their diversified counterparts in the region. The findings are essential for institutional investors seeking real estate exposure in the post-covid environment, particularly with the growth of refinancing capitals and newly troubled loans during the pandemic, according to Real Capital Analytics reports.

3. These findings offer a clear picture that specialised REITs are a preferable REIT structure for addressing institutional investor appetite, reflecting the prominent role of specialised REITs in the Pacific Rim REIT markets over the last 12 years. Real estate investment advisers should recommend specialised REITs to clients who are willing to establish a new REIT in the region.

4. These results imply that institutional investors should actively control their own real estate portfolios by investing in specialised REITs, rather than passively relying on a diversified REIT portfolio with multiple real estate sectors.

5. Although New Zealand (first REIT launched in 2007) and Taiwan (2004) are one of the earlier REIT markets in the Pacific Rim region, the market capitalisation of these two markets was not comparable to the others in the region, which have professionally specialised in one real estate market segment. The small size of NZ- and T-REITs may be attributed to the lack of REIT specialisation value in these two markets over the last 12 years.

All research findings were sourced from my PhD thesis entitled “The Risk and Return Characteristics of Sector-specific Real Estate Investment Trusts in the Asia-Pacific” here. Details on the varying magnitude of interest rate sensitivity for different real estate sectors and REIT specialisation value in Australia are available in my recent journal articles entitled “Varying Interest Rate Sensitivity of Different Property Sectors: Cross-country Evidence from REITs” in the Journal of Property Investment & Finance here, and “The value-added role of sector-specific REITs in Australia” in the Pacific Rim Property Research Journal here.