Surfing a wave of institutional adoption… and liquidity.

The best investments are often the least comfortable ones. This is certainly the case with our decision to add bitcoin exposure to Ruffer’s portfolios in November last year.

Many people seem puzzled with our involvement. Either because we took a position in the first place or because we sold our exposure. Or because our clients made money from bitcoin – getting lucky on a bad bet that went right for all the wrong reasons. Or so the commentary goes.

So why did we do it?

Asset allocators today face two existential, and interlinked, questions: first, is inflation making a generational comeback and, second, is the balanced portfolio dead? These are multi-trillion dollar questions. And if the answer to either question is yes, what do you do with your bonds?

The implications for conventional balanced portfolios are profound and painful. Bond yields rise, so bond prices fall. Equities de-rate, so equity prices fall. Worse, the two asset classes become positively correlated, which is the opposite of the past 40 years. In crypto speak, you get ‘rekt’ (wrecked)!

Investors survey a menu of asset classes offering low expected returns and a lack of diversifying or protective characteristics. So, what on earth do you do?

The self-serving answer is your bonds – 20%, 40%, whatever – should become a Ruffer allocation. The more nuanced answer is your bonds need to transition to real assets offering inflation protection.

There are a lot out there to consider, each with their own advantages and pitfalls. Inflation-linked bonds, gold, property, infrastructure, commodities – the list goes on.

Owning the right ones in the right amounts at the right time is going to be the trick.

Where does bitcoin fit in? The optimists say bitcoin is an improvement on gold, a new real asset, perfectly wired for our digital future.

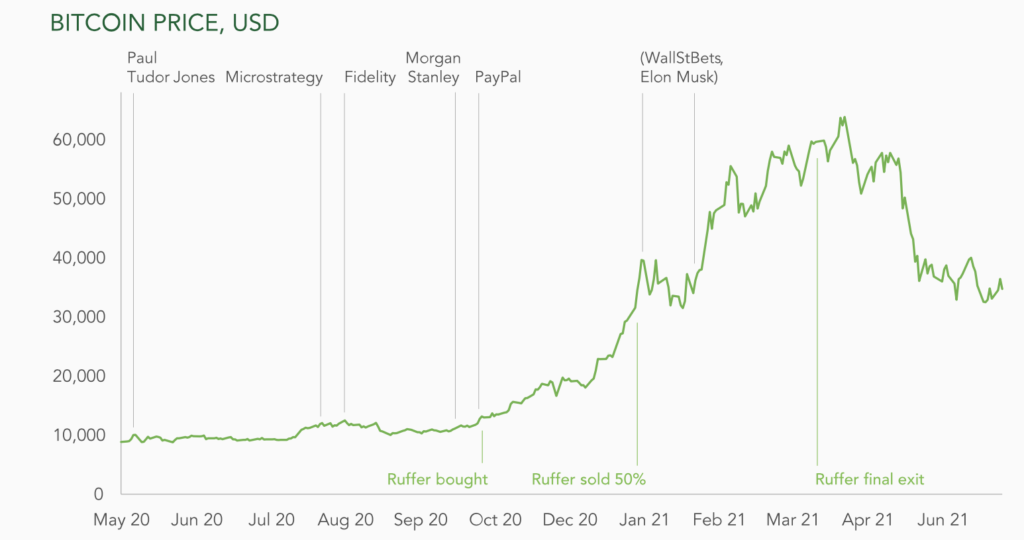

Last November, we gained exposure to bitcoin. We viewed it as an option on an emerging store of value with a highly skewed and attractive risk/reward profile. We were not alone, as the chart shows.

We invested, recognising bitcoin is an environmental riddle, wrapped in a genesis mystery, inside not an enigma, but a paradox: for bitcoin to succeed, it must first betray its spiritual foundations and be co-opted by Wall Street and blessed by the authorities.

So, what’s changed? The price.

It all has a flavour of the late 1990s. At the heart of any mania there is at least a kernel of truth. A lot of crazy things happened in the dot.com bubble, but the internet did change the world, the promise was fulfilled.

In 2021, the excitement is in crypto currencies and decentralised finance. The promise is real. But so too is the surge in excess liquidity generated by fiscal stimulus and ongoing quantitative easing.

Excess liquidity looked to us to be peaking in April, as the second wave of US stimulus cheques landed in an economy that was still largely closed.

Bitcoin may yet fulfil its potential, but peak liquidity coincided with many signs of froth – retail speculation, record leverage in the financial ecosystem, the Coinbase IPO, Tom Brady’s laser eyes, Dogecoin, Elon Musk hosting Saturday Night Live, $60m non-fungible tokens, etc.

In the short term at least, bitcoin was exhibiting the characteristics of a risky, speculative asset and therefore no longer fulfilled the role we wanted it for as a portfolio protection and diversifying asset. We sold all of our exposure in April.

Our chief investment officer, Henry Maxey, recently surmised that excess liquidity has a wonderful way of bringing the hopes of the future into the prices of the present. So, when all the good news is priced in, it’s time to waddle not HODL!