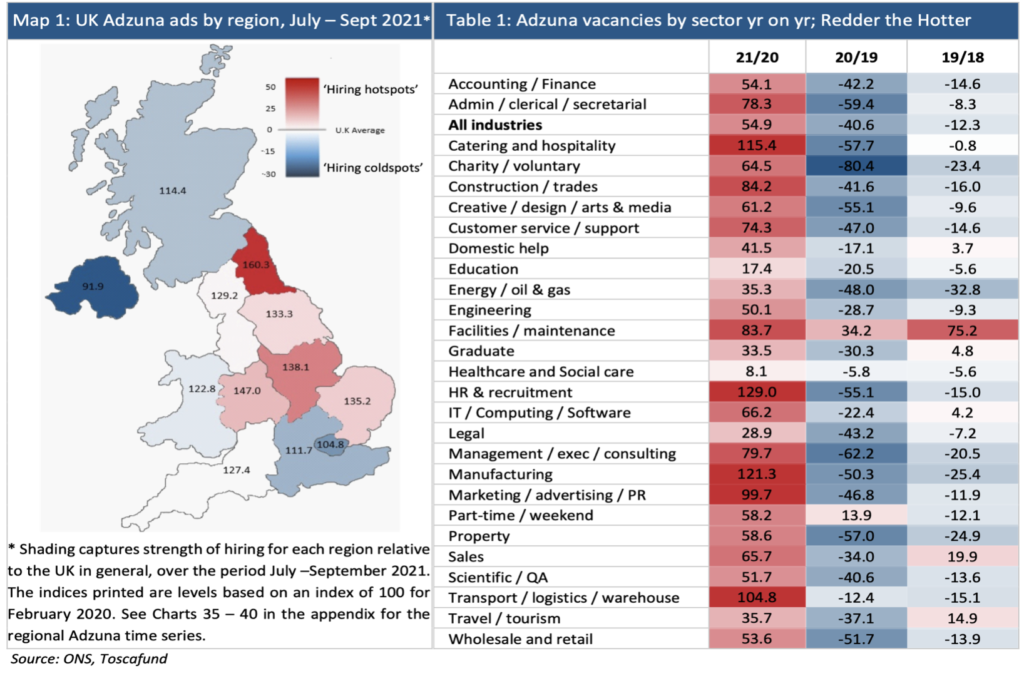

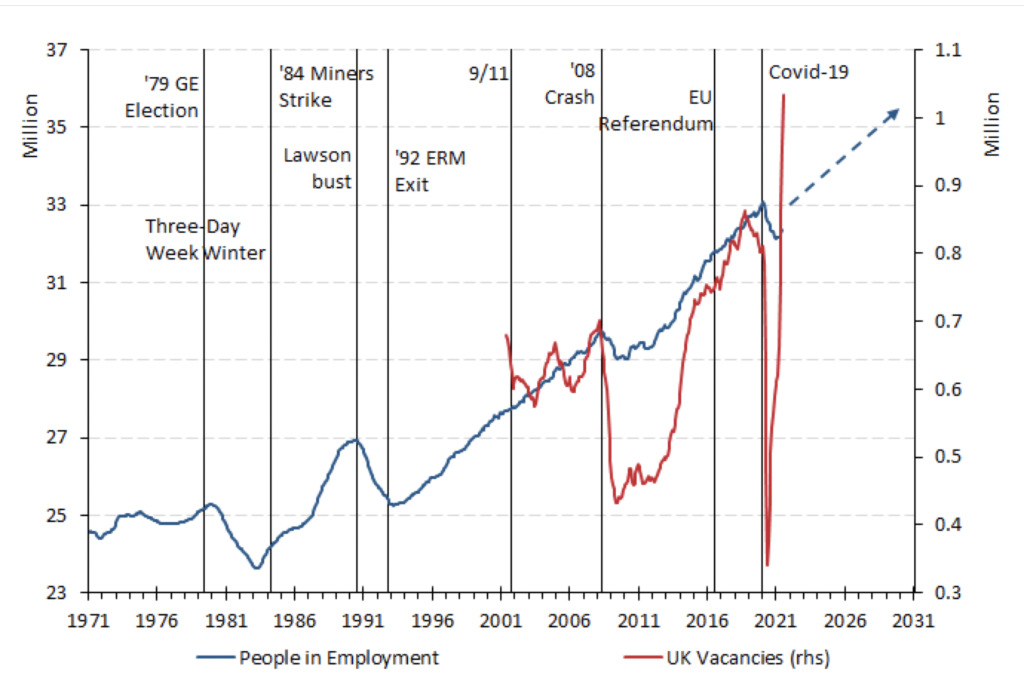

These words are written soon after the end of the UK’s work protecting – what many claim was a ‘true’ job data distorting – furlough scheme. They come in the midst of a considerable spike in the price of gas and hikes across more general products. A time, too, of a shortfall in petrol and lorry drivers; crucial in keeping all supply chains linked, shortages avoided, and inflation contained. These words are written, in short, when readers could be forgiven for being hugely concerned over the UK’s economic outlook; fearing its growth will fail and inflation flare. Let me be clear: drawing on every aspect of my education and experience convinces me the UK’s economic future is set as fair as I have ever seen. Before I explain why I hold this strong conviction, let me confront the very near term. I readily accept the expiry of all state funding of ‘furloughies’ will result in rates of unemployment across the UK ratcheting higher. This agreed, I am convinced the vast majority of those laid off will not remain involuntarily jobless for long. One can confidently claim as much for two reasons. One is the extraordinary strength being seen across the UK in hiring intentions – as captured by record high vacancies, best captured in detailed regional Adzuna data. The other is that a great many of those left without work have what it takes to easily switch into rolls being keenly advertised.

Another invariably overlooked aspect of the UK’s – generous – furlough scheme is how many of its beneficiaries chose to spend their time rusticating, as it were, ‘back home’ across the EU. I have absolutely no doubt that from 1 October, a great many of these will use their UK settlement status to quickly return. Most will resume the jobs they were furloughed from, returning, that is, to having their pay met by their old employers. What then of those EU nationals who departed the UK but are now left without their old work here? Of these I am confident a great many will return to fill the wide range of vacancies being widely advertised.

Regardless of the route taken by the soon to be ‘unfurloughed’ as they return to commercially paid work, just watch as the UK economy records a strong rebound in real jobs and growth in real wages, with these strongest in particular regions and sectors – see Chart 1, Map 1 and Table 1.

As to why the UK can possibly hope to emerge economically from the coronavirus crisis with the strong exit velocity I claim it will, the answer comes in parts. One part is that the virus struck at ‘the right time’. I make this claim not out of insensitivity to those who have been medically or otherwise harmed by it. The reason I say ‘right time’ is that Covid-19 struck with the UK having a majority parliamentary party and, as importantly, being in very capable ‘chancellorial’ hands. The crisis, moreover, hit with the UK free to act unilaterally, given it was in its transition period exiting the EU. It hit too when the UK’s real and monetary economic fundamentals were set fair: banks macro-prudentially healthy, the housing market robust, employment and vacancies at record highs, unemployment close to its lowest ever, inflation moderate, the base rate with room to cut and Gilt yields benign. Indeed, through lockdown, and thanks to furlough, UK households on balance have enjoyed a huge boost to their savings, only made better by them being denied the chance to take their money overseas (good for the UK, a loss to where we would otherwise have travelled).

Another part of the reason the UK will enjoy, indeed is enjoying, a strong exit from lockdown is that having entered this crisis as the world’s foremost user of e-commerce, it is emerging with an even greater orientation towards this very labour intensive part of the economy. Quoting from an article previously in these pages: “From the point of dispatch to point of delivery, what we have come to buy online has involved more hands being employed for the same volume of goods sold than when we journeyed to make comparable purchases”.

“The UK is sure to see a surging return of EU nationals with UK settlement status”

A third part of the reason the UK economy will – continue to – exit strongly from this viral crisis is that, sadly, the economies of many other nations will not; those far away and many all too near. In their case, Club Med euro-zone nations desperately reliant on the return to a tourism normality will see this fail to materialise. For this and other reasons, they face an extremely troubling economic period ahead. Let me here repeat the claim made earlier. The UK is sure to see a surging return of EU nationals with UK settlement status. The UK will also witness a high number of work visa applications from all over the world, including entirely fresh ones from across the EU. This brings me to geographical context.

I must apologise if my words seem focused obsessively on the UK to the exclusion of, indeed in isolation from, overseas. Here is some near afar context. Having suffered a collapse in tourist earnings – not least from locked-out Britons – large tracts of the euro-zone’s Club Med nations have not had anything like the UK’s e-commerce capacity to ensure their households continue consuming while locked-in. The reality is that while the UK’s strong economic exit from Covid is far from entirely predicated on weakness across large tracts of the EZ and far beyond it, the latter cannot fail to contribute. Contribute, that is, because weakness at home will draw Europeans back to the UK and those outside the EU to seek to fill the vacancies surging here.

What, then, of the inflation eruption?

Surging prices make for lurid headlines, and as we well know, media outlets largely exist to dwell on bad news. This said, for all the hysteria surrounding inflation, the truth is that it performs a hugely valuable re-allocation function, whether it is inflation in the price of labour – wages – or the price of goods, services or assets. When an economy is working well and managed sensibly, positive pricing pressure will encourage a mitigating positive supply response; ensuring what inflation occurs passes without becoming ingrained. It is precisely because of this corrective mechanism that inflation targeting is never at zero but c 2%. Indeed, ahead of this viral crisis, esteemed economists were recommending raising targets for overall inflation for the economic good, not bad. So, yes, the UK is presently recording seemingly alarming and uncontrollable inflation pressures. But yes, too, one can be sure these will dissipate with the arrival of a wave of new supply – of labour and goods – thanks to the absence of the frictions which so beset the UK in the past.

To close then. With the MPC quickly seeing the UK economy exiting strongly, it will beat expectations by discharging the base rate from the emergency level ward. As the UK base rate is moved sensibly, albeit only moderately, higher and earlier than being forecast, we should expect the pound to finally begin to reclaim the ground it lost with the ‘shock’ referendum result of June 2016. Rather than fear an early rate rise and renewed strength in sterling, we should welcome both moves, each in their own way acting to moderate targeted UK inflation. In addition to taming import costs, a more valuable pound will all the more attract foreign nationals to our shores, so as to earn in it; filling vacancies and moderating wage inflation.